Quartz Window Spectroscopy in 2025: Why This Technology Is Set to Revolutionize Analytical Science. Explore Breakthrough Forecasts, Game-Changing Innovations, and What’s Next for the Industry.

- Executive Summary: Key Insights & Market Trajectory

- Technology Fundamentals: How Quartz Window Spectroscopy Works

- Leading Manufacturers and Industry Stakeholders (e.g., thorlabs.com, hellma.com)

- Market Size and Growth Forecasts Through 2029

- Emerging Applications Across Scientific and Industrial Sectors

- Major Innovations and Patent Activity

- Supply Chain and Material Sourcing Trends

- Competitive Landscape: Key Players and Strategic Moves

- Regulatory Environment and Industry Standards (e.g., ieee.org, iso.org)

- Future Outlook: Disruptive Trends and Long-Term Opportunities

- Sources & References

Executive Summary: Key Insights & Market Trajectory

Quartz window spectroscopy leverages the unique optical properties of synthetic quartz, enabling precise transmission of ultraviolet (UV), visible, and near-infrared (NIR) wavelengths. As of 2025, the market for quartz windows in spectroscopic applications is characterized by strong demand from semiconductor manufacturing, medical diagnostics, and environmental monitoring. Leading manufacturers such as Heraeus, Thorlabs, and Corning Incorporated are actively expanding product lines to meet increasingly stringent optical and durability requirements.

Recent industry developments underscore a shift toward higher-purity synthetic quartz, which offers superior transmission in deep UV ranges below 200 nm—critical for advanced photolithography and high-energy spectroscopy. Collaborative efforts between equipment suppliers and quartz producers are accelerating the introduction of windows with improved surface quality and lower autofluorescence, benefitting next-generation analytical instruments. For instance, Heraeus has reported advances in manufacturing methods that reduce trace contaminants, directly impacting performance in sensitive optical systems.

The semiconductor sector remains the largest end user, driven by the proliferation of extreme ultraviolet (EUV) and deep ultraviolet (DUV) lithography for chip fabrication. Major equipment manufacturers are increasingly specifying custom quartz windows with tighter tolerance and enhanced laser damage thresholds. In parallel, life sciences and medical device companies are incorporating quartz windows into high-throughput spectrometers and PCR systems, leveraging the material’s chemical inertness and broad spectral transparency.

Asia-Pacific is projected to register the fastest growth through 2025 and beyond, reflecting robust investments in both semiconductor fabrication and environmental monitoring infrastructure. Companies such as Corning Incorporated and Heraeus are expanding regional manufacturing capacity to address localized demand and reduce supply chain risks. Meanwhile, North America and Europe retain leadership in R&D and specialized instrumentation, with ongoing collaborations between quartz suppliers and research institutes.

Looking ahead, the trajectory of quartz window spectroscopy points toward further integration with automated, inline analysis systems and miniaturized spectroscopic modules. Enhanced material engineering, such as anti-reflective coatings and precision microfabrication, is expected to unlock wider adoption in portable and wearable devices. As end-user requirements evolve—with greater emphasis on higher throughput, lower detection limits, and longer operational lifetimes—the quartz window spectroscopy market is set for sustained innovation and incremental growth over the next several years.

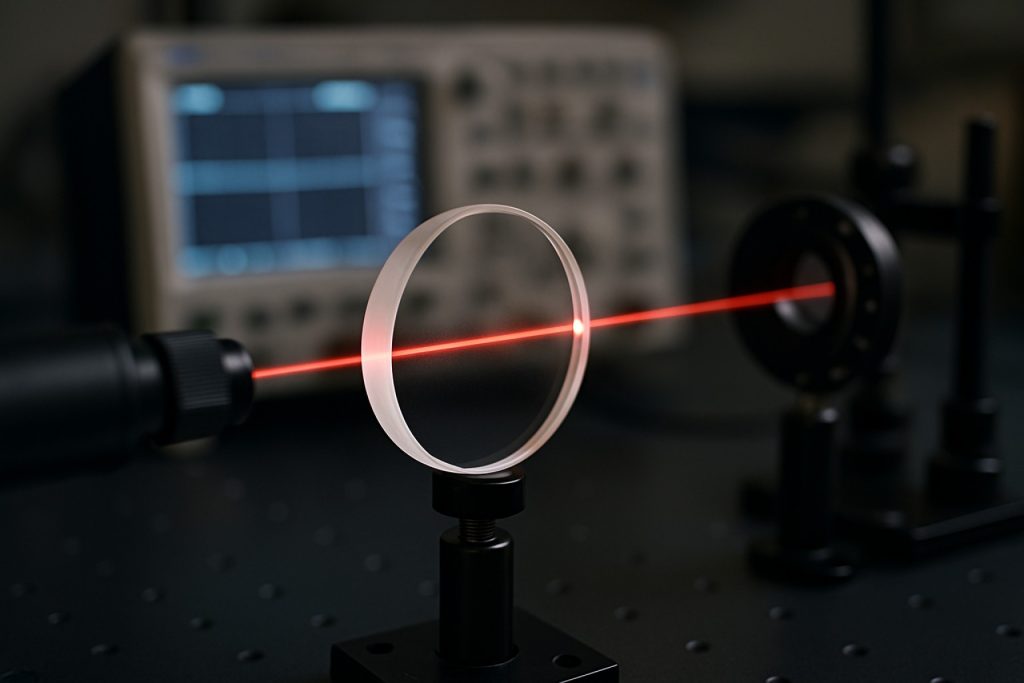

Technology Fundamentals: How Quartz Window Spectroscopy Works

Quartz window spectroscopy is a foundational analytical technique used across scientific and industrial domains for its ability to transmit a broad range of electromagnetic radiation. The core technology relies on optically pure quartz windows—typically manufactured from high-purity fused silica—which serve as transparent barriers in spectroscopic instruments. These windows are valued for their outstanding transmission characteristics from deep ultraviolet (DUV, ~160 nm) through the visible and into the mid-infrared (up to ~4,000 nm), as well as for their chemical stability, high damage threshold, and resistance to thermal shock.

The operation of quartz window spectroscopy involves the passage of a light beam through a sample, separated from the external optical environment by a high-grade quartz window. The window’s high transparency ensures that the spectroscopic measurement is minimally affected by the barrier, thereby enabling precise detection and quantification of molecular absorption, emission, or scattering within the target material. Advances in 2025 continue to focus on reducing window-induced spectral artifacts and expanding usable wavelength ranges, particularly in emerging fields such as UV laser spectroscopy and broadband IR analysis.

Key to the performance are the physical and chemical properties of the quartz material. Manufacturers such as Heraeus and Corning Incorporated play a leading role in the sector, providing fused silica windows with exceptional purity and homogeneity. These properties are critical in minimizing background absorption and fluorescence, which is especially important for sensitive applications in life sciences, semiconductor metrology, and environmental analysis. For instance, Heraeus offers synthetic fused silica grades tailored for DUV, with transmission below 200 nm, supporting next-generation photolithography and spectroscopy systems.

Contemporary instrument makers, like Thorlabs and Edmund Optics, integrate quartz windows into modular spectroscopy platforms, enabling users to customize systems for ultraviolet, visible, or infrared regimes. Advances in anti-reflective coatings and improved surface flatness are being incorporated to reduce stray light and maximize signal throughput. In 2025, there’s a growing emphasis on quartz windows with enhanced laser damage thresholds and resistance to environmental degradation, driven by demands in high-power laser spectroscopy and harsh industrial settings.

Looking ahead, the outlook for quartz window spectroscopy is robust. As spectroscopy applications diversify—spanning from quantum sensing to process analytical technology—there is ongoing R&D in engineered quartz materials with higher purity, lower birefringence, and greater mechanical strength. Leading suppliers are expected to further invest in automation and metrology for tighter production tolerances, keeping pace with the increasing precision requirements of next-generation spectroscopic instrumentation.

Leading Manufacturers and Industry Stakeholders (e.g., thorlabs.com, hellma.com)

The landscape of quartz window spectroscopy in 2025 is shaped by a cohort of globally recognized manufacturers and industry stakeholders, each contributing to technological advancements, quality standards, and broader adoption of precision optical components. Quartz windows play a crucial role in spectroscopic applications due to their high optical transmission, broad wavelength coverage (from ultraviolet to infrared), and chemical durability. Leading manufacturers invest heavily in R&D, process control, and materials science to meet the evolving demands of sectors such as pharmaceuticals, semiconductor fabrication, aerospace, and environmental monitoring.

Among the foremost industry stakeholders, Thorlabs stands out for its extensive portfolio of optical windows, including high-purity fused silica and quartz products optimized for spectroscopy. Thorlabs maintains vertically integrated manufacturing capabilities, allowing tight control over substrate quality, surface flatness, and anti-reflective coatings. Their global distribution network and commitment to technical support have positioned the company as a preferred supplier for research laboratories and OEM instrument manufacturers.

Similarly, Hellma is renowned for precision optical components, offering a diverse range of quartz windows and cuvettes tailored for spectroscopic applications. Hellma’s expertise in producing ultra-high purity fused silica windows and stringent quality assurance measures ensure minimal spectral interference and high repeatability—essential for analytical and process spectroscopy. The company collaborates with instrument builders and chemical analysis labs, providing custom solutions and embracing automation in manufacturing to address increasing demand for high-throughput, reproducible measurements.

Other major contributors include Edmund Optics, a supplier with a broad selection of UV-grade fused silica windows, and MKS Instruments (Newport/Melles Griot), which delivers advanced optical substrates for spectroscopy in R&D and industrial settings. These companies leverage global sourcing, proprietary polishing techniques, and advanced metrology to ensure window performance meets the tight tolerances required in high-precision environments.

Industry bodies such as the Optical Industry Association (OIA) contribute to the sector by fostering standards for material purity, optical clarity, and environmental sustainability, which have become increasingly important as end-users demand traceability and eco-friendly sourcing. Over the next several years, stakeholders are expected to focus on further reducing surface contamination, enhancing laser damage thresholds, and integrating novel coating technologies to extend spectral range and minimize signal loss.

In summary, the quartz window spectroscopy sector in 2025 is defined by innovation among established manufacturers, growing collaboration between suppliers and end-users, and a commitment to quality and sustainability supported by industry associations. These dynamics will likely accelerate advances in spectroscopy, driving adoption across scientific and industrial domains.

Market Size and Growth Forecasts Through 2029

Quartz window spectroscopy is an essential technique in analytical instrumentation, particularly in the ultraviolet (UV) and visible (VIS) spectral ranges, due to the high optical transparency, chemical inertness, and thermal stability of fused quartz. The global market for quartz windows used in spectroscopy is tightly coupled to the broader demand for spectrophotometers and advanced analytical tools in industries such as pharmaceuticals, environmental monitoring, semiconductors, energy, and life sciences.

As of 2025, industry-leading suppliers of quartz optical components—including Heraeus, Hellma, and Spectrogon—report sustained demand growth for high-purity fused silica and quartz windows. These components are critical in high-performance UV-VIS-NIR (near-infrared) spectrometers and increasingly in emerging applications such as quantum optics and advanced laser systems. The expansion of the semiconductor and life sciences sectors in Asia-Pacific and North America is particularly noteworthy, with multinational instrument manufacturers such as Thermo Fisher Scientific, Agilent Technologies, and PerkinElmer integrating quartz windows into their flagship spectroscopic systems.

Growth projections through 2029 point to a compound annual growth rate (CAGR) in the range of 5–7% for the quartz window spectroscopy market segment, with total market value expected to surpass several hundred million USD by the end of the forecast period. This outlook is supported by ongoing investments in laboratory automation, miniaturized spectrometers, and in-line process monitoring in manufacturing. Moreover, the increasing adoption of quartz optics in laser-based techniques—including Raman, LIBS (Laser-Induced Breakdown Spectroscopy), and hyperspectral imaging—augments demand for custom and standard quartz windows with precise transmission and durability specifications.

Key growth drivers include:

- Stringent quality and traceability requirements in pharmaceutical R&D and production, necessitating high-purity optical components.

- Expansion of environmental and air quality monitoring networks globally, which rely on robust, UV-transparent windows for accurate measurements.

- The proliferation of compact and portable spectrometers for field analysis, enabled by advances in optics manufacturing.

Looking ahead, quartz window suppliers are investing in advanced fabrication processes—such as improved surface finishing and anti-reflective coatings—to meet the exacting needs of next-generation spectroscopic platforms. Companies like Heraeus and Hellma continue to expand their production capacities and global distribution networks, positioning themselves to capture emerging opportunities in both established and rapidly evolving application fields.

Emerging Applications Across Scientific and Industrial Sectors

Quartz window spectroscopy is experiencing rapid adoption across a variety of scientific and industrial sectors as of 2025, driven by ongoing advancements in optical materials and instrumentation. Quartz, prized for its exceptional transparency in the ultraviolet (UV), visible, and near-infrared (NIR) spectral regions, serves as a critical component in high-precision spectroscopic equipment. Its resilience to thermal and chemical stress makes it suitable for demanding environments found in laboratories, manufacturing, and field applications.

In the semiconductor industry, quartz window spectroscopy is fundamental to in-situ process monitoring, notably in chemical vapor deposition (CVD) and plasma etching. Companies such as Heraeus—a global leader in quartz glass manufacturing—are supplying custom quartz optics to chip fabrication facilities, supporting stringent quality control and yield optimization. As the demand for advanced microelectronics and photonics grows, integration of robust quartz windows in spectroscopic sensors is set to expand further.

The pharmaceutical and chemical processing sectors are leveraging quartz window spectroscopy for real-time reaction monitoring and quality assurance. Leading suppliers like Hilgenberg GmbH and Filmetrics are providing precision quartz components for spectrophotometers and analytical reactors. These applications benefit from quartz’s low autofluorescence and high optical purity, enabling accurate detection of trace compounds and reaction intermediates.

Environmental science and atmospheric monitoring are also seeing surging adoption of quartz window-based instruments. Quartz’s UV transparency is essential for air quality sensors and water analysis systems, where detection of ozone, nitrogen oxides, or organic pollutants requires components that do not degrade under prolonged UV exposure. Organizations such as Hanomag Quartz are expanding their product lines to meet the increasing demand from governmental laboratories and environmental monitoring agencies.

In the field of life sciences and medical diagnostics, quartz window spectroscopy is enabling advances in fluorescence microscopy, flow cytometry, and lab-on-chip devices. The inertness and high transmission properties of quartz are being utilized for sensitive biological assays and in the development of miniaturized diagnostic platforms, supporting trends towards point-of-care testing and high-throughput screening.

Looking ahead, continued investment by industry leaders in material innovation and precision manufacturing is expected to drive down costs and expand the accessibility of quartz window spectroscopy. Emerging applications—ranging from quantum optics to advanced battery research—are likely to further increase demand for specialized quartz components tailored for new wavelengths and operational environments. As 2025 progresses and beyond, the intersection of material science and industrial need will continue to propel quartz window spectroscopy into new frontiers.

Major Innovations and Patent Activity

The field of quartz window spectroscopy is experiencing a significant wave of innovation, particularly as demand grows for high-purity optical windows in ultraviolet (UV), visible, and infrared (IR) spectroscopic applications. Quartz windows—valued for their exceptional chemical resistance, high transmission range (from deep UV to mid-IR), and durability—are essential in analytical instrumentation, semiconductor manufacturing, and advanced industrial process monitoring.

In 2025, leading manufacturers have accelerated innovation by refining fabrication techniques and introducing advanced coatings to enhance spectral performance and longevity. Heraeus, a global leader in fused silica and quartz glass, has developed new grades of synthetic quartz that offer superior UV transmission and reduced fluorescence, addressing the needs of high-sensitivity detection in pharmaceutical and semiconductor spectroscopy. Their proprietary manufacturing processes minimize inclusions and impurities, which is critical for minimizing background noise in spectroscopic measurements.

Another key player, Corning Incorporated, continues to invest in research around the molecular structure of quartz to further expand the transmission window and thermal shock resistance. In 2025, Corning’s innovations in ultra-pure fused silica substrates are geared toward next-generation UV spectrometers and laser-based analytical devices, supporting progress in materials science and environmental monitoring.

In terms of coatings, companies such as Edmund Optics and Thorlabs are pushing the envelope with anti-reflective, hydrophobic, and scratch-resistant layers that maintain high transmission rates across a broader wavelength spectrum. These advances allow quartz windows to meet the rigorous demands of high-power laser spectroscopy and harsh chemical environments.

Patent activity in this sector has intensified, with filings focusing on methods to improve window homogeneity, reduce birefringence, and optimize surface finishing for minimal signal distortion. For example, recent patents cover low-temperature bonding techniques and chemical vapor deposition (CVD) processes that enable more intricate and durable window geometries suited for miniaturized spectroscopic systems. Patent databases show a steady rise in applications from established manufacturers and emerging startups, particularly those targeting integration with microfluidic and lab-on-a-chip devices.

Looking forward, the outlook for quartz window spectroscopy is robust. Continued investment from industry leaders is expected to yield further material and process breakthroughs, fostering broader adoption in biotechnology, aerospace, and quantum sensing. Collaborations between manufacturers and academic research institutes are also likely to accelerate, driving the next generation of spectroscopic instruments with enhanced sensitivity, miniaturization, and resilience.

Supply Chain and Material Sourcing Trends

The supply chain and material sourcing landscape for quartz window spectroscopy is undergoing significant adjustments as demand rises across sectors such as semiconductor manufacturing, laser optics, life sciences, and environmental monitoring. High-purity synthetic quartz, prized for its low absorption and high transmittance in ultraviolet (UV), visible, and infrared (IR) ranges, remains the critical material for windows used in spectroscopic instruments.

As of 2025, the industry is observing a dual trend: a drive for ultra-high purity fused silica and a simultaneous need for supply chain resilience amid geopolitical and logistical uncertainties. Leading global suppliers such as Heraeus and Corning Incorporated continue to invest in advanced refining and forming technologies to meet the optical grade standards required for spectroscopy applications. These companies benefit from vertically integrated production—controlling raw material extraction, purification, and component fabrication—allowing for more consistent quality and reduced lead times.

Meanwhile, rising demand from the semiconductor and photonics sectors is straining the global supply of optical-grade quartz. In response, companies including SCHOTT and Hamamatsu Photonics are expanding their sourcing networks and investing in new production facilities. SCHOTT, for example, focuses on both natural and synthetic quartz, leveraging its international supply chain to avoid bottlenecks. Hamamatsu, a key player in spectroscopic equipment, sources specialized quartz windows for its photomultiplier tubes and spectrometers, ensuring tight control over impurity levels and surface finish.

Material sourcing is also influenced by evolving environmental and regulatory requirements. Suppliers increasingly emphasize traceability and sustainable mining or synthesis practices, partly driven by the growing adoption of environmental, social, and governance (ESG) criteria among end-users in Europe and North America. As such, manufacturers like Heraeus are highlighting their efforts in closed-loop recycling and energy-efficient quartz melting technologies.

Looking forward to the next few years, supply chain strategies are expected to prioritize geographic diversification and onshoring of critical production steps to mitigate risks. Additionally, technological innovations—such as advanced plasma melting and ultra-clean synthetic processes—are likely to drive higher yields and purer quartz, directly benefiting the performance and reliability of quartz window spectroscopy systems. Close collaborations between instrument makers and raw material suppliers will remain essential to ensure consistent availability and quality of optical quartz components.

Competitive Landscape: Key Players and Strategic Moves

The competitive landscape of quartz window spectroscopy in 2025 is characterized by a combination of established global manufacturers and specialized niche suppliers, each driving innovation and strategic expansion to meet the growing demands of spectroscopy applications. Quartz windows are integral optical components in spectroscopy due to their high transmission in ultraviolet (UV), visible, and near-infrared (NIR) regions, and their ability to withstand harsh environments and intense light sources.

Leading the market are long-established optics manufacturers such as Edmund Optics, recognized for their broad catalog of high-purity fused silica and quartz windows tailored for spectroscopy across industrial, research, and medical sectors. Their ongoing investment in precision manufacturing and coatings is positioning them to serve increasingly demanding applications, including advanced UV spectroscopy and laser-based systems.

Another major player, Thorlabs, continues to expand its global reach and product lines, offering custom and standard quartz windows for photonics and spectroscopy. Thorlabs is noted for its rapid prototyping capabilities and focus on supplying research institutions as well as OEMs, supporting the fast-paced development cycles seen in spectroscopy instrument innovation.

In Asia, CASTECH Inc. is a significant supplier of optical materials, including high-quality quartz and fused silica windows. The company’s vertically integrated production—from crystal growth to precision polishing—enables it to provide competitive pricing and consistent quality, catering to both domestic and international customers in the analytical instrumentation space.

Meanwhile, Hellma GmbH & Co. KG is a recognized specialist in optical components for analytical and life sciences. Hellma’s focus on spectroscopy cells and windows, coupled with stringent quality standards, has cemented its reputation among high-precision laboratories and instrument manufacturers worldwide.

Strategically, these companies are investing in advanced manufacturing technologies (such as improved polishing, anti-reflection coatings, and contamination-resistant surfaces) to differentiate their offerings. Partnerships with instrument makers and research institutes are increasingly common, fostering co-development of next-generation spectroscopy systems that demand higher performance from optical windows.

The outlook for 2025 and the following years suggests intensifying competition as spectroscopy expands into fields like environmental monitoring, semiconductor process control, and point-of-care diagnostics. The ability to provide reliably high transmission, durability, and custom geometries will remain critical. As new applications emerge, especially in harsh or miniaturized environments, suppliers able to innovate in material quality and precision engineering—while maintaining scalable production—are poised to strengthen their competitive positions.

Regulatory Environment and Industry Standards (e.g., ieee.org, iso.org)

Quartz window spectroscopy, integral to analytical instrumentation and industrial process monitoring, is governed by a landscape of regulatory standards and guidelines that shape product quality, reliability, and safety. As of 2025, demand for high-purity quartz optical components continues to rise, driven by sectors such as semiconductor manufacturing, life sciences, and environmental monitoring. This growth places greater emphasis on compliance with both international and industry-specific standards.

At the core of regulatory oversight are international standards bodies, including the International Organization for Standardization (ISO) and the Institute of Electrical and Electronics Engineers (IEEE). These organizations develop and periodically update standards relevant to quartz window materials, manufacturing tolerances, optical clarity, and transmission properties, particularly for ultraviolet (UV) and vacuum ultraviolet (VUV) applications.

- ISO Standards: ISO maintains standards such as ISO 10110, which specifies requirements and tolerances for optical elements, including transmission windows made from fused quartz. Recent revisions have emphasized stricter surface quality and material homogeneity criteria, responding to the evolving needs of high-precision spectroscopy applications.

- IEEE Standards: The IEEE standards framework addresses the electronic and photonic integration of spectroscopy systems. This includes guidelines on safety, electromagnetic compatibility, and performance metrics for optical sensors utilizing quartz windows.

Manufacturers operating globally are typically certified to ISO 9001 (quality management systems), and leading suppliers of quartz windows—such as Heraeus in Germany and Corning in the United States—are active participants in the ongoing development and harmonization of optical material standards. These companies often collaborate with standards bodies and industry consortia to ensure that their products meet or exceed regulatory requirements for spectral transmission, purity, and durability.

In the next few years, regulatory attention is expected to intensify around sustainability and supply chain transparency, especially concerning raw materials sourcing for high-purity quartz. Further, as spectroscopy moves deeper into the UV and extreme UV (EUV) ranges, standards for material purity, defect density, and radiation resistance are being revised to address the challenges of higher energy photon transmission. Industry groups, such as the SEMI association, are actively working on guidelines specific to semiconductor process environments, where quartz window reliability is critical.

For stakeholders in quartz window spectroscopy, ongoing engagement with standards development will be vital. Adherence to ISO and IEEE frameworks, along with industry-specific guidelines, will underpin product acceptance and regulatory compliance in the increasingly complex and high-performance landscape anticipated through 2025 and beyond.

Future Outlook: Disruptive Trends and Long-Term Opportunities

As the global demand for precise optical measurement technologies accelerates, quartz window spectroscopy is poised for significant advancements and disruptive trends in 2025 and the following years. The market momentum is largely fueled by the expanding adoption of analytical instrumentation in sectors such as semiconductor manufacturing, pharmaceuticals, environmental monitoring, and advanced materials research. Quartz, renowned for its exceptional UV transparency, chemical resistance, and thermal stability, remains the material of choice for high-performance spectroscopy windows.

One of the most notable trends is the integration of quartz windows with next-generation spectroscopic tools, particularly as semiconductor fabrication nodes shrink and require more stringent contamination control and advanced in-situ monitoring. Leading manufacturers such as Heraeus and Merck KGaA (via its Sigma-Aldrich division) are scaling up the production of ultra-pure synthetic fused silica and quartz components, which are critical for deep ultraviolet (DUV) and vacuum ultraviolet (VUV) spectroscopy applications. These materials are being engineered to deliver higher transmission rates and lower autofluorescence, directly supporting the development of more sensitive detection systems.

The convergence of quartz window spectroscopy with real-time analytics and automation is another disruptive force. Companies such as Thorlabs and Edmund Optics are offering a broader portfolio of standardized and custom quartz windows tailored for automated, inline process monitoring in pharmaceutical and bioprocessing industries. This enables continuous quality assurance and supports regulatory compliance for critical manufacturing processes, a trend expected to accelerate as digital transformation initiatives take hold across life sciences and chemical production.

Looking to the future, sustainability and supply chain resilience are emerging as strategic priorities. Suppliers are investing in greener manufacturing processes for quartz glass, as well as circular economy practices such as the reclamation and recycling of high-purity quartz. Corning Incorporated, a key global supplier, is actively developing more energy-efficient melting and forming techniques for fused silica, with the aim of reducing the carbon footprint of optical component production.

Long-term opportunities will likely stem from the synergy between quartz window spectroscopy and quantum technologies, hyperspectral imaging, and advanced photonic integration. As the resolution and sensitivity of spectroscopic instruments improve, the demand for defect-free, optically superior quartz windows is expected to rise sharply. Industry leaders are collaborating with research institutions to push the limits of material purity and fabrication precision, which will be crucial for enabling breakthroughs in both industrial applications and fundamental science in the years ahead.