Autonomous Underwater Vehicle Swarm Coordination Systems in 2025: Transforming Ocean Exploration and Defense. Discover How Next-Gen Swarm Intelligence Is Shaping the Future of Maritime Operations.

- Executive Summary: Key Trends and Market Drivers

- Market Size and Growth Forecast (2025–2030): CAGR and Revenue Projections

- Core Technologies: AI, Communication Protocols, and Sensor Fusion

- Leading Players and Industry Initiatives (e.g., kongsberg.com, teledynemarine.com, ieee.org)

- Applications: Defense, Oceanography, Offshore Energy, and Environmental Monitoring

- Swarm Coordination Algorithms: Advances and Challenges

- Integration with Existing Maritime Systems and Infrastructure

- Regulatory Landscape and Industry Standards (Referencing ieee.org, asme.org)

- Investment, Funding, and Strategic Partnerships

- Future Outlook: Innovations, Opportunities, and Market Expansion

- Sources & References

Executive Summary: Key Trends and Market Drivers

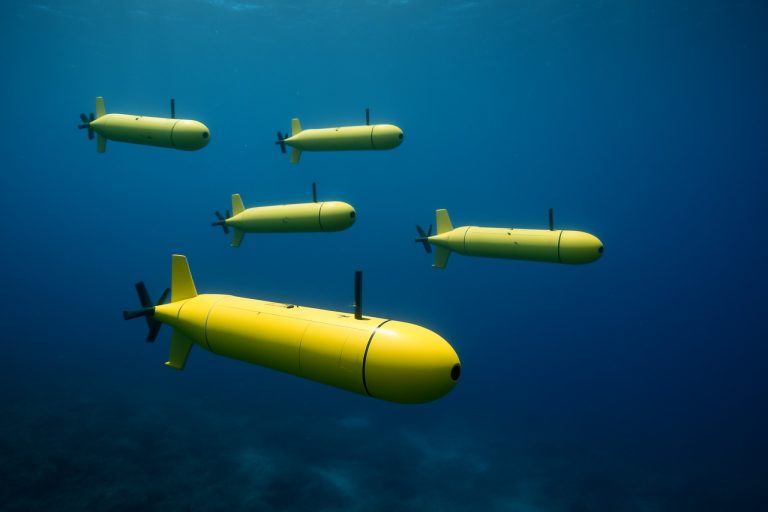

The market for Autonomous Underwater Vehicle (AUV) Swarm Coordination Systems is entering a pivotal phase in 2025, driven by rapid technological advancements, expanding commercial and defense applications, and increasing investments from both public and private sectors. Swarm coordination—enabling multiple AUVs to operate collaboratively—has emerged as a transformative capability, promising enhanced mission efficiency, resilience, and scalability for underwater operations.

A key trend shaping the sector is the integration of advanced artificial intelligence (AI) and machine learning algorithms, which allow AUV swarms to autonomously adapt to dynamic underwater environments and complex mission objectives. Leading manufacturers such as Kongsberg Gruppen and Saab AB are actively developing and deploying swarm-capable AUV platforms, leveraging real-time data sharing, decentralized decision-making, and robust communication protocols. These innovations are enabling new mission profiles, including large-area seabed mapping, environmental monitoring, and coordinated search and rescue operations.

Defense and security applications remain a primary driver, with navies and maritime agencies seeking to enhance underwater situational awareness, mine countermeasures, and anti-submarine warfare capabilities. For instance, Saab AB has demonstrated multi-vehicle coordination in its Sabertooth and Sea Wasp AUV lines, while Kongsberg Gruppen continues to expand its HUGIN AUV family with swarm-enabled features. The U.S. Navy and allied forces are also investing in swarm technologies to address evolving undersea threats and operational requirements.

Commercial sectors are increasingly adopting AUV swarms for offshore energy, subsea infrastructure inspection, and marine research. Companies like Ocean Infinity are pioneering large-scale, multi-AUV deployments for high-resolution seabed data acquisition and pipeline inspection, demonstrating the scalability and cost-effectiveness of coordinated operations. The ability to deploy swarms reduces mission time, increases data fidelity, and minimizes operational risks in challenging environments.

Looking ahead, the outlook for AUV swarm coordination systems is robust, with continued R&D expected to yield further improvements in autonomy, communication reliability, and interoperability. Industry collaborations and standardization efforts, such as those led by the Ocean Autonomy Cluster, are anticipated to accelerate technology adoption and market growth. As regulatory frameworks evolve and the value proposition of swarm-enabled missions becomes clearer, the sector is poised for significant expansion through 2025 and beyond.

Market Size and Growth Forecast (2025–2030): CAGR and Revenue Projections

The market for Autonomous Underwater Vehicle (AUV) Swarm Coordination Systems is poised for significant expansion between 2025 and 2030, driven by increasing demand for advanced underwater exploration, defense applications, and offshore energy operations. As of 2025, the global AUV market is experiencing robust growth, with swarm coordination systems emerging as a critical technological differentiator. These systems enable multiple AUVs to operate collaboratively, enhancing mission efficiency, data collection, and operational safety in complex underwater environments.

Key industry players such as Kongsberg Gruppen, a Norwegian technology leader, and Saab AB, a major Swedish defense and security company, are actively developing and integrating swarm coordination capabilities into their AUV portfolios. Kongsberg Gruppen has demonstrated multi-vehicle operations for subsea survey and inspection, while Saab AB continues to advance its Seaeye range with collaborative autonomy features. In the United States, Hydroid, Inc. (a subsidiary of Huntington Ingalls Industries) is also investing in swarm-enabled AUVs for both commercial and defense sectors.

The Compound Annual Growth Rate (CAGR) for the AUV swarm coordination systems segment is projected to exceed 15% from 2025 to 2030, outpacing the broader AUV market due to the increasing adoption of multi-vehicle solutions in offshore oil & gas, marine research, and naval operations. Revenue projections for this segment are expected to reach several hundred million USD by 2030, with the Asia-Pacific region, North America, and Europe as primary growth drivers. The expansion is fueled by government investments in maritime security, environmental monitoring, and subsea infrastructure inspection.

Recent events underscore this momentum. In 2024, Kongsberg Gruppen announced successful trials of coordinated AUV swarms for pipeline inspection, while Saab AB reported new contracts for swarm-capable vehicles with European navies. Additionally, L3Harris Technologies, a prominent U.S. defense contractor, is developing advanced autonomy and communication modules to enable real-time swarm coordination for its Iver AUV series.

Looking ahead, the market outlook remains highly positive. The convergence of artificial intelligence, underwater communication technologies, and modular AUV platforms is expected to further accelerate adoption. As end-users seek scalable, cost-effective, and resilient solutions for underwater missions, swarm coordination systems are set to become a standard feature in next-generation AUV deployments worldwide.

Core Technologies: AI, Communication Protocols, and Sensor Fusion

The evolution of Autonomous Underwater Vehicle (AUV) swarm coordination systems in 2025 is being driven by rapid advancements in artificial intelligence (AI), robust underwater communication protocols, and sophisticated sensor fusion techniques. These core technologies are enabling AUV swarms to perform complex, collaborative missions in challenging marine environments with increasing autonomy and reliability.

AI algorithms, particularly those based on distributed machine learning and multi-agent reinforcement learning, are at the heart of modern AUV swarm coordination. These systems allow individual vehicles to make real-time decisions, adapt to dynamic underwater conditions, and optimize group behaviors such as formation keeping, area coverage, and target tracking. Companies like Kongsberg Maritime and Saab are actively integrating advanced AI modules into their AUV platforms, enabling more sophisticated swarm behaviors and mission planning capabilities.

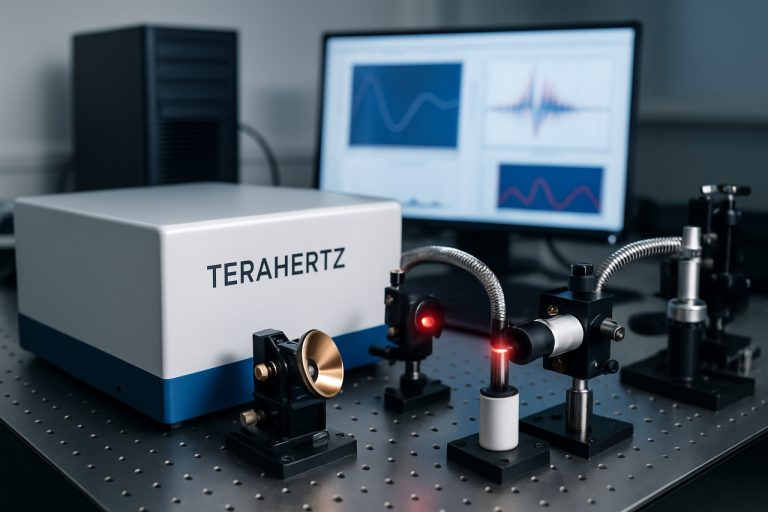

Communication remains a significant challenge for underwater swarms due to the limitations of acoustic, optical, and electromagnetic signal propagation in water. In 2025, the industry is seeing the deployment of hybrid communication protocols that combine acoustic modems for long-range, low-bandwidth messaging with optical and even short-range radio frequency (RF) links for high-speed, close-proximity data exchange. Teledyne Marine and EvoLogics are notable for their development of advanced underwater acoustic modems and networking solutions, which are being adopted in multi-vehicle operations to support reliable, low-latency swarm coordination.

Sensor fusion is another critical enabler, allowing AUV swarms to combine data from diverse onboard sensors—such as sonar, inertial measurement units (IMUs), Doppler velocity logs (DVLs), and environmental sensors—to achieve robust situational awareness and precise navigation. The integration of real-time sensor fusion algorithms is improving the collective perception and mapping capabilities of AUV swarms, which is essential for applications like seabed mapping, infrastructure inspection, and environmental monitoring. Bluefin Robotics (a General Dynamics company) and L3Harris are among the industry leaders incorporating advanced sensor fusion frameworks into their AUV systems.

Looking ahead, the next few years are expected to bring further convergence of AI, communication, and sensor technologies, with a focus on standardization and interoperability. Industry collaborations and open architecture initiatives are likely to accelerate, enabling mixed-vendor AUV swarms and more scalable, resilient underwater networks. As these core technologies mature, AUV swarms will become increasingly capable of executing autonomous, cooperative missions in both commercial and defense sectors.

Leading Players and Industry Initiatives (e.g., kongsberg.com, teledynemarine.com, ieee.org)

The field of Autonomous Underwater Vehicle (AUV) swarm coordination systems is rapidly evolving, with several leading industry players and organizations spearheading technological advancements and collaborative initiatives as of 2025. These efforts are focused on enhancing the collective intelligence, communication, and operational efficiency of AUV swarms for applications ranging from oceanographic research to defense and offshore energy.

A key industry leader, Kongsberg Gruppen, continues to expand its portfolio of AUVs and swarm coordination solutions. Kongsberg’s HUGIN series, widely deployed for subsea mapping and inspection, is increasingly being integrated with advanced swarm algorithms to enable multiple vehicles to operate collaboratively. The company’s ongoing projects emphasize robust underwater communication protocols and real-time data sharing, which are critical for coordinated missions in complex marine environments.

Another major contributor, Teledyne Marine, is actively developing modular AUV platforms with swarm capabilities. Teledyne’s Gavia and SeaRaptor AUVs are being equipped with enhanced autonomy and inter-vehicle communication systems, allowing for dynamic task allocation and adaptive mission planning. In 2025, Teledyne is participating in several international consortia aimed at standardizing swarm behaviors and interoperability, reflecting the industry’s move toward open architectures and collaborative innovation.

On the research and standards front, the IEEE Oceanic Engineering Society is playing a pivotal role in shaping the future of AUV swarm coordination. Through technical committees and working groups, IEEE is facilitating the development of best practices, interoperability standards, and ethical guidelines for multi-vehicle operations. The society’s conferences and publications in 2025 are expected to highlight breakthroughs in distributed control algorithms, underwater networking, and real-world swarm deployments.

Other notable industry participants include Saab, with its Sabertooth and AUV62 platforms, and L3Harris Technologies, both of which are investing in next-generation swarm control systems for defense and commercial applications. These companies are collaborating with academic institutions and government agencies to conduct large-scale field trials, demonstrating the scalability and resilience of coordinated AUV operations.

Looking ahead, the industry outlook for 2025 and beyond points to increased adoption of AUV swarms in deep-sea exploration, environmental monitoring, and subsea infrastructure inspection. The convergence of artificial intelligence, advanced sensing, and secure underwater communications is expected to drive further innovation, with leading players continuing to set benchmarks for reliability, autonomy, and mission flexibility in swarm coordination systems.

Applications: Defense, Oceanography, Offshore Energy, and Environmental Monitoring

Autonomous Underwater Vehicle (AUV) swarm coordination systems are rapidly advancing, with significant applications emerging across defense, oceanography, offshore energy, and environmental monitoring sectors in 2025 and the near future. These systems leverage distributed intelligence, real-time communication, and adaptive mission planning to enable fleets of AUVs to operate collaboratively, enhancing mission efficiency, coverage, and resilience.

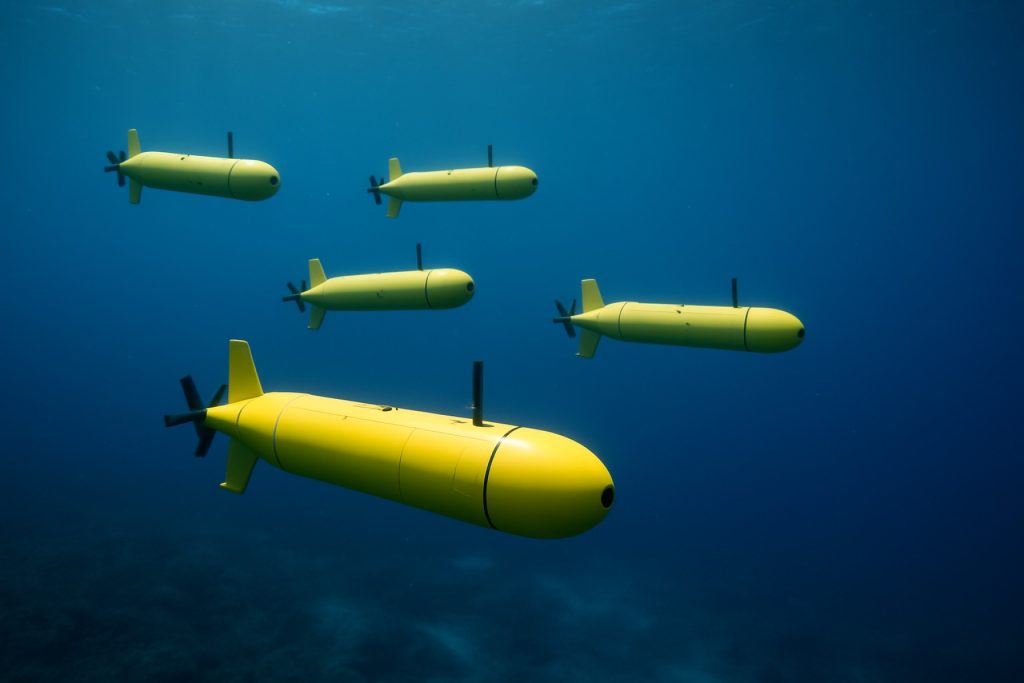

In the defense sector, AUV swarms are increasingly deployed for mine countermeasures, anti-submarine warfare, and maritime surveillance. Leading defense contractors such as Northrop Grumman and Saab are actively developing and testing swarm-capable AUVs. For example, Saab’s Sabertooth and Sea Wasp platforms are being integrated with advanced swarm algorithms to enable coordinated search and neutralization missions. The U.S. Navy, in collaboration with Northrop Grumman, is conducting trials of distributed AUV swarms for persistent undersea surveillance, aiming to improve situational awareness and reduce operational risks for crewed vessels.

In oceanography, swarm-coordinated AUVs are revolutionizing data collection by enabling simultaneous, wide-area sampling of oceanographic parameters. Organizations such as Kongsberg Maritime and Teledyne Marine are equipping their AUV fleets with swarm communication modules and adaptive mission software. This allows for real-time re-tasking and collaborative mapping of dynamic phenomena such as algal blooms, thermocline shifts, and deep-sea currents. The ability to deploy dozens of AUVs in coordinated patterns is expected to yield higher-resolution datasets and accelerate scientific discovery.

Offshore energy operators are adopting AUV swarms for subsea infrastructure inspection, pipeline monitoring, and leak detection. Companies like Ocean Infinity are pioneering the use of large-scale AUV fleets, with their Armada initiative deploying multiple robotic vessels and AUVs for synchronized survey and inspection missions. Swarm coordination reduces downtime, increases coverage, and enhances the reliability of asset integrity assessments, which is critical for both oil & gas and offshore wind sectors.

Environmental monitoring is another area where AUV swarms are making a tangible impact. Swarm-enabled AUVs can rapidly assess the extent of pollution events, monitor marine biodiversity, and track the movement of contaminants. Teledyne Marine and Kongsberg Maritime are collaborating with environmental agencies to deploy coordinated AUV missions for real-time ecosystem health assessments and long-term monitoring programs.

Looking ahead, the integration of artificial intelligence, improved underwater communication protocols, and advances in battery technology are expected to further enhance the autonomy and scalability of AUV swarm coordination systems. As these technologies mature, their adoption across defense, scientific, industrial, and environmental domains is set to accelerate, driving new capabilities and operational efficiencies through 2025 and beyond.

Swarm Coordination Algorithms: Advances and Challenges

The field of Autonomous Underwater Vehicle (AUV) swarm coordination is experiencing rapid advancements in 2025, driven by the need for robust, scalable, and adaptive algorithms that enable multiple AUVs to operate collaboratively in complex underwater environments. Swarm coordination algorithms are central to unlocking the full potential of AUV fleets for applications such as environmental monitoring, seabed mapping, and search-and-rescue missions.

Recent years have seen a shift from centralized to decentralized coordination approaches, with algorithms increasingly inspired by biological swarms and collective intelligence. Decentralized algorithms offer greater resilience to communication failures and single-point vulnerabilities, which are critical in the challenging underwater domain where acoustic communication is bandwidth-limited and prone to latency. Leading AUV manufacturers such as Kongsberg Maritime and Saab have been actively developing and integrating swarm capabilities into their platforms, focusing on distributed task allocation, adaptive path planning, and real-time obstacle avoidance.

A key milestone in 2024-2025 has been the demonstration of multi-AUV missions using advanced consensus-based and behavior-based algorithms. For example, Kongsberg Maritime has showcased coordinated seabed mapping missions where fleets of AUVs autonomously divide survey areas and dynamically reassign tasks in response to vehicle failures or environmental changes. Similarly, Saab has reported progress in collaborative mine countermeasure operations, leveraging swarm intelligence to improve coverage and reduce mission time.

Despite these advances, several challenges persist. Reliable underwater communication remains a bottleneck, limiting the scalability of swarm systems. Efforts are underway to develop more efficient acoustic networking protocols and to exploit short-range optical and electromagnetic communication for high-data-rate exchanges in localized swarms. Another challenge is the development of robust algorithms that can handle heterogeneous swarms, where AUVs with different capabilities and sensor payloads must coordinate seamlessly. Interoperability standards, such as those promoted by the U.S. Navy and international defense organizations, are expected to play a growing role in the coming years.

Looking ahead, the outlook for AUV swarm coordination systems is promising. Ongoing research and field trials are expected to yield more autonomous, adaptive, and resilient swarms by 2026 and beyond. Industry leaders like Kongsberg Maritime, Saab, and defense agencies are poised to drive further innovation, with a focus on real-world deployments and integration with broader maritime autonomous systems.

Integration with Existing Maritime Systems and Infrastructure

The integration of Autonomous Underwater Vehicle (AUV) swarm coordination systems with existing maritime systems and infrastructure is a rapidly advancing frontier in 2025. As AUV swarms become more capable and reliable, their interoperability with traditional maritime assets—such as surface vessels, subsea communication networks, and port facilities—has become a central focus for both industry and government stakeholders.

AUV swarms are increasingly being deployed for applications including subsea inspection, environmental monitoring, and defense. To maximize their utility, these swarms must seamlessly interface with established maritime command and control (C2) systems, as well as with legacy sensor networks and data management platforms. Companies like Kongsberg Gruppen, a global leader in maritime technology, are actively developing solutions that enable AUVs to communicate and coordinate with manned vessels and shore-based operations centers. Their integration efforts focus on standardized communication protocols and robust data fusion, ensuring that swarm-generated insights can be rapidly assimilated into broader maritime situational awareness frameworks.

Another key player, Saab AB, is advancing the interoperability of its AUV systems with naval and commercial infrastructure. Saab’s AUVs are designed to dock with subsea stations for data transfer and battery charging, supporting persistent operations and reducing the need for surface intervention. This capability is being extended to swarm operations, where multiple vehicles can autonomously coordinate docking and data relay, further embedding AUVs into the operational fabric of offshore energy and defense sectors.

The integration challenge is also being addressed through collaborative industry initiatives. Organizations such as the Ocean Networks Canada are working to standardize interfaces between AUVs and ocean observatory infrastructure, enabling real-time data exchange and coordinated mission planning. These efforts are critical for scaling up swarm deployments in complex environments, such as busy ports or offshore wind farms, where AUVs must operate alongside human crews and other autonomous systems.

Looking ahead, the next few years are expected to see further convergence between AUV swarm coordination systems and digital maritime infrastructure. The adoption of open architectures and interoperable software platforms will be key enablers, allowing operators to flexibly integrate new AUV capabilities as they emerge. As regulatory frameworks evolve to accommodate autonomous operations, the seamless integration of AUV swarms with existing maritime systems will be essential for unlocking their full potential in commercial, scientific, and security domains.

Regulatory Landscape and Industry Standards (Referencing ieee.org, asme.org)

The regulatory landscape and industry standards for Autonomous Underwater Vehicle (AUV) swarm coordination systems are rapidly evolving as the technology matures and deployment scales up in 2025. The increasing complexity and autonomy of AUV swarms—used for applications ranging from oceanographic research to offshore infrastructure inspection—necessitate robust frameworks to ensure safety, interoperability, and reliability.

A key player in the development of standards for AUVs and their coordination systems is the Institute of Electrical and Electronics Engineers (IEEE). The IEEE Oceanic Engineering Society has been instrumental in convening working groups focused on underwater robotics, including the IEEE P2751 standard, which addresses interoperability and communication protocols for marine robotic systems. In 2025, these efforts are intensifying, with new working groups examining the unique challenges of multi-agent coordination, such as distributed decision-making, collision avoidance, and secure communication within swarms.

Another significant contributor is the American Society of Mechanical Engineers (ASME), which provides guidelines and best practices for the mechanical design, reliability, and operational safety of underwater vehicles. ASME’s standards, such as those under the AUVSI/ASME UUV (Unmanned Underwater Vehicle) committee, are being updated to reflect the latest advances in swarm deployment, including modularity, redundancy, and fail-safe mechanisms critical for coordinated operations.

In 2025, regulatory attention is also turning toward the environmental and operational impacts of AUV swarms. International bodies, such as the International Maritime Organization (IMO), are beginning to consider how existing maritime safety and environmental protection conventions might apply to autonomous and semi-autonomous underwater operations. This includes the potential for new guidelines on frequency spectrum allocation for underwater communication, as well as protocols for deconfliction with manned vessels and marine life.

Industry stakeholders, including leading AUV manufacturers and operators, are actively participating in standards development to ensure that emerging regulations are practical and foster innovation. Companies such as Kongsberg Gruppen and Teledyne Marine are contributing technical expertise and field data to inform best practices for swarm deployment, communication, and mission planning.

Looking ahead, the next few years are expected to see the formalization of interoperability standards and certification schemes for AUV swarm systems. This will be crucial for enabling multi-vendor operations, scaling up deployments, and ensuring that AUV swarms can safely and effectively operate in increasingly crowded and regulated underwater environments.

Investment, Funding, and Strategic Partnerships

The investment landscape for Autonomous Underwater Vehicle (AUV) swarm coordination systems is experiencing significant momentum in 2025, driven by the convergence of defense, offshore energy, and environmental monitoring interests. Major defense contractors and technology firms are actively channeling capital into the development and deployment of advanced AUV swarming capabilities, recognizing their strategic value for persistent surveillance, mine countermeasures, and distributed sensing.

A notable example is BAE Systems, which has expanded its investment in underwater autonomy through both internal R&D and targeted acquisitions. In 2024, BAE Systems announced a partnership with several European research institutes to accelerate the integration of AI-driven swarm coordination algorithms into its AUV platforms, aiming to enhance multi-vehicle mission efficiency and resilience.

Similarly, Saab has increased funding for its underwater robotics division, focusing on collaborative behaviors among its Sabertooth and Sea Wasp AUVs. Saab’s strategic collaborations with offshore energy companies are designed to develop swarm-enabled inspection and maintenance solutions for subsea infrastructure, a sector expected to see robust growth through 2026 as offshore wind and oil & gas operators seek cost-effective, scalable monitoring tools.

In the United States, Lockheed Martin continues to secure government contracts for the development of next-generation AUV swarming systems, with recent Department of Defense funding supporting the integration of secure communications and distributed autonomy. Lockheed Martin’s partnerships with academic institutions and small technology firms are fostering innovation in swarm control architectures and underwater networking.

On the commercial side, Kongsberg has announced new investments in its HUGIN AUV family, with a focus on modular swarm coordination packages. Kongsberg’s collaborations with marine research organizations and offshore survey companies are aimed at deploying multi-AUV fleets for large-scale seabed mapping and environmental data collection, leveraging real-time data fusion and adaptive mission planning.

Looking ahead, the outlook for investment and strategic partnerships in AUV swarm coordination systems remains strong. The sector is expected to benefit from increased cross-sector collaboration, with defense, energy, and environmental stakeholders pooling resources to address shared challenges in underwater autonomy. As regulatory frameworks evolve and interoperability standards mature, further capital inflows and joint ventures are anticipated, positioning AUV swarming as a cornerstone of future maritime operations.

Future Outlook: Innovations, Opportunities, and Market Expansion

The future of Autonomous Underwater Vehicle (AUV) swarm coordination systems is poised for significant innovation and market expansion as we move through 2025 and into the latter part of the decade. The convergence of advanced artificial intelligence, robust underwater communication protocols, and miniaturized sensor technologies is enabling AUV swarms to operate with unprecedented autonomy and efficiency. This evolution is being driven by both commercial and governmental stakeholders seeking to enhance subsea exploration, environmental monitoring, and defense capabilities.

Key industry players are actively investing in swarm intelligence and multi-vehicle coordination. Saab AB, through its Saab Seaeye division, is developing modular AUV platforms capable of collaborative missions, leveraging distributed decision-making to optimize search and survey operations. Similarly, Kongsberg Gruppen is advancing its HUGIN AUV family with swarm-enabling software, focusing on applications such as pipeline inspection and seabed mapping. These companies are integrating machine learning algorithms to allow AUVs to adapt to dynamic underwater environments and share mission-critical data in real time.

In the United States, Lockheed Martin Corporation is working on scalable AUV swarm systems for maritime security and mine countermeasure missions, emphasizing interoperability and secure communication. The company’s ongoing collaborations with the U.S. Navy and research institutions are expected to yield operational demonstrations of large-scale AUV swarms by 2026. Meanwhile, L3Harris Technologies is focusing on modular swarm architectures that can be rapidly reconfigured for diverse mission profiles, from oceanographic data collection to infrastructure inspection.

The market outlook for AUV swarm coordination systems is robust, with increasing demand from offshore energy, marine research, and defense sectors. The International Energy Agency projects a continued rise in offshore wind and oil & gas activities, necessitating efficient subsea inspection and maintenance solutions. AUV swarms, with their ability to cover large areas and perform complex tasks cooperatively, are well positioned to meet these needs. Additionally, environmental monitoring agencies are exploring swarm-enabled AUVs for large-scale data collection on ocean health and climate change impacts.

Looking ahead, the next few years will likely see the commercialization of interoperable swarm platforms, standardized communication protocols, and AI-driven mission planning tools. Industry leaders such as Saab AB, Kongsberg Gruppen, and Lockheed Martin Corporation are expected to play pivotal roles in shaping the technological landscape and expanding the global market for AUV swarm coordination systems.