Jewelry-Embedded Wearable Technology in 2025: Where High Fashion and Smart Innovation Converge. Explore How This Niche Is Set to Redefine Personal Tech and Luxury Over the Next Five Years.

- Executive Summary: The Fusion of Jewelry and Wearable Technology

- Market Size and 2025–2030 Growth Forecasts (CAGR: 18–22%)

- Key Players and Innovators: From Luxury Brands to Tech Startups

- Core Technologies: Sensors, Materials, and Miniaturization

- Design Trends: Aesthetics, Customization, and User Experience

- Consumer Segments: Target Demographics and Adoption Drivers

- Applications: Health, Wellness, Security, and Lifestyle Integration

- Supply Chain and Manufacturing Challenges

- Regulatory, Privacy, and Sustainability Considerations

- Future Outlook: Opportunities, Risks, and Strategic Recommendations

- Sources & References

Executive Summary: The Fusion of Jewelry and Wearable Technology

The convergence of jewelry and wearable technology is rapidly redefining both the fashion and consumer electronics landscapes in 2025. Jewelry-embedded wearable technology—devices that seamlessly integrate advanced sensors and connectivity into rings, bracelets, necklaces, and earrings—has moved from niche innovation to mainstream adoption. This fusion is driven by consumer demand for discreet, aesthetically pleasing devices that deliver health, wellness, and connectivity features without sacrificing personal style.

Key industry players are leading this transformation. Oura Health has established its Oura Ring as a benchmark for smart rings, offering advanced sleep, activity, and readiness tracking in a sleek, jewelry-like form factor. The company’s partnerships with luxury brands and health organizations have expanded its reach, and its latest generation, released in late 2024, features enhanced sensors and a broader range of health metrics. Similarly, Ringly continues to blend gemstone-adorned rings and bracelets with notification and wellness tracking capabilities, targeting fashion-conscious consumers seeking subtle connectivity.

Major technology companies are also entering the space. Samsung Electronics announced its Galaxy Ring at CES 2024, signaling a significant commitment to jewelry-form wearables. The device, expected to launch globally in 2025, integrates biometric sensors for health monitoring and is designed to complement Samsung’s broader ecosystem of devices. Meanwhile, Apple has filed patents and is rumored to be exploring smart jewelry, though no official product has been released as of early 2025.

The sector is also witnessing innovation from traditional jewelry houses. Swarovski has collaborated with technology firms to embed activity tracking into crystal-adorned accessories, while Pandora is reportedly exploring partnerships to integrate digital features into its customizable jewelry lines. These collaborations aim to bridge the gap between high fashion and functional technology, appealing to a broader demographic.

Looking ahead, the outlook for jewelry-embedded wearable technology is robust. Advances in miniaturization, battery life, and material science are enabling more sophisticated features in ever-smaller, more elegant designs. Industry analysts anticipate continued growth through 2027, driven by rising consumer interest in health monitoring, contactless payments, and personalized digital experiences—all delivered in forms that align with individual style preferences. As the boundaries between fashion and function blur, jewelry-embedded wearables are poised to become a defining trend in both the technology and luxury goods sectors.

Market Size and 2025–2030 Growth Forecasts (CAGR: 18–22%)

The market for jewelry-embedded wearable technology is experiencing robust growth, driven by consumer demand for discreet, aesthetically pleasing devices that integrate health, fitness, and connectivity features. As of 2025, the global market size for jewelry wearables—including smart rings, bracelets, necklaces, and earrings—is estimated to exceed $2.5 billion, with projections indicating a compound annual growth rate (CAGR) between 18% and 22% through 2030. This expansion is fueled by advancements in miniaturized sensors, battery technology, and materials science, enabling manufacturers to embed sophisticated electronics into traditional jewelry forms without compromising style or comfort.

Key industry players are shaping the competitive landscape. Oura Health Oy has established itself as a leader in smart rings, with its Oura Ring offering advanced sleep, activity, and readiness tracking. The company’s partnerships with major sports leagues and wellness brands have broadened its reach and validated the utility of jewelry-based wearables in both consumer and professional settings. Ringly and Motiv have also contributed to the segment, focusing on fashionable rings and bracelets that deliver notifications, fitness tracking, and security features.

In the luxury segment, brands like TAG Heuer and Swarovski are collaborating with technology firms to create high-end smart jewelry that appeals to affluent consumers seeking both functionality and prestige. Meanwhile, companies such as Bellabeat are targeting the wellness market with jewelry that monitors stress, menstrual cycles, and meditation, catering especially to women’s health needs.

Geographically, North America and Europe currently dominate the market, but rapid adoption is expected in Asia-Pacific, particularly in China, Japan, and South Korea, where tech-savvy consumers and fashion-forward trends converge. The proliferation of contactless payment systems and digital ID solutions is also driving demand for jewelry wearables that offer secure authentication and transaction capabilities.

Looking ahead to 2030, the jewelry-embedded wearable technology market is poised for continued innovation. Integration with artificial intelligence, enhanced biometric sensors, and sustainable materials are anticipated to further differentiate products and expand their appeal. As privacy and data security concerns grow, industry leaders are expected to invest in robust encryption and user controls, ensuring consumer trust and regulatory compliance. Overall, the sector’s outlook remains highly positive, with jewelry wearables set to become an increasingly integral part of the connected lifestyle ecosystem.

Key Players and Innovators: From Luxury Brands to Tech Startups

The landscape of jewelry-embedded wearable technology in 2025 is defined by a dynamic interplay between established luxury brands, innovative technology companies, and agile startups. This convergence is driving both aesthetic refinement and functional advancement in wearables, as consumer demand grows for devices that seamlessly blend fashion with utility.

Among luxury brands, Cartier and Tiffany & Co. have made notable strides by collaborating with technology partners to integrate discreet health and connectivity features into their high-end jewelry lines. These partnerships aim to preserve the traditional craftsmanship and exclusivity of luxury jewelry while introducing functionalities such as activity tracking and contactless payments. For example, Cartier has explored limited-edition smart bracelets that incorporate biometric sensors, while Tiffany & Co. has piloted rings with embedded NFC chips for authentication and digital experiences.

On the technology front, Oura Health stands out as a leader with its Oura Ring, a sleek, sensor-laden ring that tracks sleep, activity, and readiness metrics. The company has expanded its partnerships in 2025, collaborating with fashion designers to offer limited-edition collections that appeal to style-conscious consumers. Similarly, Ringly has continued to innovate with gemstone-adorned smart rings and bracelets, focusing on wellness notifications and mindfulness features. Their products are designed to look indistinguishable from traditional jewelry, a key factor in their growing adoption among women and professionals.

Startups are also playing a pivotal role in pushing the boundaries of jewelry-embedded wearables. Companies like Bellabeat have introduced elegant pendants and bracelets that monitor stress, hydration, and reproductive health, targeting the wellness market with a strong emphasis on design. Meanwhile, Nimb has developed smart rings with built-in panic buttons, providing personal safety features in a discreet form factor. These innovations reflect a broader trend toward specialized, purpose-driven wearables that address specific consumer needs.

Looking ahead, the sector is expected to see increased collaboration between jewelry houses and technology firms, as well as the integration of advanced materials and miniaturized components. The focus will likely remain on enhancing both the aesthetic appeal and the functional value of wearable devices, with sustainability and personalization emerging as key differentiators. As the market matures, established players and newcomers alike are poised to redefine the intersection of fashion and technology in the coming years.

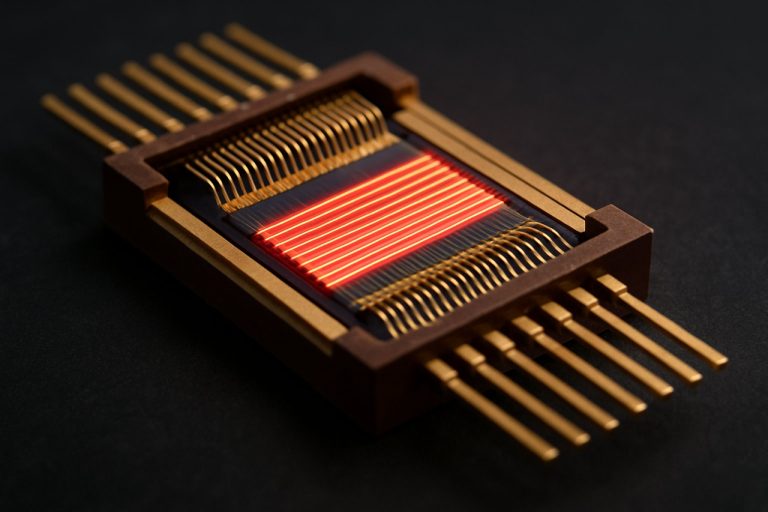

Core Technologies: Sensors, Materials, and Miniaturization

Jewelry-embedded wearable technology is rapidly advancing, driven by innovations in sensors, materials, and miniaturization. As of 2025, the sector is characterized by a convergence of fashion and function, with leading companies integrating sophisticated electronics into rings, bracelets, necklaces, and earrings. The core technologies underpinning this trend are evolving to meet consumer demands for both aesthetics and advanced health and connectivity features.

Sensor technology is at the heart of jewelry wearables. Miniaturized photoplethysmography (PPG) sensors, accelerometers, and temperature sensors are now small enough to fit into compact jewelry form factors without compromising accuracy. For example, Oura Health has refined its Oura Ring to include multi-sensor arrays capable of tracking heart rate, blood oxygen, temperature, and sleep stages, all within a sleek, finger-worn device. Similarly, Motiv (now part of Proxy) previously developed a smart ring with biometric authentication and activity tracking, demonstrating the potential for secure, always-on sensing in jewelry.

Material science is another critical enabler. The use of hypoallergenic metals, ceramics, and advanced polymers ensures both comfort and durability. Companies like Oura Health and Ringly have pioneered the use of precious metals and gemstones to house electronics, blending traditional jewelry craftsmanship with modern technology. Innovations in flexible printed circuit boards and encapsulation techniques protect sensitive electronics from moisture and impact, extending device lifespans and enabling new form factors.

Miniaturization remains a central challenge and opportunity. Advances in system-on-chip (SoC) design, low-power Bluetooth connectivity, and micro-batteries have allowed manufacturers to shrink components while maintaining performance. Oura Health’s latest ring, for instance, boasts a battery life of up to seven days, a significant achievement given its size. Meanwhile, Ringly has focused on integrating haptic feedback and notification LEDs into rings and bracelets, requiring further miniaturization of actuators and light sources.

Looking ahead, the next few years are expected to bring further integration of advanced sensors, such as electrodermal activity and non-invasive glucose monitoring, into jewelry. The sector is also likely to benefit from ongoing research into biocompatible materials and wireless charging solutions, which will enhance both user experience and device longevity. As jewelry-embedded wearables become more discreet and capable, their adoption is poised to accelerate, particularly in health, wellness, and secure authentication applications.

Design Trends: Aesthetics, Customization, and User Experience

Jewelry-embedded wearable technology is rapidly evolving in 2025, with design trends emphasizing aesthetics, customization, and seamless user experience. The convergence of fine jewelry and advanced electronics is driving a new era of wearables that prioritize both form and function. Leading companies are collaborating with renowned designers and leveraging innovative materials to create pieces that are as visually appealing as they are technologically advanced.

Aesthetics remain at the forefront, with brands like OMEGA SA and TAG Heuer integrating smart modules into luxury watches and bracelets, ensuring that technology does not compromise the elegance of traditional jewelry. These companies are focusing on slim profiles, precious metals, and gemstone embellishments, making wearables indistinguishable from high-end accessories. For example, TAG Heuer continues to expand its Connected collection, blending Swiss watchmaking with digital features.

Customization is another key trend, as consumers increasingly seek personalized experiences. Pandora A/S has introduced modular smart jewelry that allows users to swap charms and bands, tailoring both the look and the functionality to individual preferences. Similarly, Swarovski AG has partnered with technology firms to embed activity trackers and notification modules into crystal-adorned pieces, offering a range of colors and styles to suit diverse tastes.

User experience is being redefined through intuitive interfaces and discreet integration of sensors. Companies like Oura Health Oy have set benchmarks with their smart rings, which provide advanced health metrics while maintaining a minimalist, jewelry-like appearance. The Oura Ring, for instance, is designed to be worn 24/7, with a focus on comfort and unobtrusiveness, and is now available in multiple finishes to match personal style.

Looking ahead, the outlook for jewelry-embedded wearables is robust. Industry leaders are investing in sustainable materials and ethical sourcing, responding to consumer demand for responsible luxury. The integration of AI-driven features, such as adaptive notifications and health insights, is expected to further enhance the value proposition. As 2025 progresses and into the next few years, the sector is poised for continued growth, with collaborations between technology firms and jewelry houses likely to yield even more sophisticated and customizable offerings.

Consumer Segments: Target Demographics and Adoption Drivers

Jewelry-embedded wearable technology is rapidly evolving, with 2025 marking a pivotal year for consumer adoption across diverse demographic segments. The convergence of fashion and function is driving interest among both traditional jewelry buyers and tech-savvy consumers, with leading brands and startups targeting specific groups based on lifestyle, age, and health priorities.

A primary target demographic is women aged 25-45, who value both aesthetics and discreet health or connectivity features. Companies such as Oura Health have seen significant uptake of their smart rings, which offer sleep, activity, and wellness tracking in a form factor that resembles fine jewelry. Oura’s collaborations with luxury brands and its focus on design-forward, customizable options have broadened its appeal beyond early adopters to mainstream fashion-conscious consumers.

Another key segment is the wellness and fitness community, including both men and women seeking unobtrusive health monitoring. Motiv (now part of Proxy) previously pioneered smart rings with fitness tracking, and the trend continues with new entrants focusing on biometric data collection in elegant, jewelry-like devices. These products are particularly attractive to users who prefer not to wear bulky wristbands or watches.

The luxury market is also embracing jewelry-embedded wearables, with established jewelry houses experimenting with connected pieces. Cartier and Tiffany & Co. have both signaled interest in integrating technology into their collections, aiming to attract affluent consumers who desire exclusivity and innovation. These collaborations often emphasize limited editions and precious materials, targeting collectors and high-net-worth individuals.

Adoption drivers in 2025 include heightened consumer awareness of health and wellness, the desire for seamless integration of technology into daily life, and the growing importance of personalization. The COVID-19 pandemic accelerated interest in health monitoring, and this momentum continues as consumers seek non-invasive, always-on solutions. Additionally, the ability to personalize jewelry—through materials, finishes, and even embedded features—resonates with younger buyers, particularly Gen Z and Millennials, who value self-expression.

Looking ahead, the next few years are expected to see further segmentation, with products tailored for specific needs such as fertility tracking, stress management, and secure authentication. As technology miniaturizes and battery life improves, jewelry-embedded wearables are poised to become a mainstream accessory across age groups and lifestyles, with companies like Oura Health and luxury brands leading the charge in both innovation and market expansion.

Applications: Health, Wellness, Security, and Lifestyle Integration

Jewelry-embedded wearable technology is rapidly evolving, with 2025 marking a significant year for its integration into health, wellness, security, and lifestyle applications. These devices, which seamlessly blend aesthetics with advanced functionality, are increasingly being adopted by consumers seeking both style and utility.

In health and wellness, jewelry wearables are moving beyond basic activity tracking to offer more sophisticated biometric monitoring. For example, the Oura Health ring, a discreet smart ring, continues to gain traction for its ability to monitor sleep quality, heart rate variability, and body temperature. In 2025, Oura is expanding its partnerships with health platforms and insurance providers, aiming to integrate its data into broader health management systems. Similarly, Motiv (now part of Proxy) has focused on biometric authentication and health tracking, embedding sensors in rings that can monitor physical activity and provide secure access to digital services.

Security applications are also advancing. Smart rings and bracelets are being used for contactless payments and secure authentication. McLEAR offers a payment ring that enables users to make purchases with a simple tap, leveraging NFC technology. In 2025, McLEAR is expanding its compatibility with global payment networks and exploring partnerships with banks to enhance security features, such as two-factor authentication and biometric verification.

Lifestyle integration is a key driver of adoption. Companies like Ringly have pioneered jewelry that delivers smartphone notifications through subtle vibrations and colored lights, allowing users to stay connected without constantly checking their devices. As of 2025, the trend is toward even more seamless integration, with jewelry pieces that can control smart home devices, manage calendars, and interact with voice assistants. Bellabeat targets women’s wellness with smart jewelry that tracks stress, menstrual cycles, and activity, and is expanding its ecosystem to include personalized coaching and wellness content.

Looking ahead, the outlook for jewelry-embedded wearable technology is robust. The miniaturization of sensors and advances in battery technology are enabling more discreet and fashionable designs. Industry leaders are focusing on interoperability, ensuring that jewelry wearables can communicate with a wide range of devices and platforms. As privacy and data security remain top concerns, companies are investing in end-to-end encryption and user-controlled data sharing. With growing consumer demand for devices that blend seamlessly into daily life, jewelry-embedded wearables are poised to become a mainstream component of personal technology ecosystems in the coming years.

Supply Chain and Manufacturing Challenges

The supply chain and manufacturing landscape for jewelry-embedded wearable technology in 2025 is characterized by both rapid innovation and significant operational challenges. As consumer demand for aesthetically pleasing, functional wearables grows, companies are under pressure to integrate advanced electronics into compact, durable, and stylish jewelry forms. This convergence of fashion and technology introduces unique complexities across sourcing, assembly, and distribution.

A primary challenge lies in sourcing specialized components that meet both the miniaturization and aesthetic requirements of jewelry. Precious metals and gemstones must be combined with microelectronics, sensors, and batteries, often necessitating custom fabrication. For example, Pandora, a global leader in jewelry, has begun exploring partnerships with technology providers to develop smart jewelry lines, but faces hurdles in ensuring that electronic components do not compromise the brand’s signature design and material quality.

Manufacturing processes must also adapt to accommodate the integration of delicate electronics into traditional jewelry settings. Companies like ŌURA Health, known for its smart ring, have invested heavily in precision engineering and automated assembly lines to maintain consistency and reliability at scale. However, the need for manual craftsmanship in high-end pieces can slow production and increase costs, especially when incorporating custom features or luxury materials.

Supply chain resilience is another concern, particularly given the reliance on global suppliers for both electronic and jewelry-grade materials. Disruptions in the availability of semiconductors or precious metals can delay production and impact product launches. Swarovski, which has collaborated with technology firms on smart jewelry, has highlighted the importance of diversifying suppliers and investing in local manufacturing capabilities to mitigate such risks.

Quality assurance and regulatory compliance add further complexity. Wearable devices must meet stringent safety and performance standards, including those related to electromagnetic emissions and skin compatibility. This requires close coordination between jewelry manufacturers and technology partners, as well as ongoing investment in testing and certification.

Looking ahead, the sector is expected to see increased adoption of advanced manufacturing techniques such as additive manufacturing (3D printing) and micro-assembly robotics, which can help streamline production and enable greater customization. Companies are also exploring sustainable sourcing and recycling initiatives to address environmental concerns associated with both electronics and precious materials. As the market matures, successful players will likely be those who can balance innovation with operational agility and supply chain robustness.

Regulatory, Privacy, and Sustainability Considerations

Jewelry-embedded wearable technology is rapidly evolving, prompting increased attention to regulatory, privacy, and sustainability considerations as the sector matures in 2025 and beyond. As these devices blend fashion with advanced sensors and connectivity, they raise unique challenges and opportunities for manufacturers, regulators, and consumers.

On the regulatory front, jewelry wearables that monitor health metrics or facilitate payments are subject to a patchwork of international standards. In the United States, the U.S. Food and Drug Administration (FDA) continues to clarify its oversight of wearable devices, particularly those with medical claims or biometric monitoring features. The European Union’s Medical Device Regulation (MDR) and General Data Protection Regulation (GDPR) also impact manufacturers selling in Europe, requiring strict controls on data handling and device safety. Companies such as Oura Health, known for its smart rings, and Swarovski, which has partnered with technology firms for smart jewelry, must navigate these evolving frameworks to ensure compliance and market access.

Privacy remains a central concern as jewelry-embedded wearables collect sensitive personal data, including biometric, location, and behavioral information. In 2025, leading manufacturers are increasingly adopting privacy-by-design principles, offering users granular control over data sharing and storage. For example, Oura Health emphasizes user consent and transparency in its data policies, while Fitbit (now part of Google) continues to update its privacy practices to align with global standards. The integration of payment capabilities, as seen in products from McLEAR, further necessitates compliance with financial data protection regulations such as the Payment Card Industry Data Security Standard (PCI DSS).

Sustainability is gaining prominence as consumers and regulators demand more responsible production and end-of-life management. Jewelry-embedded wearables often use precious metals, rare earth elements, and batteries, raising concerns about sourcing and recyclability. Companies like Swarovski have publicized commitments to responsible sourcing and environmental stewardship, while others are exploring modular designs to facilitate repair and recycling. The Responsible Jewellery Council is working with industry stakeholders to develop standards that address the unique challenges of tech-infused jewelry, including traceability and lifecycle impacts.

Looking ahead, the convergence of regulatory, privacy, and sustainability imperatives is expected to shape product development and market strategies. Stakeholders anticipate more harmonized international standards, increased transparency in data practices, and greater emphasis on circular economy principles. As jewelry-embedded wearable technology becomes more mainstream, proactive engagement with these considerations will be critical for industry growth and consumer trust.

Future Outlook: Opportunities, Risks, and Strategic Recommendations

The future of jewelry-embedded wearable technology in 2025 and the coming years is marked by significant opportunities, emerging risks, and strategic imperatives for stakeholders. As the convergence of fashion and technology accelerates, the sector is poised for robust growth, driven by consumer demand for discreet, aesthetically pleasing devices that offer health, wellness, and connectivity features.

Key players such as Oura Health, known for its Oura Ring, and RingConn, which offers a similar smart ring platform, are expanding their product lines and forging partnerships with health and fitness platforms. Swarovski has also entered the space, collaborating with technology firms to embed sensors into luxury jewelry pieces. Meanwhile, Samsung Electronics is expected to launch its Galaxy Ring in 2025, signaling the entry of major consumer electronics brands into the jewelry-wearable segment.

Opportunities abound in health monitoring, with jewelry wearables increasingly capable of tracking biometrics such as heart rate, sleep, blood oxygen, and even stress levels. The miniaturization of sensors and advances in battery technology are enabling more sophisticated features without compromising design. For example, Oura Health continues to refine its algorithms for sleep and activity tracking, while RingConn emphasizes continuous health data collection with a focus on user privacy.

Risks include data privacy concerns, as jewelry wearables collect sensitive health information. Companies must comply with evolving regulations such as GDPR and HIPAA, and invest in robust cybersecurity measures. Another challenge is balancing technological functionality with the traditional aesthetics and comfort expected from jewelry. Device durability, water resistance, and battery longevity remain critical technical hurdles.

Strategic recommendations for industry participants include:

- Investing in R&D to further miniaturize components and extend battery life, ensuring seamless integration into jewelry form factors.

- Forming cross-industry partnerships between technology firms and established jewelry brands, as seen with Swarovski, to leverage design expertise and brand trust.

- Prioritizing user privacy and transparent data practices to build consumer confidence and comply with global regulations.

- Expanding use cases beyond health, such as contactless payments and secure authentication, to broaden market appeal.

Looking ahead, the jewelry-embedded wearable technology market is expected to diversify rapidly, with new entrants and innovative applications. As consumer expectations evolve, success will depend on delivering both advanced functionality and timeless design, positioning jewelry wearables as both a fashion statement and a personal health companion.