Catalytic Membrane Technology for Wastewater Treatment in 2025: Unleashing Next-Gen Efficiency and Sustainability. Explore How Advanced Catalysis is Transforming Industrial and Municipal Water Management.

- Executive Summary: 2025 Market Snapshot & Key Takeaways

- Catalytic Membrane Technology: Principles and Recent Innovations

- Global Market Size, Segmentation, and 2025–2030 Growth Forecasts

- Key Industry Players and Strategic Partnerships (e.g., pall.com, veoliawatertechnologies.com, suezwatertechnologies.com)

- Drivers: Regulatory Pressures, Sustainability Goals, and Industrial Demand

- Barriers: Technical Challenges, Cost Factors, and Adoption Hurdles

- Emerging Applications: Pharmaceuticals, Petrochemicals, and Municipal Wastewater

- Competitive Landscape and Patent Activity

- Case Studies: Successful Deployments and Measured Impact

- Future Outlook: Technology Roadmap, Investment Trends, and Projected CAGR (2025–2030: ~11–14%)

- Sources & References

Executive Summary: 2025 Market Snapshot & Key Takeaways

Catalytic membrane technology is rapidly emerging as a transformative solution in the global wastewater treatment sector, driven by increasing regulatory pressures, water scarcity, and the need for advanced contaminant removal. As of 2025, the market is witnessing accelerated adoption of catalytic membranes, which integrate catalytic materials (such as metal oxides, nanoparticles, or enzymes) with membrane filtration systems to achieve higher efficiency in degrading persistent organic pollutants, pharmaceuticals, and industrial chemicals.

Key industry players are scaling up production and deployment of catalytic membrane systems, with a focus on both municipal and industrial wastewater applications. Companies such as SUEZ and Veolia are actively investing in research and pilot projects, aiming to commercialize next-generation catalytic membrane modules that offer improved fouling resistance and longer operational lifespans. These advancements are particularly relevant for sectors with complex effluent streams, including pharmaceuticals, textiles, and petrochemicals.

Recent data from industry sources indicate that the adoption rate of catalytic membrane reactors (CMRs) is expected to grow at a double-digit CAGR through 2028, with Asia-Pacific and Europe leading in new installations. The European Union’s tightening of micropollutant discharge limits and China’s ongoing industrial water reuse initiatives are major drivers for this growth. In 2025, several large-scale demonstration plants are coming online, showcasing the ability of catalytic membranes to reduce energy consumption and chemical usage compared to conventional advanced oxidation or adsorption processes.

Technology providers such as DuPont and Toray Industries are expanding their portfolios to include hybrid catalytic-ceramic and polymeric membrane products, targeting both retrofits and new builds. These companies are also collaborating with academic and public sector partners to validate performance under real-world conditions and to address challenges such as catalyst deactivation and membrane scaling.

Looking ahead, the outlook for catalytic membrane technology in wastewater treatment remains robust. The next few years are expected to see further cost reductions, improved catalyst immobilization techniques, and the integration of digital monitoring for predictive maintenance. As water utilities and industrial operators seek to meet stricter discharge standards and sustainability goals, catalytic membranes are positioned to play a central role in the evolution of advanced water treatment infrastructure.

Catalytic Membrane Technology: Principles and Recent Innovations

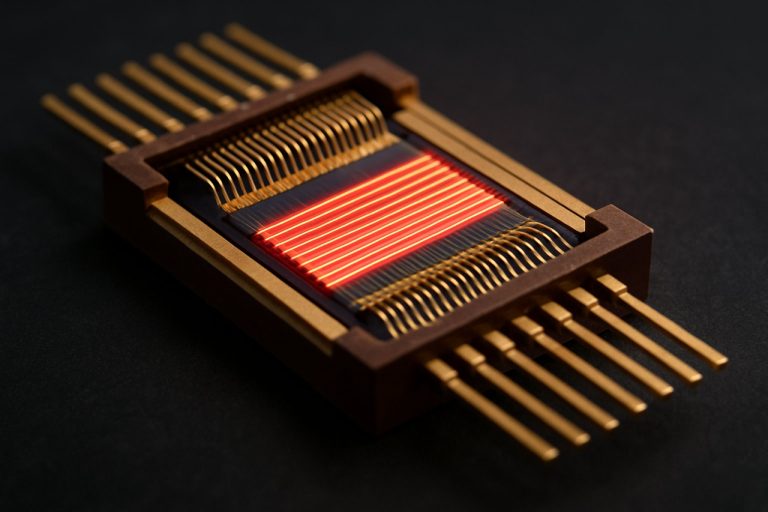

Catalytic membrane technology is rapidly emerging as a transformative approach in wastewater treatment, combining the selective separation capabilities of membranes with the enhanced reactivity of catalysts. This hybrid technology addresses persistent challenges in conventional treatment, such as the removal of recalcitrant organic pollutants, pharmaceuticals, and industrial chemicals, which are often resistant to biological degradation.

The core principle involves integrating catalytic materials—such as metal oxides, nanoparticles, or enzyme immobilizations—onto or within membrane matrices. This enables simultaneous filtration and catalytic degradation of contaminants, often through advanced oxidation processes (AOPs) or redox reactions. In 2025, research and pilot-scale deployments are focusing on membranes embedded with photocatalysts (e.g., TiO2, ZnO), which, when activated by UV or visible light, generate reactive species capable of mineralizing complex organics.

Recent innovations include the development of nanocomposite membranes, where nanoparticles are uniformly dispersed within polymeric or ceramic supports, enhancing both permeability and catalytic efficiency. Companies such as DuPont and SUEZ are actively advancing membrane materials and module designs, with a focus on durability, fouling resistance, and scalability for municipal and industrial applications. DuPont’s water solutions division, for example, is exploring hybrid catalytic membranes for the breakdown of micropollutants and emerging contaminants.

Another significant trend is the integration of catalytic membranes into modular treatment systems, enabling decentralized and energy-efficient operation. SUEZ has piloted advanced membrane bioreactor (MBR) systems incorporating catalytic functionalities, targeting pharmaceutical and textile wastewater streams. These systems demonstrate improved removal rates for persistent organic pollutants and reduced chemical consumption compared to traditional AOPs.

In parallel, Asian manufacturers such as Toray Industries are investing in the scale-up of ceramic catalytic membranes, which offer superior thermal and chemical stability for harsh industrial effluents. Toray Industries is also collaborating with research institutes to optimize membrane surface modification techniques, aiming to enhance catalyst loading and longevity.

Looking ahead to the next few years, the outlook for catalytic membrane technology is promising, with ongoing efforts to reduce costs, improve regeneration methods, and expand the range of treatable contaminants. Industry bodies such as the International Water Association are facilitating knowledge exchange and standardization, supporting the transition from laboratory-scale innovation to full-scale deployment. As regulatory pressures mount for stricter discharge limits and resource recovery, catalytic membranes are poised to play a pivotal role in the next generation of sustainable wastewater treatment solutions.

Global Market Size, Segmentation, and 2025–2030 Growth Forecasts

Catalytic membrane technology is rapidly emerging as a transformative solution in the global wastewater treatment sector, driven by increasing regulatory pressures, water scarcity, and the need for advanced contaminant removal. As of 2025, the global market for catalytic membrane systems—encompassing both ceramic and polymeric variants integrated with catalytic functionalities—has reached an estimated value in the low single-digit billions USD, with robust growth projected through 2030. This expansion is underpinned by rising adoption in municipal, industrial, and specialized applications such as pharmaceutical and textile effluent treatment.

Market segmentation reveals that Asia-Pacific leads in both installed capacity and new project announcements, propelled by rapid industrialization and stringent water reuse mandates in countries like China, India, and South Korea. Europe follows closely, with the European Union’s Green Deal and circular economy initiatives incentivizing the deployment of advanced water treatment technologies. North America, while a mature market, is witnessing renewed investment in catalytic membranes for PFAS and micropollutant removal, particularly in the United States and Canada.

Key industry players are shaping the competitive landscape. SUEZ and Veolia—both global leaders in water technologies—have expanded their portfolios to include catalytic membrane modules, targeting municipal and industrial clients seeking to meet tightening discharge standards. DuPont is actively developing next-generation polymeric membranes with embedded catalytic nanoparticles, aiming for higher selectivity and fouling resistance. In the ceramic segment, Mott Corporation and Pall Corporation are advancing catalytic ceramic membranes for high-temperature and aggressive wastewater streams, with pilot projects underway in petrochemical and mining sectors.

From 2025 to 2030, the catalytic membrane market is forecast to grow at a compound annual growth rate (CAGR) in the high single to low double digits, outpacing conventional membrane technologies. Growth drivers include the increasing prevalence of contaminants of emerging concern (CECs), stricter effluent regulations, and the push for water reuse and zero liquid discharge (ZLD) systems. Technological advancements—such as hybrid catalytic-adsorptive membranes and modular, retrofittable units—are expected to further accelerate adoption.

Looking ahead, the market outlook remains highly positive, with ongoing R&D investments and demonstration projects by leading manufacturers and utilities. Strategic partnerships between technology providers and end-users are anticipated to facilitate commercialization and scale-up, particularly in regions facing acute water stress and regulatory transformation.

Key Industry Players and Strategic Partnerships (e.g., pall.com, veoliawatertechnologies.com, suezwatertechnologies.com)

The landscape of catalytic membrane technology for wastewater treatment in 2025 is shaped by a select group of global industry leaders, each leveraging strategic partnerships and innovation to address increasingly stringent water quality regulations and sustainability goals. These companies are not only advancing membrane materials and reactor designs but are also integrating catalytic functionalities—such as photocatalysis, enzymatic catalysis, and advanced oxidation—into scalable solutions for municipal and industrial clients.

Pall Corporation, a subsidiary of Danaher, remains a prominent force in membrane-based water treatment. The company’s portfolio includes advanced membrane modules and systems that are being adapted for catalytic applications, particularly in the removal of persistent organic pollutants and trace contaminants. Pall’s collaborations with research institutions and technology providers are focused on integrating catalytic layers into their existing membrane platforms, aiming to enhance degradation rates and reduce fouling, a persistent challenge in membrane operations. Their global presence and established client base in pharmaceuticals, food & beverage, and municipal water sectors position them as a key driver of catalytic membrane adoption (Pall Corporation).

Veolia Water Technologies, a division of Veolia Group, is another major player actively developing and deploying catalytic membrane systems. Veolia’s R&D centers are working on hybrid processes that combine membrane filtration with catalytic oxidation, targeting micropollutant removal and water reuse. The company’s “Actiflo® Carb” and “Memthane®” solutions, while not exclusively catalytic, are being enhanced with catalytic functionalities to address emerging contaminants and improve process efficiency. Veolia’s strategic partnerships with universities and technology startups are accelerating the commercialization of these next-generation systems, particularly in Europe and Asia, where regulatory drivers are strongest (Veolia Water Technologies).

SUEZ Water Technologies & Solutions (now part of Veolia since the 2022 merger, but still operating under its own brand in many regions) continues to invest in catalytic membrane research, focusing on advanced oxidation processes (AOPs) integrated with membrane bioreactors (MBRs). SUEZ’s collaborations with industrial partners are yielding pilot projects that demonstrate the removal of pharmaceuticals, endocrine disruptors, and other recalcitrant compounds. Their global network and expertise in digital water management further support the deployment and monitoring of catalytic membrane systems at scale (SUEZ Water Technologies & Solutions).

Looking ahead, the next few years are expected to see intensified collaboration between these industry leaders, academic institutions, and emerging technology firms. Joint ventures and licensing agreements are likely to accelerate the commercialization of novel catalytic membrane materials, such as those incorporating nanomaterials or bio-inspired catalysts. As regulatory pressures mount and the demand for water reuse grows, these strategic partnerships will be critical in scaling up catalytic membrane technology from pilot to full-scale deployment worldwide.

Drivers: Regulatory Pressures, Sustainability Goals, and Industrial Demand

Catalytic membrane technology is rapidly gaining traction in wastewater treatment, propelled by a convergence of regulatory, sustainability, and industrial drivers. As of 2025, increasingly stringent environmental regulations are compelling industries and municipalities to adopt advanced treatment solutions that can efficiently remove persistent organic pollutants, pharmaceuticals, and emerging contaminants. The European Union’s Urban Waste Water Treatment Directive (UWWTD) revision, set to be enforced in the coming years, mandates higher removal rates for micropollutants and nutrients, directly incentivizing the adoption of innovative technologies such as catalytic membranes. Similarly, the United States Environmental Protection Agency (EPA) is intensifying its focus on per- and polyfluoroalkyl substances (PFAS) and other recalcitrant compounds, pushing utilities and manufacturers to seek more effective treatment options.

Sustainability goals are another major driver. Many global corporations have set ambitious water stewardship targets for 2025 and beyond, aiming to achieve zero liquid discharge (ZLD), reduce water footprints, and enable water reuse. Catalytic membrane reactors, which combine separation and catalytic degradation in a single step, offer significant advantages in energy efficiency and operational footprint compared to conventional multi-stage processes. Companies such as SUEZ and Veolia are actively developing and piloting catalytic membrane systems, targeting both municipal and industrial clients seeking to meet sustainability commitments and reduce operational costs.

Industrial demand is particularly strong in sectors with complex effluents, such as pharmaceuticals, chemicals, textiles, and food processing. These industries face mounting pressure to comply with discharge limits for hazardous substances and to recover valuable resources from wastewater streams. In 2025, several large-scale demonstration projects are underway, with companies like Evoqua Water Technologies (now part of Xylem) and Pall Corporation investing in the development and commercialization of catalytic membrane modules tailored for industrial applications. These systems are designed to degrade persistent contaminants while enabling water reuse, aligning with circular economy principles.

Looking ahead, the outlook for catalytic membrane technology is robust. Regulatory timelines in the EU, US, and Asia-Pacific are expected to tighten further, while corporate sustainability reporting frameworks increasingly require transparent disclosure of water management practices. As a result, adoption rates for catalytic membrane systems are projected to accelerate, especially as costs decline and performance data from pilot installations become widely available. Industry leaders and technology providers are expected to expand partnerships and invest in R&D to address scalability and fouling challenges, positioning catalytic membranes as a cornerstone of next-generation wastewater treatment.

Barriers: Technical Challenges, Cost Factors, and Adoption Hurdles

Catalytic membrane technology is increasingly recognized for its potential to revolutionize wastewater treatment by enabling advanced contaminant removal and resource recovery. However, as of 2025, several barriers continue to impede its widespread adoption. These challenges span technical limitations, cost considerations, and broader market and regulatory hurdles.

Technical Challenges remain a primary concern. Catalytic membranes, which integrate catalytic materials (such as metal oxides or nanoparticles) with filtration media, often face issues related to membrane fouling, catalyst deactivation, and long-term stability. Fouling—caused by the accumulation of organic matter, biofilms, or inorganic precipitates—reduces membrane efficiency and lifespan. While companies like SUEZ and Veolia are actively developing anti-fouling coatings and self-cleaning membrane systems, the durability of catalytic activity under real-world wastewater conditions remains a significant technical hurdle. Additionally, the leaching of catalytic materials, especially nanoparticles, raises concerns about secondary contamination and environmental safety.

Cost Factors are another major barrier. The production of catalytic membranes typically involves advanced materials and complex fabrication processes, resulting in higher capital and operational expenditures compared to conventional membrane systems. For example, the integration of precious metals or engineered nanomaterials as catalysts can substantially increase costs. While scale-up efforts by manufacturers such as Pall Corporation and Toray Industries are underway, the price gap between catalytic and traditional membranes remains significant. Furthermore, maintenance costs associated with membrane cleaning, replacement, and catalyst regeneration add to the total cost of ownership, making it challenging for municipal and industrial users to justify investment without clear regulatory or economic incentives.

Adoption Hurdles are compounded by market and regulatory uncertainties. The lack of standardized testing protocols and performance benchmarks for catalytic membranes complicates procurement and risk assessment for utilities and industries. Regulatory frameworks in many regions have yet to specifically address the use of catalytic or nanomaterial-enhanced membranes in water treatment, leading to uncertainty about approval processes and long-term liability. Industry bodies such as the International Water Association are working to develop guidelines, but widespread harmonization is still pending. Additionally, end-users may be hesitant to adopt new technologies without robust, long-term field data demonstrating reliability, safety, and cost-effectiveness under diverse operating conditions.

Looking ahead, overcoming these barriers will require coordinated efforts in materials innovation, cost reduction through scale, and the establishment of clear regulatory pathways. As leading water technology companies and industry organizations intensify R&D and standardization efforts, the outlook for catalytic membrane technology in wastewater treatment remains cautiously optimistic for the next several years.

Emerging Applications: Pharmaceuticals, Petrochemicals, and Municipal Wastewater

Catalytic membrane technology is rapidly gaining traction as a transformative solution for advanced wastewater treatment, particularly in sectors facing complex contaminant profiles such as pharmaceuticals, petrochemicals, and municipal wastewater. As of 2025, the integration of catalytic membranes—membranes embedded or coated with catalytic materials—offers a dual-function approach: physical separation and in-situ degradation of pollutants, including persistent organic compounds and emerging contaminants.

In the pharmaceutical industry, the challenge of removing active pharmaceutical ingredients (APIs) and antibiotic residues from effluents has driven the adoption of catalytic membrane reactors (CMRs). These systems, often utilizing photocatalytic or enzymatic membranes, can degrade micro-pollutants that conventional treatments fail to address. Companies such as SUEZ and Veolia are actively piloting and deploying advanced membrane bioreactor (MBR) systems with catalytic enhancements, targeting pharmaceutical manufacturing hubs in Europe and Asia. These solutions are designed to meet increasingly stringent discharge regulations and to mitigate the risk of antimicrobial resistance propagation.

The petrochemical sector, characterized by high loads of refractory organics and toxic byproducts, is also witnessing the deployment of catalytic membrane technologies. For instance, hybrid systems combining ceramic membranes with catalytic oxidation (e.g., TiO2 or noble metal catalysts) are being trialed for the breakdown of phenols, polyaromatic hydrocarbons, and other persistent contaminants. Aker Carbon Capture and DuPont are among the companies exploring catalytic membrane modules for integration into existing petrochemical wastewater treatment trains, aiming to reduce chemical consumption and operational costs while achieving higher effluent quality.

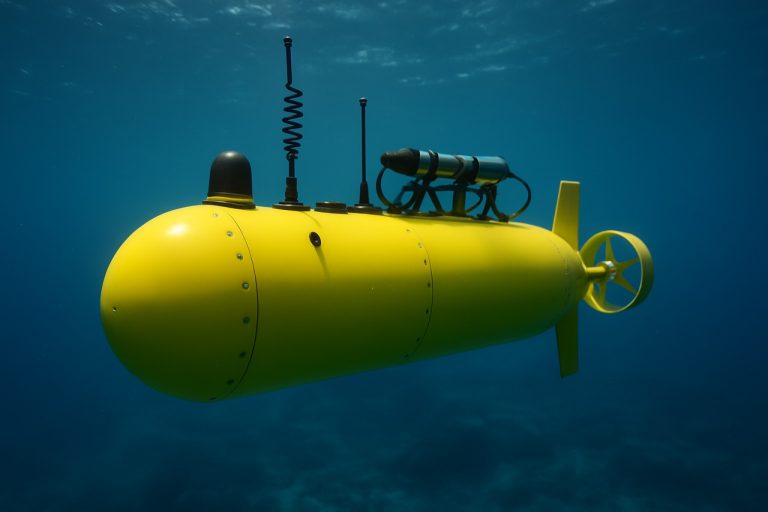

Municipal wastewater treatment plants are increasingly challenged by the presence of trace pharmaceuticals, endocrine-disrupting compounds, and microplastics. Catalytic membrane systems, particularly those leveraging visible-light photocatalysis or advanced oxidation processes, are being evaluated for tertiary treatment and water reuse applications. Xylem and Pentair are developing pilot-scale installations in North America and Europe, focusing on energy efficiency and the minimization of secondary waste streams.

Looking ahead, the outlook for catalytic membrane technology in wastewater treatment is robust. Ongoing R&D is expected to yield membranes with enhanced catalytic activity, fouling resistance, and scalability. Industry collaborations and public-private partnerships are accelerating commercialization, with regulatory drivers and sustainability goals pushing adoption. By 2027, catalytic membranes are projected to play a pivotal role in closing the water loop for high-impact sectors, supporting both environmental compliance and circular economy objectives.

Competitive Landscape and Patent Activity

The competitive landscape for catalytic membrane technology in wastewater treatment is rapidly evolving as the sector moves into 2025. This field is characterized by a blend of established membrane manufacturers, chemical companies, and innovative startups, all vying to commercialize advanced solutions that integrate catalytic functions—such as photocatalysis, Fenton-like reactions, or enzymatic catalysis—into membrane systems for enhanced contaminant removal.

Key players in the global membrane market, such as Toray Industries and SUEZ, have been actively developing and patenting hybrid membrane technologies. Toray Industries, a leader in polymeric and ceramic membranes, has expanded its R&D focus to include catalytic functionalities, particularly for the degradation of persistent organic pollutants and pharmaceuticals in municipal and industrial effluents. SUEZ has similarly invested in advanced oxidation and catalytic membrane modules, targeting both municipal and industrial clients seeking to meet tightening discharge regulations.

In the Asia-Pacific region, Mitsubishi Chemical Group and Haier Group (through its water technology subsidiaries) are notable for their patent filings and pilot projects involving catalytic ceramic and polymeric membranes. These companies are leveraging their material science expertise to develop membranes embedded with metal oxides or nanomaterials, aiming for higher flux, fouling resistance, and catalytic degradation of emerging contaminants.

Patent activity in this sector has intensified, with a marked increase in filings related to photocatalytic membranes (e.g., TiO2-coated membranes), catalytic ozonation, and enzyme-immobilized membranes. According to the European Patent Office and the World Intellectual Property Organization, the number of international patent applications referencing “catalytic membrane” and “wastewater treatment” has grown steadily since 2022, with a significant proportion originating from China, Japan, and the European Union.

Startups and university spin-offs are also shaping the competitive landscape. For example, Aker Carbon Capture and Evonik Industries have announced collaborations with academic partners to scale up catalytic membrane prototypes for industrial wastewater applications. These partnerships are often supported by public funding and are expected to yield commercial products within the next few years.

Looking ahead, the competitive intensity is expected to increase as regulatory drivers—such as the European Union’s Urban Waste Water Treatment Directive and China’s “Zero Liquid Discharge” initiatives—spur demand for advanced treatment technologies. Companies with strong patent portfolios and demonstrated pilot-scale performance are likely to secure early market leadership, while ongoing innovation in catalyst integration and membrane fabrication will remain key differentiators in the sector.

Case Studies: Successful Deployments and Measured Impact

Catalytic membrane technology has transitioned from laboratory research to real-world applications, with several notable deployments in municipal and industrial wastewater treatment over the past few years. As of 2025, these case studies highlight both the versatility and the measurable impact of catalytic membranes in addressing persistent organic pollutants, pharmaceuticals, and other recalcitrant contaminants.

One of the most prominent examples is the integration of photocatalytic ceramic membranes in pilot-scale municipal wastewater treatment plants in Europe. Kerafol, a German manufacturer specializing in ceramic membranes, has collaborated with regional utilities to retrofit existing membrane bioreactor (MBR) systems with TiO2-coated catalytic membranes. These systems have demonstrated up to 90% removal efficiency for pharmaceuticals such as diclofenac and carbamazepine, compared to less than 50% with conventional ultrafiltration membranes. The pilot projects have also reported a significant reduction in membrane fouling, leading to lower operational costs and extended membrane lifespan.

In Asia, Mitsubishi Chemical Group has advanced the deployment of catalytic membrane reactors for industrial wastewater, particularly in the textile and dyeing sectors. Their hybrid systems, combining ozonation with catalytic ceramic membranes, have been installed in several facilities in Japan and China since 2023. These installations have achieved over 95% color removal and a 70% reduction in chemical oxygen demand (COD), while also enabling water reuse within the plants. The company’s ongoing projects aim to scale up these systems for broader adoption across the region.

Another significant case is the use of catalytic membranes in the petrochemical industry. SUEZ, a global leader in water technologies, has piloted advanced oxidation membrane systems at refineries in the Middle East. Their deployments have focused on the degradation of persistent organic pollutants and oil residues. Early results from 2024-2025 indicate a 60-80% reduction in total organic carbon (TOC) and improved compliance with stringent discharge regulations. SUEZ is now working with local authorities to expand these solutions to other industrial clusters.

Looking ahead, the success of these deployments is driving further investment and interest in catalytic membrane technology. Industry bodies such as the Water Environment Federation are actively promoting knowledge exchange and best practices, while manufacturers are scaling up production and customization of catalytic membranes for diverse applications. As regulatory pressures on micropollutant removal intensify, the next few years are expected to see broader commercialization and integration of catalytic membrane systems in both municipal and industrial wastewater treatment worldwide.

Future Outlook: Technology Roadmap, Investment Trends, and Projected CAGR (2025–2030: ~11–14%)

Catalytic membrane technology is poised for significant growth in the wastewater treatment sector between 2025 and 2030, with a projected compound annual growth rate (CAGR) of approximately 11–14%. This robust outlook is driven by escalating regulatory pressures, increasing water scarcity, and the need for advanced solutions to remove emerging contaminants such as pharmaceuticals, microplastics, and persistent organic pollutants.

In 2025, the technology roadmap for catalytic membranes is characterized by a shift from laboratory-scale demonstrations to pilot and full-scale deployments. Key industry players are investing in the development of hybrid systems that integrate catalytic membranes with established processes like membrane bioreactors (MBRs) and advanced oxidation processes (AOPs). These hybrid systems are designed to enhance contaminant degradation efficiency, reduce fouling, and lower operational costs.

Major membrane manufacturers and water technology companies are actively expanding their portfolios to include catalytic membrane modules. SUEZ, a global leader in water and wastewater treatment, has announced ongoing R&D initiatives focused on catalytic ceramic membranes for industrial effluent treatment. Similarly, Veolia is piloting catalytic membrane systems in Europe and Asia, targeting the removal of trace organic contaminants and antibiotic-resistant bacteria. Toray Industries, a prominent Japanese membrane producer, is advancing the commercialization of catalytic polymeric membranes with embedded metal nanoparticles, aiming for higher selectivity and durability.

Investment trends indicate a surge in public-private partnerships and venture capital funding for startups specializing in catalytic membrane innovation. Governments in the European Union, China, and the United States are allocating grants and incentives to accelerate the adoption of advanced water treatment technologies, in line with tightening discharge regulations and circular economy goals. Industry consortia and collaborative research programs are also emerging, fostering knowledge transfer and standardization efforts.

Looking ahead, the market is expected to witness increased adoption in municipal and industrial wastewater treatment plants, particularly in sectors such as pharmaceuticals, chemicals, and food processing. The integration of digital monitoring and process automation is anticipated to further optimize membrane performance and lifecycle management. As the technology matures, cost reductions and scalability improvements are likely, making catalytic membranes a mainstream solution for sustainable water management by 2030.