Unleashing the Depths: How Autonomous Underwater Vehicle Telemetry Systems Are Transforming Ocean Intelligence in 2025 and Beyond. Explore the Technologies, Market Forces, and Strategic Opportunities Shaping the Next Wave of Subsea Innovation.

- Executive Summary: 2025 Market Snapshot & Key Takeaways

- Market Size, Growth Forecast (2025–2030): 18% CAGR and Revenue Projections

- Core Technologies: Sensors, Communication Protocols, and Data Integration

- Leading Players & Strategic Partnerships (e.g., kongsberg.com, teledynemarine.com, bluefinrobotics.com)

- Emerging Applications: Defense, Energy, Environmental Monitoring, and Research

- Regulatory Landscape & Industry Standards (e.g., ieee.org, asme.org)

- Innovation Drivers: AI, Edge Computing, and Real-Time Telemetry Advances

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges & Barriers: Connectivity, Power Management, and Data Security

- Future Outlook: Disruptive Trends, Investment Hotspots, and Strategic Recommendations

- Sources & References

Executive Summary: 2025 Market Snapshot & Key Takeaways

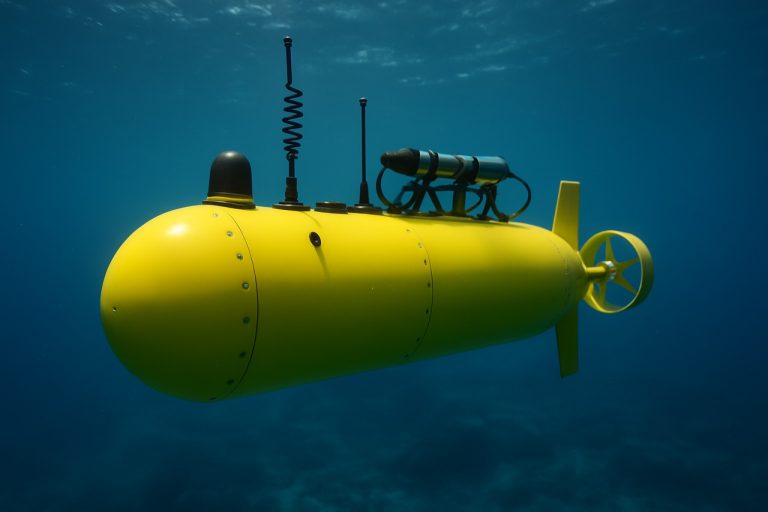

The global market for Autonomous Underwater Vehicle (AUV) telemetry systems is poised for significant growth in 2025, driven by expanding applications in oceanography, offshore energy, defense, and environmental monitoring. Telemetry systems—responsible for the real-time transmission of data between AUVs and surface operators—are increasingly critical as missions become more complex and require higher data throughput, longer ranges, and robust reliability in challenging underwater environments.

Key industry players such as Kongsberg Gruppen, a Norwegian technology leader, and Teledyne Marine, a major U.S.-based manufacturer, continue to innovate in acoustic, optical, and hybrid telemetry solutions. These companies are investing in advanced communication protocols and hardware to support multi-vehicle operations, real-time video streaming, and integration with cloud-based data analytics. For example, Kongsberg Gruppen has expanded its HUGIN AUV series with enhanced telemetry modules, enabling longer missions and improved data fidelity. Similarly, Teledyne Marine is advancing its BlueComm optical modems for high-bandwidth, short-range data transfer, complementing traditional acoustic systems for comprehensive telemetry coverage.

In 2025, the demand for AUV telemetry systems is being propelled by several high-profile projects and government initiatives. The offshore wind sector, particularly in Europe and Asia-Pacific, is deploying fleets of AUVs for subsea cable inspection and environmental surveys, necessitating reliable telemetry for mission-critical data. Defense agencies in the U.S., U.K., and Australia are also investing in next-generation AUVs with secure, encrypted telemetry links for mine countermeasures and intelligence gathering, as evidenced by contracts awarded to Saab and Leonardo.

Technological advancements in 2025 are focused on increasing the range and bandwidth of underwater telemetry, reducing latency, and improving energy efficiency. Hybrid systems that combine acoustic, optical, and even RF (for near-surface operations) are gaining traction, allowing for adaptive communication strategies based on mission requirements and environmental conditions. Interoperability and standardization efforts, led by organizations such as the Ocean Networks Canada, are expected to accelerate, enabling seamless integration of telemetry systems across different AUV platforms.

Looking ahead, the outlook for AUV telemetry systems remains robust, with continued investment in R&D and a growing emphasis on autonomous, networked underwater operations. The convergence of artificial intelligence, edge computing, and advanced telemetry will further enhance the capabilities and value proposition of AUVs in scientific, commercial, and defense domains through 2025 and beyond.

Market Size, Growth Forecast (2025–2030): 18% CAGR and Revenue Projections

The global market for Autonomous Underwater Vehicle (AUV) telemetry systems is poised for robust expansion between 2025 and 2030, with industry analysts projecting a compound annual growth rate (CAGR) of approximately 18%. This growth trajectory is underpinned by increasing demand for advanced subsea data acquisition, environmental monitoring, offshore energy exploration, and defense applications. Revenue projections for the sector suggest that the market, valued at an estimated $1.2 billion in 2025, could surpass $2.7 billion by 2030, reflecting both technological advancements and expanding operational requirements.

Key drivers of this growth include the proliferation of offshore wind and oil & gas projects, which require reliable, real-time telemetry for asset inspection and maintenance. The defense sector is also a significant contributor, with navies worldwide investing in AUV fleets for mine countermeasures, surveillance, and reconnaissance. The integration of high-bandwidth acoustic modems, satellite communication links, and advanced sensor payloads is enabling more complex missions and longer-duration deployments, further fueling market expansion.

Several leading companies are shaping the competitive landscape. Kongsberg Gruppen, a Norwegian technology powerhouse, is recognized for its comprehensive AUV solutions and telemetry systems, serving both commercial and defense clients. Teledyne Technologies Incorporated, based in the United States, offers a broad portfolio of subsea communication and navigation products, including acoustic modems and integrated telemetry modules. Saab AB, through its Seaeye division, is another major player, providing advanced AUVs and telemetry solutions for offshore and security applications. L3Harris Technologies is also active in this space, supplying telemetry and control systems for unmanned maritime vehicles, with a focus on interoperability and secure communications.

The outlook for 2025–2030 is characterized by ongoing innovation in underwater wireless communication, miniaturization of telemetry hardware, and the adoption of artificial intelligence for autonomous data processing. Industry collaborations and government-funded research initiatives are expected to accelerate the deployment of next-generation telemetry systems, supporting more efficient and resilient AUV operations. As the market matures, the emphasis will likely shift toward standardization, cybersecurity, and integration with broader maritime digital ecosystems, ensuring sustained growth and technological leadership in the years ahead.

Core Technologies: Sensors, Communication Protocols, and Data Integration

Autonomous Underwater Vehicle (AUV) telemetry systems are at the heart of modern subsea exploration, enabling real-time data acquisition, vehicle control, and mission adaptability. As of 2025, the sector is witnessing rapid advancements in core technologies—particularly in sensor integration, communication protocols, and data fusion—driven by the increasing complexity of underwater missions in scientific, defense, and commercial domains.

Sensor technology remains a foundational pillar. Leading AUV manufacturers such as Kongsberg Maritime and Teledyne Marine are equipping vehicles with multi-modal sensor suites, including high-resolution sonar, Doppler velocity logs, inertial navigation systems, and environmental sensors. These sensors generate vast streams of data, necessitating robust onboard processing and efficient telemetry for both real-time and post-mission analysis. The integration of advanced sensor fusion algorithms is enabling AUVs to achieve higher levels of autonomy, situational awareness, and mission reliability.

Communication protocols are evolving to address the unique challenges of underwater environments, where radio frequency signals are ineffective and acoustic channels are bandwidth-limited and prone to latency. Companies like Sonardyne International are pioneering acoustic telemetry systems that support reliable long-range communication and positioning. Recent developments include adaptive modulation schemes and error correction protocols that optimize data throughput and resilience in dynamic ocean conditions. Additionally, hybrid communication approaches—combining acoustic, optical, and even emerging magnetic induction methods—are being trialed to enhance short-range, high-bandwidth data transfer during critical mission phases or when AUVs surface.

Data integration is another critical focus area. The proliferation of heterogeneous sensors and the need for interoperability across platforms have led to the adoption of standardized data formats and middleware solutions. Industry groups such as the Open Geospatial Consortium are promoting open standards for marine data exchange, facilitating seamless integration between AUVs, surface vessels, and shore-based command centers. Real-time data fusion and onboard analytics are increasingly being implemented, allowing AUVs to adapt mission parameters autonomously based on sensor feedback and environmental cues.

Looking ahead, the next few years are expected to bring further convergence of artificial intelligence, edge computing, and advanced telemetry in AUV systems. This will enable more complex, multi-vehicle operations and persistent ocean monitoring, with telemetry systems providing the backbone for secure, efficient, and intelligent underwater data exchange.

Leading Players & Strategic Partnerships (e.g., kongsberg.com, teledynemarine.com, bluefinrobotics.com)

The global market for Autonomous Underwater Vehicle (AUV) telemetry systems is being shaped by a select group of leading players, each leveraging advanced technologies and strategic partnerships to address the growing demands of oceanographic research, defense, offshore energy, and environmental monitoring. As of 2025, the sector is characterized by rapid innovation in real-time data transmission, sensor integration, and interoperability, with several companies at the forefront.

Kongsberg Gruppen ASA remains a dominant force in the AUV telemetry landscape. Through its Kongsberg Maritime division, the company offers the HUGIN and REMUS AUV series, which are equipped with proprietary telemetry solutions for high-bandwidth acoustic and satellite communications. Kongsberg’s ongoing collaborations with defense agencies and research institutions have resulted in the deployment of AUVs for subsea infrastructure inspection, mine countermeasures, and deep-sea exploration. The company’s focus on modular, scalable telemetry architectures is expected to further enhance mission flexibility and data reliability in the coming years (Kongsberg Gruppen ASA).

Teledyne Marine, a business segment of Teledyne Technologies Incorporated, is another key player, offering a comprehensive suite of telemetry solutions integrated into its Gavia and SeaRaptor AUV platforms. Teledyne’s expertise spans acoustic modems, long-range wireless communication, and hybrid telemetry systems, enabling robust data transfer in challenging underwater environments. The company’s strategic partnerships with oil & gas operators and marine research organizations have driven the adoption of its telemetry-enabled AUVs for pipeline inspection, environmental monitoring, and search-and-recovery missions. Teledyne’s ongoing investment in AI-driven data processing and edge computing is poised to further advance real-time telemetry capabilities (Teledyne Marine).

Bluefin Robotics, a subsidiary of General Dynamics Mission Systems, specializes in modular AUVs with advanced telemetry and navigation systems. Bluefin’s vehicles are widely used by the U.S. Navy and allied defense forces for intelligence, surveillance, and reconnaissance (ISR) operations. The company’s focus on secure, encrypted telemetry links and multi-vehicle coordination is driving new standards in underwater communications. Recent collaborations with academic institutions and technology partners are expected to yield next-generation telemetry solutions optimized for swarm operations and persistent monitoring (Bluefin Robotics).

Looking ahead, the next few years will likely see intensified collaboration among these industry leaders, as well as with sensor manufacturers and satellite communication providers. Joint ventures and technology-sharing agreements are anticipated to accelerate the development of interoperable telemetry standards, supporting the integration of heterogeneous AUV fleets and expanding the operational envelope of autonomous underwater missions.

Emerging Applications: Defense, Energy, Environmental Monitoring, and Research

Autonomous Underwater Vehicle (AUV) telemetry systems are rapidly evolving to meet the growing demands of defense, energy, environmental monitoring, and scientific research sectors. As of 2025, these systems are characterized by enhanced data transmission capabilities, robust sensor integration, and improved reliability in challenging subsea environments. The convergence of advanced telemetry with artificial intelligence and edge computing is enabling AUVs to operate with greater autonomy and efficiency across diverse applications.

In the defense sector, AUV telemetry is critical for real-time situational awareness, mine countermeasures, and persistent surveillance. Leading defense contractors such as Saab and Northrop Grumman are actively developing AUVs equipped with secure, high-bandwidth telemetry links that support encrypted communications and long-range operations. These systems are designed to transmit mission-critical data—including sonar imagery and environmental parameters—back to command centers, even in GPS-denied or contested environments.

The energy industry, particularly offshore oil and gas, relies on AUV telemetry for subsea infrastructure inspection, pipeline monitoring, and leak detection. Companies like Kongsberg and Teledyne Marine are at the forefront, offering AUVs with telemetry systems capable of real-time data streaming via acoustic modems and, increasingly, through hybrid acoustic-optical solutions. These advances are reducing the need for surface vessel support, lowering operational costs, and enabling continuous asset monitoring.

Environmental monitoring and oceanographic research are also benefiting from next-generation telemetry. Organizations such as Woods Hole Oceanographic Institution and Monterey Bay Aquarium Research Institute deploy AUVs with multi-sensor payloads and adaptive telemetry protocols. These systems facilitate the collection and transmission of high-resolution data on water quality, marine life, and climate variables, supporting long-duration missions in remote or deep-sea locations.

Looking ahead, the outlook for AUV telemetry systems is marked by the integration of 5G/6G satellite communications, mesh networking, and edge processing. Industry leaders are investing in interoperable, modular telemetry architectures to support collaborative AUV swarms and real-time data fusion. The next few years are expected to see further miniaturization of telemetry hardware, increased use of AI-driven data compression, and expanded adoption of open standards to enhance cross-platform compatibility. These trends will enable AUVs to play an even greater role in subsea defense, energy, environmental stewardship, and scientific discovery.

Regulatory Landscape & Industry Standards (e.g., ieee.org, asme.org)

The regulatory landscape and industry standards for Autonomous Underwater Vehicle (AUV) telemetry systems are evolving rapidly as the sector matures and deployment scales up globally. In 2025, the focus is on harmonizing communication protocols, ensuring interoperability, and addressing cybersecurity and data integrity concerns, all while supporting the unique operational environments of AUVs.

AUV telemetry systems rely on robust standards to facilitate reliable data exchange between vehicles and surface operators, often under challenging conditions such as deep-sea pressure, variable salinity, and limited bandwidth. The Institute of Electrical and Electronics Engineers (IEEE) continues to play a pivotal role, particularly through the IEEE 802.15.4 standard for low-rate wireless personal area networks, which is being adapted for underwater acoustic telemetry. Additionally, the IEEE Oceanic Engineering Society is actively involved in developing best practices and technical guidelines for underwater communication and sensor integration.

The American Society of Mechanical Engineers (ASME) contributes to the mechanical and systems integration standards, ensuring that telemetry hardware can withstand harsh marine environments and interface seamlessly with AUV platforms. ASME’s standards for pressure vessels and subsea equipment are increasingly referenced in the design of telemetry housings and connectors.

Internationally, the International Maritime Organization (IMO) is monitoring the proliferation of AUVs and their telemetry systems, particularly regarding navigational safety and the prevention of interference with manned vessels. The IMO’s guidelines on the use of autonomous and remotely operated systems are expected to be updated in the coming years to address telemetry-specific issues, such as frequency allocation and data security.

Industry consortia, such as the Ocean Networks Canada and the Society for Underwater Technology (SUT), are facilitating collaboration between manufacturers, operators, and regulators to develop open standards for data formats and communication protocols. These efforts aim to ensure interoperability between AUVs from different vendors, a critical requirement as multi-vehicle operations and data sharing become more common in scientific, defense, and commercial applications.

Looking ahead, the regulatory outlook for AUV telemetry systems will likely see increased emphasis on cybersecurity, as the risk of data interception and manipulation grows with the expansion of autonomous operations. Standardization bodies are expected to introduce new guidelines for encryption and authentication in underwater telemetry, while also addressing the environmental impact of acoustic communications on marine life. The next few years will be marked by a convergence of technical, safety, and environmental standards, shaping a more secure and interoperable future for AUV telemetry systems.

Innovation Drivers: AI, Edge Computing, and Real-Time Telemetry Advances

The evolution of Autonomous Underwater Vehicle (AUV) telemetry systems is being propelled by rapid advances in artificial intelligence (AI), edge computing, and real-time data transmission technologies. As of 2025, these innovation drivers are fundamentally reshaping how AUVs collect, process, and relay critical underwater data, enabling new applications in oceanography, offshore energy, defense, and environmental monitoring.

AI integration is at the forefront of this transformation. Modern AUVs are increasingly equipped with onboard machine learning algorithms that enable adaptive mission planning, anomaly detection, and autonomous decision-making. This reduces the need for constant human oversight and allows vehicles to respond dynamically to changing underwater conditions. Companies such as Kongsberg Gruppen and Saab AB are actively embedding AI-driven autonomy into their AUV platforms, enhancing both operational efficiency and data quality.

Edge computing is another critical innovation, allowing AUVs to process vast amounts of sensor data locally, rather than relying solely on post-mission analysis or intermittent surface communications. This is particularly important given the bandwidth limitations of underwater acoustic telemetry. By performing real-time data reduction, feature extraction, and event detection onboard, AUVs can prioritize the most relevant information for transmission. Teledyne Marine and L3Harris Technologies are notable for integrating edge processing capabilities into their telemetry systems, supporting missions that require immediate situational awareness or rapid response.

Real-time telemetry advances are also being realized through hybrid communication architectures that combine acoustic, optical, and even emerging RF-based technologies for short-range, high-bandwidth data transfer. These systems are enabling near-real-time updates and remote control, even in challenging subsea environments. For example, Kongsberg Gruppen has demonstrated multi-modal telemetry solutions that optimize data flow based on mission requirements and environmental constraints.

Looking ahead to the next few years, the convergence of AI, edge computing, and advanced telemetry is expected to further expand the operational envelope of AUVs. Industry roadmaps indicate a focus on swarm operations, where fleets of AUVs collaborate autonomously, sharing data and coordinating tasks in real time. This will require robust, low-latency telemetry networks and even more sophisticated onboard intelligence. As these technologies mature, AUVs are poised to play an increasingly central role in subsea exploration, infrastructure inspection, and environmental stewardship.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global landscape for Autonomous Underwater Vehicle (AUV) telemetry systems is shaped by distinct regional dynamics, with North America, Europe, Asia-Pacific, and the Rest of the World each exhibiting unique drivers and adoption patterns as of 2025 and looking ahead.

North America remains a leader in AUV telemetry innovation and deployment, propelled by robust investments in defense, offshore energy, and oceanographic research. The United States Navy continues to be a major end-user, driving demand for secure, long-range telemetry solutions for surveillance and mine countermeasure missions. Major manufacturers such as Lockheed Martin and Teledyne Marine are at the forefront, integrating advanced acoustic and hybrid communication systems to enhance data transfer rates and operational reliability. The region also benefits from a strong academic and research ecosystem, with institutions collaborating on next-generation telemetry protocols and interoperability standards.

Europe is characterized by a focus on environmental monitoring, subsea infrastructure inspection, and maritime security. Countries like Norway, the United Kingdom, and France are investing in AUV fleets for offshore wind farm maintenance and marine habitat assessment. Companies such as Saab (notably through its Saab Seaeye division) and Kongsberg are prominent, offering telemetry systems that support both real-time and delayed-mode data transmission, often tailored for harsh North Sea and Arctic conditions. The European Union’s emphasis on sustainable blue economy initiatives is expected to further stimulate demand for reliable telemetry solutions in the coming years.

Asia-Pacific is witnessing rapid growth, driven by expanding maritime security needs, resource exploration, and scientific research. China, Japan, South Korea, and Australia are increasing investments in indigenous AUV development and telemetry technologies. Chinese firms, including China Shipbuilding Industry Corporation (CSIC), are advancing acoustic and satellite-based telemetry for deep-sea exploration and surveillance. Meanwhile, Japan’s focus on disaster monitoring and subsea cable inspection is fostering innovation in compact, high-bandwidth telemetry modules. Regional collaboration, such as joint research programs and technology transfer agreements, is expected to accelerate the adoption of advanced telemetry systems through 2027.

Rest of the World encompasses emerging markets in Latin America, the Middle East, and Africa, where AUV telemetry adoption is at an earlier stage but gaining momentum. Offshore oil and gas exploration in Brazil and the Gulf states is a key driver, with international suppliers like Fugro providing integrated AUV and telemetry solutions for subsea asset inspection. As these regions invest in marine resource management and security, demand for cost-effective, scalable telemetry systems is projected to rise, supported by technology partnerships and capacity-building initiatives.

Across all regions, the outlook for AUV telemetry systems is shaped by the convergence of digitalization, miniaturization, and the need for secure, high-throughput communications. Regional priorities—ranging from defense and energy to environmental stewardship—will continue to influence technology adoption and innovation trajectories through the remainder of the decade.

Challenges & Barriers: Connectivity, Power Management, and Data Security

Autonomous Underwater Vehicle (AUV) telemetry systems face persistent and evolving challenges in connectivity, power management, and data security as the sector advances into 2025 and beyond. These barriers are central to the operational reliability and scalability of AUV deployments for scientific, commercial, and defense applications.

Connectivity remains a fundamental obstacle due to the physical properties of the underwater environment. Radio frequency (RF) signals, which are standard for terrestrial and aerial telemetry, attenuate rapidly in seawater, forcing reliance on acoustic, optical, or, in rare cases, low-frequency electromagnetic communication. Acoustic telemetry, the most widely used, is limited by low bandwidth, high latency, and susceptibility to multipath interference and ambient noise. Companies such as Kongsberg Gruppen and Teledyne Marine are at the forefront of developing advanced acoustic modems and hybrid communication systems, but even their latest solutions in 2025 are constrained to data rates typically below 100 kbps and ranges of a few kilometers. Optical systems, while offering higher bandwidth, are limited to clear water and short distances, and are being explored by innovators like Bluefin Robotics (a General Dynamics company).

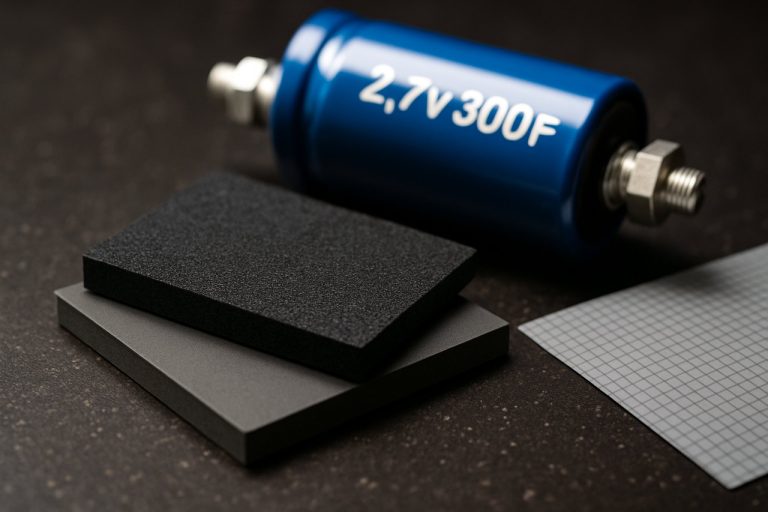

Power management is another critical barrier. AUVs are inherently limited by the energy density of onboard batteries, which directly impacts mission duration, sensor payload, and telemetry capabilities. While lithium-ion battery technology has improved incrementally, the sector is actively investigating alternatives such as fuel cells and energy harvesting. Saab and Hydroid (a subsidiary of Huntington Ingalls Industries) are among those trialing new battery chemistries and modular power systems. However, the slow pace of battery innovation and the high cost of advanced energy solutions continue to restrict the operational envelope of AUVs, especially for long-duration or deep-sea missions.

Data security is gaining prominence as AUVs are increasingly networked and tasked with sensitive operations. Underwater telemetry is inherently vulnerable to interception, spoofing, and jamming, particularly in defense and critical infrastructure monitoring. The implementation of robust encryption and authentication protocols is complicated by the limited processing power and bandwidth available on AUVs. Industry leaders such as Kongsberg Gruppen and Teledyne Marine are collaborating with cybersecurity specialists to develop lightweight, resilient security frameworks tailored for underwater environments, but widespread adoption is still in its early stages as of 2025.

Looking ahead, overcoming these challenges will require cross-disciplinary innovation in materials science, communications engineering, and cybersecurity. The next few years are expected to see incremental improvements rather than breakthroughs, with hybrid communication architectures, smarter power management algorithms, and adaptive security protocols gradually enhancing the reliability and reach of AUV telemetry systems.

Future Outlook: Disruptive Trends, Investment Hotspots, and Strategic Recommendations

The future of Autonomous Underwater Vehicle (AUV) telemetry systems is poised for significant transformation as technological advancements, strategic investments, and evolving mission requirements converge. In 2025 and the coming years, several disruptive trends are expected to reshape the sector, with implications for both commercial and defense applications.

A primary driver is the rapid evolution of underwater communication technologies. Traditional acoustic telemetry, while reliable, faces limitations in bandwidth and latency. Emerging solutions such as optical and hybrid acoustic-optical telemetry are gaining traction, promising higher data rates and lower latency for real-time mission-critical operations. Companies like Kongsberg Gruppen and Teledyne Marine are actively developing next-generation telemetry modules that integrate multiple communication modalities, enabling more robust and flexible data transfer in challenging subsea environments.

Another disruptive trend is the integration of artificial intelligence (AI) and edge computing within AUV telemetry systems. By processing sensor data onboard, AUVs can reduce the volume of data transmitted and make autonomous decisions in real time. This is particularly relevant for long-duration missions and deep-sea exploration, where communication windows are limited. Saab, through its Seaeye division, and L3Harris Technologies are investing in smart telemetry solutions that leverage AI for adaptive mission planning and anomaly detection.

Investment hotspots are emerging around dual-use technologies that serve both civilian and defense markets. The growing demand for subsea infrastructure inspection, environmental monitoring, and maritime security is attracting funding from government agencies and private sector players alike. Strategic partnerships between AUV manufacturers and telecom providers are also accelerating the deployment of subsea wireless networks, which are essential for persistent AUV operations and swarm deployments. Hydroid (a subsidiary of Kongsberg) and Bluefin Robotics (a General Dynamics company) are notable for their collaborations in this space.

Looking ahead, the sector is expected to see increased standardization of telemetry protocols and interoperability frameworks, driven by industry bodies and consortia. This will facilitate multi-vendor AUV fleets and enable more complex, collaborative missions. Strategic recommendations for stakeholders include prioritizing R&D in high-bandwidth, low-latency telemetry, investing in AI-enabled onboard processing, and fostering cross-sector partnerships to leverage synergies between commercial and defense applications. As the underwater domain becomes more connected and autonomous, telemetry systems will be at the heart of operational effectiveness and mission success.

Sources & References

- Kongsberg Gruppen

- Teledyne Marine

- Saab

- Leonardo

- Ocean Networks Canada

- Teledyne Technologies Incorporated

- L3Harris Technologies

- Open Geospatial Consortium

- Kongsberg Gruppen ASA

- Teledyne Marine

- Northrop Grumman

- Monterey Bay Aquarium Research Institute

- Institute of Electrical and Electronics Engineers (IEEE)

- American Society of Mechanical Engineers (ASME)

- International Maritime Organization (IMO)

- Society for Underwater Technology (SUT)

- Lockheed Martin

- Fugro