Microfluidic Diagnostic Instrumentation in 2025: Transforming Healthcare with Precision, Speed, and Scalability. Explore the Market Forces and Breakthrough Technologies Shaping the Next Five Years.

- Executive Summary: Key Trends and Market Outlook for 2025–2030

- Market Size, Growth Rate, and Forecasts (2025–2030)

- Technological Innovations: Next-Gen Microfluidic Platforms

- Competitive Landscape: Leading Companies and Emerging Players

- Regulatory Environment and Standards (FDA, ISO, etc.)

- Application Areas: From Point-of-Care to Centralized Labs

- Integration with Digital Health and AI

- Challenges: Scalability, Cost, and Adoption Barriers

- Regional Analysis: North America, Europe, Asia-Pacific, and Beyond

- Future Outlook: Disruptive Opportunities and Strategic Recommendations

- Sources & References

Executive Summary: Key Trends and Market Outlook for 2025–2030

Microfluidic diagnostic instrumentation is poised for significant growth and transformation between 2025 and 2030, driven by advances in miniaturization, integration, and automation. The sector is witnessing rapid adoption across clinical diagnostics, point-of-care (POC) testing, and emerging applications such as infectious disease surveillance and personalized medicine. Key trends shaping the market include the convergence of microfluidics with digital health, the expansion of multiplexed assays, and the increasing role of artificial intelligence (AI) in data interpretation.

Major industry players are accelerating innovation and commercialization. Standard BioTools Inc. (formerly Fluidigm) continues to expand its microfluidic-based platforms for genomics and proteomics, targeting both research and clinical markets. Dolomite Microfluidics is advancing modular microfluidic systems, enabling rapid prototyping and scalable manufacturing for diagnostics developers. Abbott Laboratories and F. Hoffmann-La Roche AG are integrating microfluidic cartridges into their next-generation POC devices, aiming to deliver faster, more accurate results in decentralized settings.

Recent years have seen a surge in demand for rapid, multiplexed testing—exemplified by the global response to COVID-19. This has catalyzed investment in microfluidic platforms capable of simultaneously detecting multiple pathogens or biomarkers from a single sample. Companies such as bioMérieux and Cepheid are expanding their microfluidic-based molecular diagnostic portfolios, with new assays targeting respiratory, sexually transmitted, and antimicrobial resistance pathogens.

Looking ahead, the market outlook for 2025–2030 is robust. The integration of microfluidics with smartphone-based readers and cloud connectivity is expected to democratize access to diagnostics, particularly in resource-limited settings. The adoption of AI-driven analytics will further enhance the clinical utility of microfluidic data, supporting earlier disease detection and more precise patient stratification. Regulatory agencies are also adapting to the pace of innovation, with streamlined pathways for microfluidic diagnostic approvals anticipated in major markets.

Challenges remain, including the need for standardized manufacturing processes, cost reduction, and ensuring interoperability with existing laboratory infrastructure. However, with sustained investment from both established companies and startups, microfluidic diagnostic instrumentation is set to play a pivotal role in the evolution of global healthcare delivery through 2030.

Market Size, Growth Rate, and Forecasts (2025–2030)

The global market for microfluidic diagnostic instrumentation is poised for robust growth between 2025 and 2030, driven by increasing demand for rapid, point-of-care (POC) diagnostics, ongoing technological innovation, and expanding applications in both clinical and non-clinical settings. As of 2025, the market is characterized by a diverse landscape of established players and emerging innovators, with North America, Europe, and Asia-Pacific representing the largest regional markets.

Key industry leaders such as Thermo Fisher Scientific, Agilent Technologies, and Bio-Rad Laboratories continue to invest heavily in microfluidic platforms, integrating advanced materials, automation, and digital connectivity to enhance diagnostic accuracy and throughput. These companies are expanding their product portfolios to address infectious diseases, oncology, prenatal testing, and chronic disease monitoring, reflecting the broadening scope of microfluidic applications.

In 2025, the market size for microfluidic diagnostic instrumentation is estimated to be in the multi-billion-dollar range, with double-digit compound annual growth rates (CAGR) projected through 2030. This growth is underpinned by the increasing adoption of microfluidic-based POC devices in decentralized healthcare settings, such as clinics, pharmacies, and even home environments. The COVID-19 pandemic accelerated the acceptance of rapid, portable diagnostics, a trend that continues to influence market dynamics.

Emerging players, including Standard BioTools (formerly Fluidigm), Dolomite Microfluidics, and Micronit, are contributing to market expansion by offering customizable microfluidic solutions and contract manufacturing services. These companies are enabling the development of next-generation diagnostic instruments tailored to specific biomarkers and disease states, further fueling market growth.

Looking ahead, the market outlook for 2025–2030 is shaped by several factors: the miniaturization of diagnostic platforms, integration with digital health ecosystems, and the push for cost-effective, high-throughput testing. Regulatory support for innovative diagnostic technologies, particularly in the United States and European Union, is expected to streamline product approvals and accelerate commercialization. Additionally, the Asia-Pacific region is anticipated to witness the fastest growth, driven by expanding healthcare infrastructure and rising investment in biotechnology.

Overall, the microfluidic diagnostic instrumentation market is set for sustained expansion, with leading manufacturers and new entrants alike capitalizing on the convergence of microengineering, biotechnology, and digital health to deliver accessible, accurate, and rapid diagnostic solutions worldwide.

Technological Innovations: Next-Gen Microfluidic Platforms

The landscape of microfluidic diagnostic instrumentation is undergoing rapid transformation in 2025, driven by advances in device miniaturization, integration of multiplexed assays, and the convergence of microfluidics with digital and AI-powered analytics. Next-generation microfluidic platforms are increasingly designed for point-of-care (POC) and decentralized testing, with a focus on speed, sensitivity, and user-friendliness.

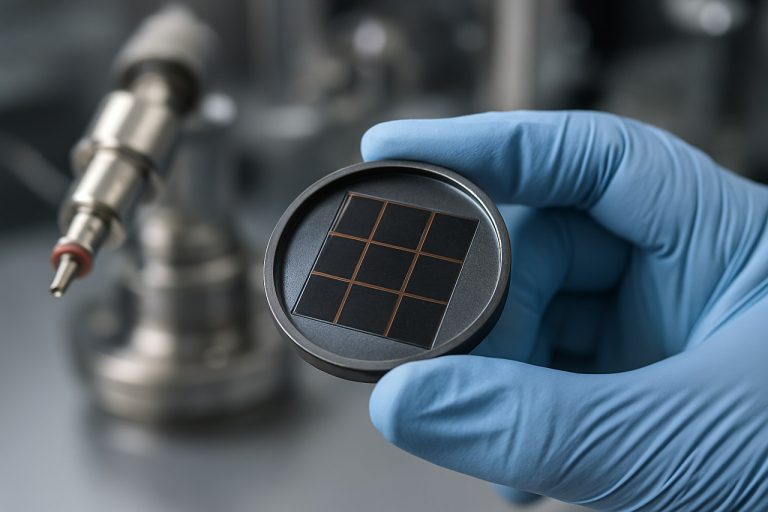

A key innovation is the integration of microfluidic chips with advanced biosensors and automated fluid handling, enabling real-time detection of multiple biomarkers from minimal sample volumes. Companies such as Standard BioTools (formerly Fluidigm) are at the forefront, offering microfluidic-based systems capable of high-throughput single-cell analysis and multiplexed protein detection. Their platforms leverage microfluidic circuit design to automate complex workflows, reducing human error and turnaround time.

Another significant trend is the adoption of paper-based and polymer-based microfluidic devices, which are cost-effective and suitable for mass production. Abbott Laboratories continues to expand its i-STAT handheld blood analyzer line, utilizing microfluidic cartridges for rapid bedside diagnostics. These devices are increasingly being equipped with wireless connectivity, allowing seamless integration with electronic health records and telemedicine platforms.

The use of digital microfluidics—where discrete droplets are manipulated on an array using electric fields—is gaining traction for its flexibility and scalability. BioReliance (a Merck KGaA company) and Dolomite Microfluidics are developing platforms that enable programmable, on-demand assay customization, which is particularly valuable for emerging infectious disease diagnostics and personalized medicine.

Artificial intelligence and machine learning are being embedded into microfluidic diagnostic systems to enhance data interpretation and automate result reporting. Thermo Fisher Scientific is integrating AI-driven analytics into its microfluidic qPCR and immunoassay platforms, improving diagnostic accuracy and enabling remote expert consultation.

Looking ahead, the next few years are expected to see further miniaturization, increased multiplexing capacity, and broader adoption of microfluidic diagnostic instrumentation in both clinical and resource-limited settings. The ongoing development of fully integrated, sample-to-answer platforms will likely accelerate the decentralization of diagnostics, supporting rapid response to public health challenges and expanding access to high-quality testing worldwide.

Competitive Landscape: Leading Companies and Emerging Players

The competitive landscape of microfluidic diagnostic instrumentation in 2025 is characterized by a dynamic mix of established industry leaders and innovative emerging players. The sector is driven by the demand for rapid, accurate, and cost-effective diagnostic solutions, particularly in point-of-care (POC) and decentralized healthcare settings. Key companies are leveraging advances in microfabrication, integration of biosensors, and digital connectivity to differentiate their offerings.

Among the global leaders, Thermo Fisher Scientific continues to expand its microfluidics portfolio, integrating microfluidic chips into its genetic analysis and molecular diagnostics platforms. The company’s focus on scalable manufacturing and robust assay development positions it as a dominant supplier for both clinical and research applications. Similarly, Agilent Technologies has strengthened its presence through microfluidic-based sample preparation and analysis systems, targeting genomics and proteomics markets.

Another major player, Bio-Rad Laboratories, is recognized for its droplet digital PCR (ddPCR) technology, which utilizes microfluidic partitioning to enable highly sensitive nucleic acid quantification. This technology has seen increased adoption in oncology, infectious disease, and prenatal testing. Standard BioTools (formerly Fluidigm) remains a key innovator, offering integrated microfluidic platforms for single-cell analysis and high-throughput screening, with a focus on translational and clinical research.

In the POC diagnostics segment, Abbott Laboratories has advanced its i-STAT system, a handheld blood analyzer that incorporates microfluidic cartridges for rapid bedside testing. The company’s ongoing investment in connectivity and data integration is expected to further enhance its competitive edge. Cepheid, a subsidiary of Danaher Corporation, continues to lead in cartridge-based molecular diagnostics, with its GeneXpert system widely deployed for infectious disease detection, including tuberculosis and COVID-19.

Emerging players are also shaping the landscape. Dolomite Microfluidics specializes in custom microfluidic solutions and modular instrumentation, catering to both diagnostics developers and academic researchers. Startups such as Sphere Fluidics are gaining traction with novel droplet-based microfluidic platforms for single-cell analysis and biotherapeutic discovery.

Looking ahead, the sector is expected to see increased collaboration between established diagnostics companies and agile startups, as well as strategic investments in automation, multiplexing, and AI-driven data analysis. The competitive environment will likely intensify as regulatory approvals accelerate and new applications in personalized medicine and decentralized testing emerge.

Regulatory Environment and Standards (FDA, ISO, etc.)

The regulatory environment for microfluidic diagnostic instrumentation is rapidly evolving as these technologies become increasingly central to point-of-care and laboratory diagnostics. In 2025, regulatory agencies such as the U.S. Food and Drug Administration (FDA) and international standards organizations are intensifying their focus on ensuring the safety, efficacy, and quality of microfluidic-based devices.

The FDA continues to regulate microfluidic diagnostic devices under its medical device framework, with most falling under Class II (moderate risk) or Class III (high risk) categories, depending on intended use and risk profile. The agency’s Center for Devices and Radiological Health (CDRH) has issued guidance documents specifically addressing in vitro diagnostic (IVD) devices, including those utilizing microfluidic technologies. In 2024 and 2025, the FDA has emphasized the importance of analytical validation, clinical performance, and robust manufacturing controls for microfluidic platforms, especially those intended for infectious disease detection and personalized medicine applications. The agency is also piloting programs to streamline review processes for innovative diagnostics, including the Breakthrough Devices Program, which several microfluidic companies have leveraged for accelerated pathways (U.S. Food and Drug Administration).

On the international front, the International Organization for Standardization (ISO) has updated several standards relevant to microfluidic diagnostics. ISO 13485:2016 remains the cornerstone for quality management systems in medical device manufacturing, and compliance is increasingly expected for market access in Europe, Asia, and other regions. Additionally, ISO 15189:2022, which specifies requirements for quality and competence in medical laboratories, is being adopted by clinical labs utilizing microfluidic instruments. The European Union’s In Vitro Diagnostic Regulation (IVDR), fully enforced as of 2025, imposes stricter requirements for clinical evidence, post-market surveillance, and traceability, directly impacting microfluidic device manufacturers seeking CE marking (International Organization for Standardization).

Industry leaders such as Standard BioTools (formerly Fluidigm), Dolomite Microfluidics, and Abbott are actively engaging with regulators to shape standards and best practices. These companies are investing in compliance infrastructure and participating in working groups to address unique challenges posed by microfluidic systems, such as device miniaturization, integration of multiple assay steps, and data integrity.

Looking ahead, the regulatory landscape is expected to further adapt to the rapid pace of innovation in microfluidics. Regulatory agencies are exploring new frameworks for software-driven diagnostics, cybersecurity, and real-time data reporting, all of which are increasingly relevant as microfluidic platforms become more connected and automated. Collaboration between industry, regulators, and standards bodies will be critical to ensure that regulatory pathways keep pace with technological advancements, supporting both patient safety and timely access to next-generation diagnostic tools.

Application Areas: From Point-of-Care to Centralized Labs

Microfluidic diagnostic instrumentation is rapidly transforming the landscape of clinical diagnostics, with applications spanning from decentralized point-of-care (POC) settings to high-throughput centralized laboratories. In 2025, the sector is witnessing accelerated adoption driven by the need for rapid, accurate, and cost-effective diagnostic solutions, particularly in infectious disease detection, chronic disease monitoring, and personalized medicine.

At the point-of-care, microfluidic devices are enabling near-patient testing with minimal sample volumes and reduced turnaround times. Companies such as Abbott Laboratories and Cepheid have developed compact, cartridge-based systems that integrate sample preparation, amplification, and detection within a single disposable unit. These platforms are widely used for respiratory infections, including COVID-19 and influenza, as well as for sexually transmitted infections and antimicrobial resistance screening. The portability and ease-of-use of these instruments are particularly valuable in resource-limited settings and for remote patient monitoring.

In parallel, centralized laboratories are leveraging microfluidic automation to increase throughput and reduce operational costs. High-capacity instruments from providers like Standard BioTools Inc. (formerly Fluidigm) and Bio-Rad Laboratories utilize microfluidic chips to process hundreds to thousands of samples simultaneously, supporting applications such as multiplexed PCR, digital PCR, and next-generation sequencing library preparation. These systems are integral to large-scale screening programs, oncology diagnostics, and population health initiatives, where efficiency and scalability are paramount.

A notable trend in 2025 is the convergence of microfluidics with digital connectivity and artificial intelligence. Instrumentation is increasingly equipped with wireless data transmission and cloud-based analytics, enabling real-time result sharing and integration with electronic health records. Companies like Thermo Fisher Scientific are incorporating these features to facilitate remote diagnostics and epidemiological surveillance.

Looking ahead, the next few years are expected to bring further miniaturization, multiplexing capabilities, and integration of sample-to-answer workflows. The expansion of microfluidic platforms into home-based testing and wearable formats is anticipated, supported by ongoing collaborations between diagnostics manufacturers and technology firms. Regulatory agencies are also adapting frameworks to accommodate the unique characteristics of microfluidic devices, which is likely to accelerate market entry and adoption.

Overall, microfluidic diagnostic instrumentation is poised to play a central role in the evolution of both POC and centralized laboratory testing, offering scalable solutions that address the growing demand for rapid, reliable, and accessible diagnostics worldwide.

Integration with Digital Health and AI

The integration of microfluidic diagnostic instrumentation with digital health platforms and artificial intelligence (AI) is rapidly transforming the landscape of point-of-care and decentralized diagnostics in 2025. Microfluidic devices, which manipulate small volumes of fluids for biochemical analysis, are increasingly being paired with cloud connectivity, smartphone interfaces, and AI-driven analytics to deliver faster, more accurate, and user-friendly diagnostic solutions.

Leading microfluidics companies are actively embedding digital health features into their platforms. For example, Standard BioTools (formerly Fluidigm) has developed microfluidic systems that can interface with digital data management tools, enabling seamless transfer of test results to electronic health records (EHRs) and telemedicine platforms. Similarly, Abbott Laboratories continues to expand its i-STAT handheld blood analyzer ecosystem, which now supports wireless data transmission and integration with hospital information systems, facilitating real-time clinical decision-making.

AI is playing a pivotal role in enhancing the diagnostic capabilities of microfluidic instruments. Companies such as Becton, Dickinson and Company (BD) are incorporating machine learning algorithms into their microfluidic-based platforms to automate image analysis, pattern recognition, and anomaly detection, thereby reducing human error and improving diagnostic accuracy. These AI-powered systems are particularly valuable in resource-limited settings, where skilled personnel may be scarce.

The convergence of microfluidics, digital health, and AI is also fostering the development of at-home diagnostic solutions. Thermo Fisher Scientific and Roche are investing in microfluidic devices that connect to mobile apps, allowing patients to perform tests at home and share results with healthcare providers remotely. This approach not only enhances patient engagement but also supports public health surveillance by enabling real-time data aggregation and epidemiological analysis.

Looking ahead, the next few years are expected to see further integration of microfluidic diagnostic instrumentation with digital health ecosystems. Industry collaborations with technology giants and healthcare providers are anticipated to accelerate, driving interoperability standards and regulatory frameworks. The ongoing miniaturization of microfluidic devices, combined with advances in AI and secure data transmission, will likely expand the reach of precision diagnostics to broader populations, supporting personalized medicine and proactive disease management.

Challenges: Scalability, Cost, and Adoption Barriers

Microfluidic diagnostic instrumentation, while promising transformative advances in point-of-care and laboratory diagnostics, faces persistent challenges in scalability, cost, and widespread adoption as of 2025. The transition from laboratory prototypes to mass-produced, clinically robust devices remains a significant hurdle. One of the primary scalability challenges is the complexity of manufacturing microfluidic chips with consistent quality and performance. Traditional fabrication methods, such as soft lithography, are labor-intensive and not easily scalable for high-volume production. Although companies like Dolomite Microfluidics and Fluidigm Corporation have developed proprietary manufacturing techniques and platforms, the industry still grapples with standardization and reproducibility across batches, which is critical for regulatory approval and clinical trust.

Cost remains a central barrier, particularly for resource-limited settings where microfluidic diagnostics could have the greatest impact. The integration of multiple functions—such as sample preparation, reagent storage, and detection—onto a single chip often requires specialized materials and precise engineering, driving up production costs. While some companies, such as Abbott Laboratories and Thermo Fisher Scientific, have the scale and resources to invest in cost-reduction strategies, smaller innovators may struggle to achieve price points competitive with established diagnostic methods. Furthermore, the cost of ancillary equipment, such as readers and data management systems, adds to the total cost of ownership, potentially limiting adoption in decentralized healthcare environments.

Adoption barriers are also shaped by regulatory and clinical acceptance. Microfluidic devices must meet stringent regulatory requirements for accuracy, reliability, and safety. The lack of harmonized international standards for microfluidic diagnostics complicates the approval process, often resulting in lengthy and costly validation studies. Additionally, clinicians and laboratory personnel may be hesitant to adopt new workflows, especially if training requirements are significant or if the perceived benefits over existing technologies are marginal. Industry leaders like Becton, Dickinson and Company and Bio-Rad Laboratories are actively engaged in educational initiatives and collaborative studies to demonstrate clinical utility and build user confidence.

Looking ahead, the outlook for overcoming these challenges is cautiously optimistic. Advances in automated manufacturing, such as roll-to-roll processing and injection molding, are expected to improve scalability and reduce costs over the next few years. Strategic partnerships between microfluidic innovators and established diagnostics companies may accelerate regulatory pathways and market entry. However, widespread adoption will likely depend on continued progress in standardization, cost reduction, and clear demonstration of clinical value in real-world settings.

Regional Analysis: North America, Europe, Asia-Pacific, and Beyond

The global landscape for microfluidic diagnostic instrumentation in 2025 is marked by dynamic regional developments, with North America, Europe, and Asia-Pacific leading innovation, commercialization, and adoption. Each region demonstrates unique strengths and faces distinct challenges, shaping the trajectory of microfluidic diagnostics in the near future.

North America remains at the forefront, driven by robust R&D ecosystems, established healthcare infrastructure, and a strong presence of pioneering companies. The United States, in particular, is home to industry leaders such as Standard BioTools (formerly Fluidigm), which continues to expand its microfluidic-based platforms for genomics and proteomics. Thermo Fisher Scientific and Illumina are also advancing microfluidic integration in next-generation sequencing and point-of-care diagnostics. Regulatory clarity from the U.S. Food and Drug Administration (FDA) is expected to further accelerate clinical adoption, especially as microfluidic devices play a growing role in decentralized and rapid diagnostics.

Europe is characterized by strong public-private partnerships and a focus on quality and regulatory compliance. Companies such as QIAGEN (Germany/Netherlands) and Bio-Rad Laboratories (France operations) are investing in microfluidic solutions for molecular diagnostics and infectious disease testing. The European Union’s emphasis on digital health and cross-border healthcare interoperability is fostering collaborative projects, with microfluidic platforms increasingly integrated into telemedicine and remote patient monitoring. The region’s regulatory environment, shaped by the In Vitro Diagnostic Regulation (IVDR), is expected to influence product development and market entry strategies through 2025 and beyond.

Asia-Pacific is emerging as a major growth engine, propelled by rising healthcare investments, expanding biotechnology sectors, and a large patient base. In China, companies like Guangzhou Wondfo Biotech are scaling up production of microfluidic-based point-of-care tests, particularly for infectious diseases and chronic condition monitoring. Japan’s Sysmex Corporation is advancing microfluidic hematology analyzers and cancer diagnostics, while South Korea’s Seegene is integrating microfluidics into multiplex molecular testing. Regional governments are supporting domestic innovation and local manufacturing, aiming to reduce reliance on imports and improve healthcare access.

Beyond these regions, countries in Latin America and the Middle East are beginning to adopt microfluidic diagnostic technologies, often through partnerships with global suppliers. However, challenges such as limited infrastructure and regulatory harmonization persist. Looking ahead, the global market is expected to see increased cross-regional collaborations, technology transfer, and standardization efforts, with microfluidic diagnostic instrumentation playing a pivotal role in the evolution of personalized and decentralized healthcare worldwide.

Future Outlook: Disruptive Opportunities and Strategic Recommendations

The future of microfluidic diagnostic instrumentation is poised for significant disruption and accelerated adoption, driven by advances in miniaturization, integration of artificial intelligence, and the growing demand for decentralized healthcare solutions. As of 2025, the sector is witnessing a convergence of enabling technologies—such as advanced materials, precision manufacturing, and cloud connectivity—that are transforming both the capabilities and accessibility of microfluidic platforms.

Key industry leaders, including Standard BioTools (formerly Fluidigm), Dolomite Microfluidics, and Carl Zeiss AG, are investing heavily in next-generation systems that offer multiplexed, high-throughput analysis with minimal sample volumes. These companies are focusing on integrating microfluidics with digital readouts and automated workflows, enabling rapid, point-of-care diagnostics for infectious diseases, oncology, and chronic conditions. For example, Standard BioTools continues to expand its CyTOF and microfluidic PCR platforms, targeting both research and clinical diagnostics markets.

A major disruptive opportunity lies in the democratization of diagnostics through portable, user-friendly devices. Startups and established players alike are developing cartridge-based systems that require little technical expertise, making them suitable for use in resource-limited settings and at-home testing. Abbott Laboratories and Thermo Fisher Scientific are notable for their ongoing efforts to commercialize compact, integrated microfluidic analyzers for rapid molecular and immunoassay testing.

Strategically, the next few years will see increased collaboration between microfluidic device manufacturers and software/AI companies to enhance data interpretation and clinical decision support. The integration of cloud-based analytics and remote monitoring is expected to further expand the utility of microfluidic diagnostics, particularly in telemedicine and epidemiological surveillance. Regulatory bodies are also adapting to these innovations, with streamlined pathways for emergency use and digital health integration.

To capitalize on these trends, stakeholders should prioritize:

- Investing in scalable manufacturing and robust supply chains to meet surging demand.

- Fostering partnerships with digital health and AI firms to unlock new diagnostic insights.

- Engaging with regulatory agencies early to ensure compliance and accelerate market entry.

- Focusing on user-centric design to maximize adoption in both clinical and non-clinical environments.

In summary, microfluidic diagnostic instrumentation is entering a phase of rapid innovation and market expansion. Companies that embrace integration, automation, and digital connectivity will be best positioned to lead in this evolving landscape.