Capillary Electrophoresis Instrumentation 2025–2030: Surprising Growth Drivers Revealed—Is Your Lab Ready?

Table of Contents

- Executive Summary: 2025 Market Pulse and Key Insights

- Technology Evolution: Innovations in Capillary Electrophoresis Hardware & Software

- Leading Manufacturers and Strategic Partnerships (e.g., sciex.com, agilent.com, beckmancoulter.com)

- Emerging Applications: Biotechnology, Pharma, Food Safety, and Clinical Diagnostics

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Beyond

- Competitive Landscape: Company Profiles and Market Share Shifts

- Market Forecast 2025–2030: Growth Projections and Revenue Opportunities

- Regulatory Drivers and Industry Standards (Referencing ifcc.org, fda.gov)

- Sustainability and Green Chemistry in Capillary Electrophoresis

- Future Outlook: Disruptive Trends, AI Integration, and What’s Next for Stakeholders

- Sources & References

Executive Summary: 2025 Market Pulse and Key Insights

In 2025, the global capillary electrophoresis (CE) instrumentation market is shaped by advancing analytical requirements across the pharmaceutical, biotechnology, environmental, and food safety sectors. The demand for precise, high-throughput, and cost-effective separation techniques continues to drive innovation, with key players introducing next-generation systems that address evolving regulatory and research demands. Leading manufacturers such as Agilent Technologies, Thermo Fisher Scientific, and SCIEX are at the forefront, enhancing instrument sensitivity, miniaturization, and automation.

A notable event in 2024 was the launch of Agilent’s 7100 Capillary Electrophoresis System, which advances CE’s applicability in both routine and research laboratories by integrating higher sensitivity, reduced sample consumption, and seamless interfacing with mass spectrometry (Agilent Technologies). Similarly, Thermo Fisher Scientific’s continued expansion of its Vanquish CE portfolio in 2025 reflects a trend toward modular, scalable platforms that can be tailored for clinical, forensics, and pharmaceutical quality control applications (Thermo Fisher Scientific).

On the technological front, integration with mass spectrometry (CE-MS) is gaining significant momentum, enabling highly selective biomolecule characterization and proteomics workflows. SCIEX, for instance, is promoting its CESI 8000 Plus system, which combines CE with electrospray ionization for enhanced detection sensitivity in biopharmaceutical and omics research (SCIEX). Such hybrid systems are expected to see increased adoption through 2025 and beyond, as regulatory agencies emphasize comprehensive impurity profiling and the need for orthogonal analytical methods.

The outlook for the next few years includes growing automation, user-friendly interfaces, and cloud-based data management, reducing human error and increasing throughput for regulated laboratories. Additionally, efforts by manufacturers to lower total cost of ownership—through improved consumable longevity and instrument reliability—are making CE more accessible to academic and contract research organizations. As digitalization and green chemistry initiatives gain traction, CE’s inherently low reagent consumption and minimal waste generation further support its expanding role in sustainable laboratory operations.

In summary, 2025 marks a pivotal period for capillary electrophoresis instrumentation, with robust product pipelines, increased instrument versatility, and integration with digital ecosystems. Continued innovation by established industry leaders is expected to further cement CE’s position as a critical technology for analytical separations across global life sciences and quality control sectors.

Technology Evolution: Innovations in Capillary Electrophoresis Hardware & Software

Capillary electrophoresis (CE) instrumentation is experiencing a period of rapid evolution, driven by technological advances and growing demand for high-sensitivity, high-throughput analytical platforms across pharmaceuticals, biotechnology, food safety, and environmental testing. As of 2025, the sector is witnessing significant hardware and software innovations that are reshaping performance, usability, and integration capabilities.

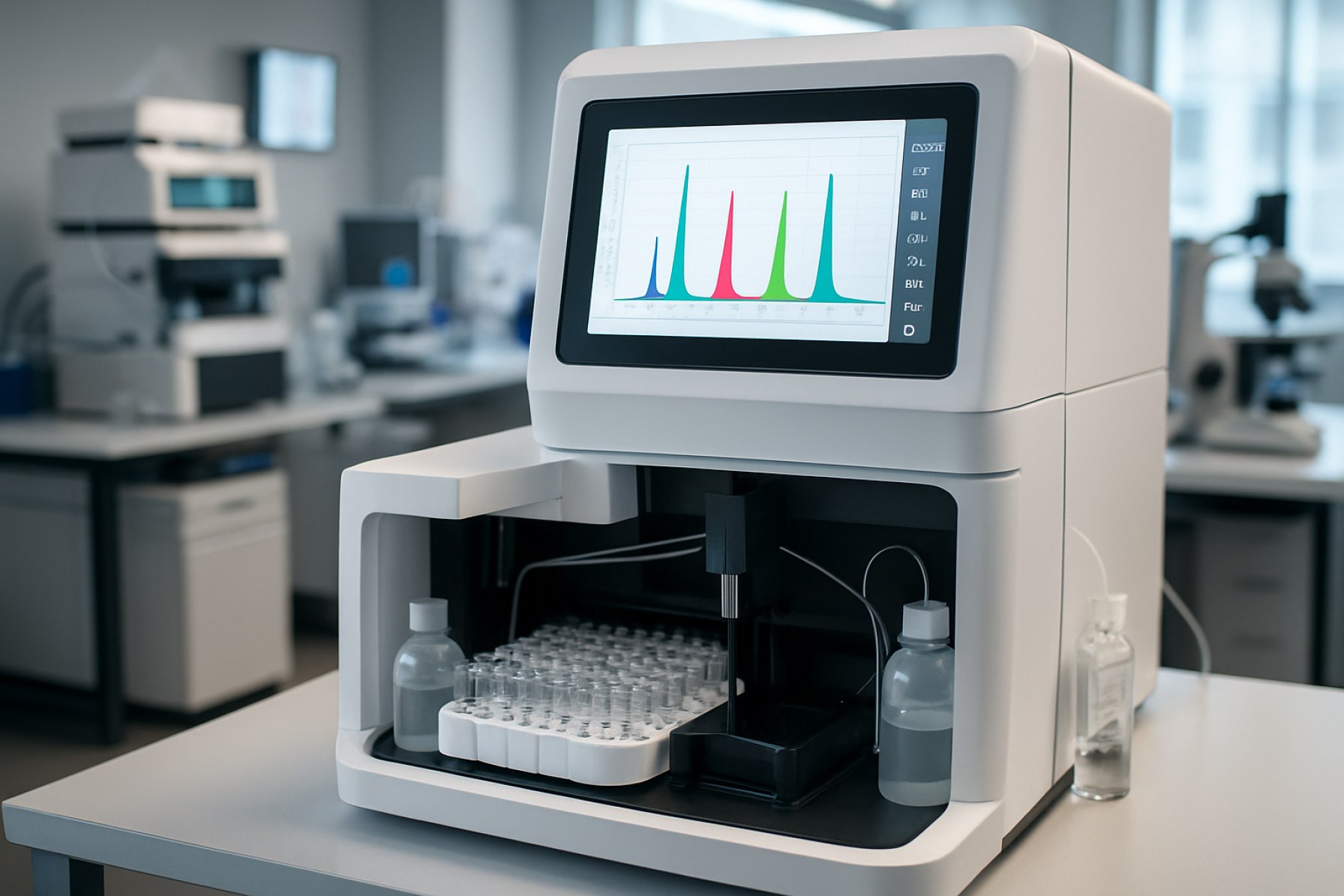

A key trend is the miniaturization and automation of CE systems. Leading manufacturers such as Agilent Technologies and SCIEX have recently introduced compact benchtop CE instruments that integrate sample handling, separation, and detection modules within a unified footprint. These systems reduce manual intervention, lower sample and reagent consumption, and allow for streamlined workflows, directly addressing the needs of clinical and quality control laboratories seeking efficiency gains.

Detection sensitivity is also improving through hardware upgrades. For instance, Agilent Technologies now offers high-sensitivity laser-induced fluorescence (LIF) detectors and advanced diode array detectors (DAD) that boost detection limits for trace-level analytes. Innovations in capillary coatings and temperature control modules are further enhancing reproducibility and resolution, critical for complex biomolecule analysis. Bio-Rad Laboratories has also released CE systems with robust thermal management and improved separation cartridges, catering to demanding proteomics and genomics applications.

Software advances are equally transformative. The newest generation of CE instruments features intuitive, touchscreen-driven user interfaces, sophisticated data analysis algorithms, and seamless laboratory information management system (LIMS) integration. For example, SCIEX’s software ecosystem enables real-time monitoring, automated peak identification, and compliance-ready reporting, which are increasingly critical for regulated environments such as pharmaceutical manufacturing.

Connectivity and remote operation are gaining momentum, with CE platforms now supporting cloud-based data storage and remote diagnostics. This trend is exemplified by Agilent Technologies’s instrument control software, which allows for secure remote access, system maintenance alerts, and firmware updates, minimizing downtime and enhancing laboratory productivity.

Looking ahead to the next few years, the outlook for CE instrumentation is marked by continued convergence with other analytical modalities, including mass spectrometry (MS). Hybrid CE-MS systems are being refined for broader routine use, promising unparalleled specificity and sensitivity for biomolecule characterization. Additionally, industry leaders are expected to focus on further miniaturization, fully automated sample-to-answer solutions, and advanced machine learning-driven data analysis modules, solidifying capillary electrophoresis as a mainstay of modern analytical laboratories.

Leading Manufacturers and Strategic Partnerships (e.g., sciex.com, agilent.com, beckmancoulter.com)

The capillary electrophoresis (CE) instrumentation market is characterized by a small group of leading manufacturers, each driving innovation and expanding global reach through strategic partnerships. As of 2025, the sector is dominated by SCIEX, Agilent Technologies, and Beckman Coulter Life Sciences, with additional contributions from specialized firms and collaborative ventures.

SCIEX continues to advance CE technology with its portfolio of capillary electrophoresis instruments, most notably the PA 800 Plus platform, which is heavily utilized in biopharmaceutical characterization and quality control. In recent years, SCIEX has emphasized workflow automation and seamless integration with mass spectrometry, enhancing efficiency for pharmaceutical and clinical laboratories. The company’s collaborations with software developers and reagent providers have also led to more robust, application-specific CE solutions for glycan analysis and charge variant profiling (SCIEX).

Agilent Technologies remains a major player, highlighted by its 7100 Capillary Electrophoresis System, which has seen incremental enhancements targeting reproducibility, throughput, and regulatory compliance. In 2024 and into 2025, Agilent has pursued partnerships with biopharma companies to co-develop CE-based methods for advanced oligonucleotide and protein therapeutics analysis. The company’s focus on sustainability and user-friendly interfaces is reflected in their latest instrument releases and software updates, catering to both research and GMP environments (Agilent Technologies).

Beckman Coulter Life Sciences continues to innovate, with its P/ACE MDQ Plus system widely adopted for high-resolution separations in both research and regulated settings. Beckman Coulter’s recent emphasis has been on CE integration with sample preparation automation and LIMS connectivity, facilitating streamlined workflows for clinical and bioprocessing applications. Strategic alliances with diagnostics and automation companies are extending the reach of Beckman Coulter’s CE technologies into new markets (Beckman Coulter Life Sciences).

Looking toward the next few years, industry leaders are expected to intensify collaborations with pharmaceutical manufacturers and analytical software firms to tackle emerging challenges such as complex biologics characterization and regulatory demands for data integrity. Miniaturization, enhanced detection modalities, and AI-driven data analysis are anticipated trends, with these companies positioned to lead technological adoption and global standardization in CE instrumentation.

Emerging Applications: Biotechnology, Pharma, Food Safety, and Clinical Diagnostics

Capillary electrophoresis (CE) instrumentation is experiencing a notable transformation as it becomes increasingly pivotal across biotechnology, pharmaceutical development, food safety, and clinical diagnostics. In 2025 and heading into the next several years, leading instrument manufacturers and technology developers are focusing on expanding the analytical capabilities, automation, and integration of CE systems to suit the rigorous demands of these emerging applications.

Major biotechnology and pharmaceutical companies are leveraging advances in CE instrumentation for rapid, high-resolution analysis of proteins, peptides, nucleic acids, and small molecules. Recent instrument launches have emphasized enhanced sensitivity, reproducibility, and throughput, catering to the needs of biotherapeutic characterization and quality control. For instance, SCIEX and Agilent Technologies have released new-generation CE platforms featuring improved sample handling, integrated software for compliance, and streamlined workflows for applications such as glycan analysis and charge variant profiling—crucial in monoclonal antibody production and biosimilar development.

In food safety, CE is being adopted for the detection and quantification of contaminants, additives, and adulterants. The ability of CE instrumentation to separate complex mixtures with minimal sample preparation supports regulatory compliance and risk management in the food and beverage sector. Shimadzu Corporation and Thermo Fisher Scientific have expanded their CE instrument lines to address these needs, offering systems compatible with a wide range of matrices and detection modalities, furthering their penetration into food safety laboratories worldwide.

- Clinical diagnostics: There is growing interest in CE for clinical applications—particularly in hemoglobinopathy screening, genetic disorder testing, and therapeutic drug monitoring. Automated CE systems with robust data management, such as those from SebiA, are being implemented in clinical labs to deliver fast, accurate results in accordance with global health standards.

- Biotechnology and pharma: High-throughput CE platforms are central to process development and release testing, with innovations focused on multiplexing and microfluidics to further reduce analysis times and increase sample capacity (Bio-Rad Laboratories).

- Food safety: New CE modules are being tailored for pesticide, mycotoxin, and allergen analysis, enhancing food quality monitoring.

Looking ahead, the CE instrumentation sector is expected to see continued miniaturization, integration with mass spectrometry, and further development of point-of-care and portable devices. These advances will likely drive broader adoption across decentralized testing environments, supporting the growing need for rapid, reliable, and cost-effective analytical solutions in biotechnology, pharma, food safety, and clinical diagnostics (Eurofins Scientific).

Regional Market Analysis: North America, Europe, Asia-Pacific, and Beyond

The global market for capillary electrophoresis (CE) instrumentation continues to advance in 2025, shaped by regional investments, regulatory frameworks, and scientific demand. In North America, the United States remains the largest adopter, driven by robust pharmaceutical research, biopharmaceutical manufacturing, and clinical laboratories. Leading instrument manufacturers such as Agilent Technologies and SCIEX are headquartered in the region, ensuring widespread access to cutting-edge CE systems. The U.S. Food and Drug Administration’s evolving guidelines for biotherapeutic characterization and quality control further accelerate CE adoption in analytical workflows, especially for applications like glycan analysis and charge variant profiling.

Europe demonstrates a strong focus on regulatory-compliant analysis and environmental monitoring, with countries such as Germany, the UK, and Switzerland investing in CE technology for both pharmaceutical and academic research. Companies like Separation Science and Bio-Rad Laboratories maintain substantial market presence, and EU regulations on food safety and pharmaceuticals continue to drive demand for precise, reproducible electrophoretic instrumentation. The regional emphasis on sustainability and automation is pushing vendors to develop energy-efficient, user-friendly CE systems with improved throughput.

The Asia-Pacific region is witnessing the fastest growth, primarily propelled by investments in biotechnology and life sciences in China, Japan, and South Korea. Chinese pharmaceutical and academic sectors are rapidly adopting CE platforms for drug development and quality control, encouraged by local manufacturing and the increasing availability of CE systems from companies such as Shimadzu Corporation. Japan, with its legacy of analytical innovation, continues to support CE research through collaborations between universities and industry. The growing prevalence of contract research organizations (CROs) in Asia-Pacific further boosts demand for flexible, high-throughput CE instrumentation.

Beyond these major regions, emerging markets in Latin America and the Middle East are gradually integrating capillary electrophoresis systems into clinical diagnostics and forensic laboratories, albeit at a slower pace due to cost considerations and limited infrastructure. However, technology transfer initiatives and partnerships with global manufacturers are expected to improve access and adoption rates in these regions over the next few years.

Looking ahead, the regional market dynamics for CE instrumentation will likely reflect a continued push toward miniaturization, automation, and integration with complementary analytical techniques. Manufacturers are responding with versatile platforms and region-specific support, ensuring capillary electrophoresis remains integral to pharmaceutical, clinical, and environmental analysis worldwide.

Competitive Landscape: Company Profiles and Market Share Shifts

The competitive landscape for capillary electrophoresis (CE) instrumentation in 2025 is marked by dynamic shifts among established market leaders and the emergence of innovative entrants. Historically, the sector has been dominated by a handful of global players such as Agilent Technologies, Thermo Fisher Scientific, SCIEX (a Danaher company), and Bio-Rad Laboratories. These firms have maintained significant market share through continuous product innovation, robust distribution networks, and comprehensive service offerings.

In 2024–2025, Agilent Technologies continues to be a frontrunner, leveraging its 7100 Capillary Electrophoresis System, which is widely adopted in pharmaceutical, environmental, and food safety laboratories. Agilent’s strategic partnerships and investment in method development have reinforced its leadership in the sector. Thermo Fisher Scientific remains a key competitor, with its Capillary Electrophoresis systems integrated into automated workflows for biopharmaceutical analysis and high-throughput QC, reflecting the growing demand for regulatory compliance and process efficiency.

SCIEX has seen increased adoption of its PA 800 Plus Pharmaceutical Analysis System, particularly in the analysis of biologics and gene therapies. The company’s focus on biopharmaceutical applications and its growing strength in the Asia-Pacific region have contributed to a notable uptick in global market share as of 2025.

Meanwhile, Bio-Rad Laboratories continues to serve niche segments, particularly in clinical diagnostics and forensic applications, leveraging its know-how in capillary electrophoresis for protein analysis. Other players, such as Shimadzu Corporation and Separations, are carving out space through regional distribution strategies and specialized instruments, especially in academic and research settings.

The competitive outlook for the next few years suggests intensified rivalry as new entrants seek to capitalize on trends such as microfluidics-based CE, miniaturization, and integration with mass spectrometry. Companies like Aurora Biomed are introducing compact and automated CE platforms targeting both research and clinical settings. At the same time, established manufacturers are expected to invest in AI-driven software and enhanced data analytics, aiming to differentiate their offerings and address evolving regulatory requirements.

Overall, market share in 2025 is poised for gradual redistribution, favoring companies that can deliver enhanced throughput, automation, and compliance with emerging analytical standards. Strategic collaborations and regional expansions will likely shape the competitive landscape, with innovation in CE instrumentation remaining a key determinant of market leadership.

Market Forecast 2025–2030: Growth Projections and Revenue Opportunities

The capillary electrophoresis (CE) instrumentation market is poised for steady growth from 2025 through 2030, driven by technological advancements, expanding applications in biopharmaceuticals, and increasing demand for high-resolution analytical techniques. Industry leaders and specialized manufacturers anticipate compound annual growth rates (CAGR) in the mid-to-high single digits for this period, reflecting expanding needs in pharmaceutical quality control, life sciences research, clinical diagnostics, and environmental monitoring.

A key driver fueling market expansion is the continual innovation among core instrument manufacturers. Companies such as Agilent Technologies and SCIEX are investing in automation, miniaturization, and enhanced detection capabilities to meet stringent regulatory requirements and accelerate throughput in both research and QA/QC settings. For instance, Agilent Technologies has introduced next-generation CE platforms with improved sensitivity and user-friendly software interfaces, targeting laboratories seeking to streamline workflows and reduce hands-on analysis time.

The biopharmaceutical sector remains a prominent growth engine for CE instrumentation. The ability of capillary electrophoresis to characterize complex biomolecules such as proteins, peptides, and oligonucleotides aligns with regulatory trends emphasizing comprehensive impurity profiling and glycan analysis. SCIEX highlights the adoption of its CE systems for monoclonal antibody (mAb) analysis and gene therapy product quality assurance, a pattern expected to intensify as novel biologics and cell/gene therapies progress through clinical pipelines.

Meanwhile, regulatory authorities such as the U.S. Food and Drug Administration (FDA) are increasingly recognizing capillary electrophoresis methods for validated release and stability testing. This trend is anticipated to further open revenue opportunities, as pharmaceutical and contract research organizations ramp up investments in compliant CE platforms to meet evolving regulatory standards.

Geographically, North America and Europe continue to represent the largest markets, but Asia-Pacific is projected to experience above-average growth through 2030. This is attributed to rising R&D investments, expanding pharmaceutical manufacturing, and government initiatives favoring advanced analytical instrumentation. Companies such as Shimadzu Corporation and Bio-Rad Laboratories are responding with region-specific product launches and expanded service networks.

Looking ahead, revenue opportunities will increasingly hinge on integration with complementary technologies (e.g., mass spectrometry), cloud-based data management, and sustainability initiatives targeting reduced reagent consumption. As manufacturers and laboratories prioritize innovation and compliance, the capillary electrophoresis instrumentation market is well-positioned for robust growth and diversification through 2030.

Regulatory Drivers and Industry Standards (Referencing ifcc.org, fda.gov)

Regulatory frameworks and industry standards play a defining role in the development, validation, and adoption of capillary electrophoresis (CE) instrumentation, particularly as its applications expand in clinical diagnostics, pharmaceutical analysis, and food safety. In 2025 and beyond, both global and national regulatory bodies are intensifying efforts to harmonize standards and ensure the analytical reliability of CE-based methods.

A significant driver comes from the growing integration of CE into clinical laboratories. The International Federation of Clinical Chemistry and Laboratory Medicine (IFCC) continues to support the standardization of laboratory methods, including CE, especially in the context of hemoglobinopathy screening and protein analysis. IFCC’s working groups are actively engaged in developing reference measurement procedures and promoting external quality assessment schemes, pushing instrument manufacturers to meet evolving performance criteria for reproducibility, sensitivity, and traceability.

In the United States, the U.S. Food and Drug Administration (FDA) maintains oversight of CE instrumentation used in both diagnostic and pharmaceutical quality control settings. In 2025, the FDA is expected to further refine its regulatory guidance for analytical instrumentation, emphasizing 21 CFR Part 11 compliance for computerized systems and enhanced data integrity requirements for electronic records. This has prompted manufacturers to bolster instrument software security, audit trails, and ensure robust validation documentation. FDA’s ongoing emphasis on “fit-for-purpose” validation—where analytical methods, including CE, must be proven suitable for their intended use—has also led to more extensive performance characterization studies submitted as part of regulatory filings.

Additionally, alignment with international standards, such as ISO/IEC 17025 for laboratory competence and ISO 15189 for medical laboratories, is increasingly expected. These standards require rigorous demonstration of method validation, instrument qualification, and ongoing performance verification, influencing both instrument design and the supporting documentation provided by CE system suppliers. Regulatory harmonization efforts between the FDA, the European Medicines Agency, and other global agencies are anticipated to continue, facilitating cross-border acceptability of CE-generated data and instruments.

Looking ahead, the regulatory environment is poised to become even more stringent as CE technology is applied to emerging fields such as gene therapy product characterization and novel biomarker discovery. This will likely drive further innovation among CE instrument manufacturers to ensure compliance with evolving guidelines and to provide users with tools and documentation that streamline regulatory submissions.

Sustainability and Green Chemistry in Capillary Electrophoresis

Capillary electrophoresis (CE) instrumentation continues to evolve in response to the increasing demand for sustainability and green chemistry in analytical laboratories. The current landscape—projected through 2025 and beyond—shows leading manufacturers and sector stakeholders intensifying their efforts to reduce environmental impact across the instrument lifecycle, from design to operation and eventual disposal.

One of the defining trends is the focus on reducing reagent and solvent consumption. Modern CE systems are inherently more sustainable than many chromatographic methods due to their minimal sample and buffer requirements. Leading instrumentation providers, such as Agilent Technologies and SCIEX, emphasize microscale operation and automated sample handling, which together drastically reduce chemical waste and operator exposure. Recent system releases incorporate features like advanced capillary cooling, further limiting energy consumption during analysis.

Instrumentation developments are also targeting energy efficiency. For example, Thermo Fisher Scientific has implemented energy-saving standby modes and optimized power management in its CE platforms, aligning with laboratory sustainability initiatives. Meanwhile, modular instrument architectures allow users to upgrade specific components rather than replacing entire systems, extending instrument life cycles and reducing electronic waste.

Material selection is another area of innovation. Companies are increasingly considering the environmental footprint of instrument components. Shimadzu Corporation has announced efforts to incorporate recyclable materials in their instrument housings and to streamline manufacturing processes to minimize waste. In addition, suppliers are offering capillaries with improved durability, reducing the frequency of replacement and the associated disposal burden.

On the software front, automation and remote monitoring capabilities are being integrated to enhance operational efficiency and further reduce resource use. Vendors like Agilent Technologies and SCIEX now provide cloud-based instrument management, which supports predictive maintenance and reduces downtime, thereby optimizing instrument utilization and energy consumption.

Looking ahead, the sector anticipates further progress in the adoption of biobased or biodegradable buffer systems, and the use of life-cycle analysis tools to guide instrument development. Industry-wide initiatives, sometimes in partnership with sustainability certifying bodies, are expected to establish new benchmarks for green instrumentation practices by the late 2020s. As regulatory and consumer pressure for greener laboratory operations intensifies, CE instrumentation is poised to remain at the forefront of sustainable analytical technologies.

Future Outlook: Disruptive Trends, AI Integration, and What’s Next for Stakeholders

The future of capillary electrophoresis (CE) instrumentation is poised for transformative change, driven by advances in automation, digital integration, and artificial intelligence (AI). As of 2025, leading manufacturers and technology developers are accelerating the pace of innovation, responding to increasing demand for higher throughput, greater analytical precision, and integration with broader laboratory informatics ecosystems.

A central trend is the push toward fully automated and miniaturized CE platforms. Companies such as Agilent Technologies and SCIEX have recently released or announced next-generation instruments that feature enhanced sample handling robotics, real-time data processing, and improved user interfaces. These developments are designed to reduce hands-on time, minimize operator error, and enable remote operation—capabilities in high demand across pharmaceutical, biopharma, and clinical diagnostics laboratories.

AI and machine learning are being embedded into CE workflows to address complex data interpretation and instrument optimization. For example, Shimadzu Corporation is actively developing smart diagnostics and maintenance systems that leverage AI to predict component wear and automate troubleshooting, thereby reducing downtime and improving reliability. Similarly, Bio-Rad Laboratories is exploring the use of AI-driven algorithms for peak identification and quantification, with early deployments already demonstrating gains in analytical consistency and reproducibility.

Integration with Laboratory Information Management Systems (LIMS) is another disruptive trend. Instrument manufacturers are offering open APIs and cloud connectivity to seamlessly connect CE instruments with laboratory digital infrastructures. Thermo Fisher Scientific has made strides in this area by providing cloud-enabled platforms that allow data sharing, regulatory compliance monitoring, and remote quality control, which is particularly crucial for labs operating in regulated environments.

Looking ahead, stakeholders should anticipate the convergence of CE with other separation and detection technologies—such as mass spectrometry—for expanded analytical capability in a single workflow. Collaborative efforts between technology providers suggest that hybrid or modular platforms could become mainstream by the late 2020s, supporting multi-omic and precision medicine applications.

Overall, the outlook for CE instrumentation is one of rapid evolution and convergence. Stakeholders—including laboratory managers, pharmaceutical developers, and clinical researchers—should actively monitor advances from established leaders like Agilent Technologies, SCIEX, Shimadzu Corporation, Bio-Rad Laboratories, and Thermo Fisher Scientific, as their R&D investments and strategic partnerships will likely define the next generation of CE capabilities through 2025 and beyond.