Table of Contents

- Executive Summary: Key Findings & 2025 Outlook

- Global Market Size, Growth Forecasts & Regional Hotspots (2025–2030)

- Competitive Landscape: Market Leaders, Challengers & New Entrants

- Cutting-Edge Device Technologies & Material Advancements

- Regulatory Shifts, Approvals & Compliance Trends

- Strategic Partnerships, M&A, and Investment Activity

- Emerging Applications: Personalized, Minimally Invasive, and Smart Fixation Solutions

- Manufacturing Innovations: Automation, 3D Printing, and Cost Optimization

- Challenges & Barriers: Supply Chain, Reimbursement, and Surgeon Adoption

- Future Outlook: Game-Changers, Industry Roadmap, and Strategic Recommendations

- Sources & References

Executive Summary: Key Findings & 2025 Outlook

The cervical vertebrae fixation devices manufacturing sector is positioned for steady growth through 2025, driven by advancements in biomaterials, increased demand for minimally invasive surgical solutions, and the growing global incidence of degenerative cervical spine conditions. Key industry players continue to invest in research and development, focusing on innovations that enhance patient outcomes, device longevity, and surgical precision.

Several notable events are shaping the landscape. In 2024, Medtronic introduced its latest cervical plating system, integrating enhanced screw locking technology and streamlined instrumentation, designed for both anterior and posterior cervical procedures. Similarly, Zimmer Biomet expanded its spine portfolio with new zero-profile interbody devices, emphasizing reduced operative time and improved fusion rates for cervical spine surgeries.

Manufacturers are also responding to the increasing preference for titanium and PEEK materials, which offer superior biocompatibility and imaging compatibility. DePuy Synthes has reported ongoing development of radiolucent fixation devices, which support intraoperative visualization and postoperative assessment, reflecting a broader industry trend towards advanced material science applications.

Regulatory clearances continue to accelerate innovation cycles. The U.S. Food and Drug Administration (FDA) granted several 510(k) clearances in late 2024 for next-generation cervical fixation systems, including expandable cage technologies and modular plate-screw constructs. Globus Medical and NuVasive are among those receiving approvals for novel devices designed to address both trauma and degenerative pathologies.

From a market perspective, North America and Western Europe remain primary drivers of procedural volume, while emerging markets in Asia-Pacific are witnessing accelerated adoption fueled by rising healthcare investments and increased surgeon training initiatives. For example, Stryker has recently expanded its manufacturing and distribution capabilities in Asia to meet growing demand.

Looking ahead, the cervical vertebrae fixation device market is expected to maintain a compound annual growth rate in the mid-single digits through 2025. Ongoing trends include further miniaturization of implants, the integration of navigation and robotic-assisted surgical systems, and a strong focus on patient-specific solutions. Manufacturers are expected to deepen collaborations with healthcare providers to optimize device design and clinical outcomes, ensuring that the sector remains at the forefront of orthopedic innovation.

Global Market Size, Growth Forecasts & Regional Hotspots (2025–2030)

The global market for cervical vertebrae fixation devices is on an upward trajectory in 2025, driven by rising incidences of spinal disorders, advancements in surgical techniques, and an aging population. According to industry leaders, demand for devices such as anterior cervical plates, posterior fixation systems, and interbody cages is especially robust in the United States, Europe, and key Asia-Pacific markets.

In 2025, North America continues to dominate the market, benefiting from established healthcare infrastructure and high adoption of minimally invasive procedures. Companies like Medtronic, Stryker, and Zimmer Biomet have expanded their cervical fixation device portfolios, launching products that emphasize enhanced biomechanical stability and ease of implantation. For example, Stryker’s Tritanium C Anterior Cervical Cage and Medtronic’s Infinity OCT System are designed for complex cervical spine conditions, reflecting a focus on innovation.

Europe follows closely, with countries such as Germany, France, and the UK showing significant uptake. DePuy Synthes and B. Braun are investing in next-generation implants that integrate imaging and navigation technologies, addressing surgeon preferences for precision and safety in cervical procedures.

The Asia-Pacific region is forecasted to see the fastest compound annual growth rate (CAGR) through 2030. Rising healthcare expenditure in China, India, and South Korea, along with increased awareness of spinal health, are propelling local manufacturing. Domestic players like Shandong Weigao Orthopaedic Device are scaling up production, while global firms such as Medtronic and Stryker are expanding their distribution networks and local partnerships to capture market share.

Latin America and the Middle East & Africa are considered emerging markets, with gradual improvements in healthcare access and surgical capabilities. Device makers are leveraging these regions for long-term growth, frequently via collaborations with local distributors and training programs for surgeons.

Looking ahead to 2030, the cervical vertebrae fixation device sector is expected to benefit from digital surgery platforms and personalized implant solutions, with a continued focus on biocompatible materials and reduced operative times. Manufacturers are expected to invest in smart instrumentation, AI-assisted planning, and expanded regulatory approvals, paving the way for sustained growth and broader global adoption.

Competitive Landscape: Market Leaders, Challengers & New Entrants

The competitive landscape of cervical vertebrae fixation devices manufacturing in 2025 is characterized by the dominance of established multinational corporations, the emergence of agile challengers, and the entry of innovative startups. The market is being shaped by technological advancements, regulatory approvals, and a growing demand for minimally invasive spinal surgeries.

- Market Leaders: Major medical device companies such as Medtronic, Stryker, DePuy Synthes (Johnson & Johnson MedTech), and Zimmer Biomet continue to maintain their leadership through robust portfolios featuring cervical plates, screws, and novel fixation systems. These firms leverage global distribution networks and invest heavily in R&D, with recent launches including low-profile and modular systems that address both surgeon preferences and patient outcomes. For instance, Medtronic’s Infinity OCT System highlights ongoing innovations in posterior cervical fixation, integrating streamlined implants with navigation compatibility.

- Challengers: Companies such as Globus Medical and NuVasive have gained significant market share by focusing on differentiated technologies like expandable cages and minimally invasive approaches. Their strategy includes rapid product iteration and clinical partnership programs, fostering adoption in both established and emerging healthcare markets.

- New Entrants and Innovators: The sector has seen a surge of new entrants, particularly startups emphasizing 3D-printed implants, patient-specific devices, and bioresorbable materials. Companies such as Aurora Spine are expanding their cervical fixation lines with proprietary designs and materials, targeting niche indications and outpatient surgical centers. Collaborations with academic institutions and technology licensing agreements are key strategies for these innovators.

The outlook for the next few years points to intensifying competition, especially as patent expirations and regulatory harmonization (such as the EU MDR and US FDA’s streamlined pathways) lower barriers for new product introductions. Market leaders are responding by acquiring promising startups and investing in digital surgery platforms and robotic-assisted systems, aiming to offer comprehensive solutions from planning to fixation. Meanwhile, challengers and new entrants are expected to capitalize on the demand for patient-specific, cost-effective, and minimally invasive solutions, reshaping the cervical vertebrae fixation devices landscape through 2025 and beyond.

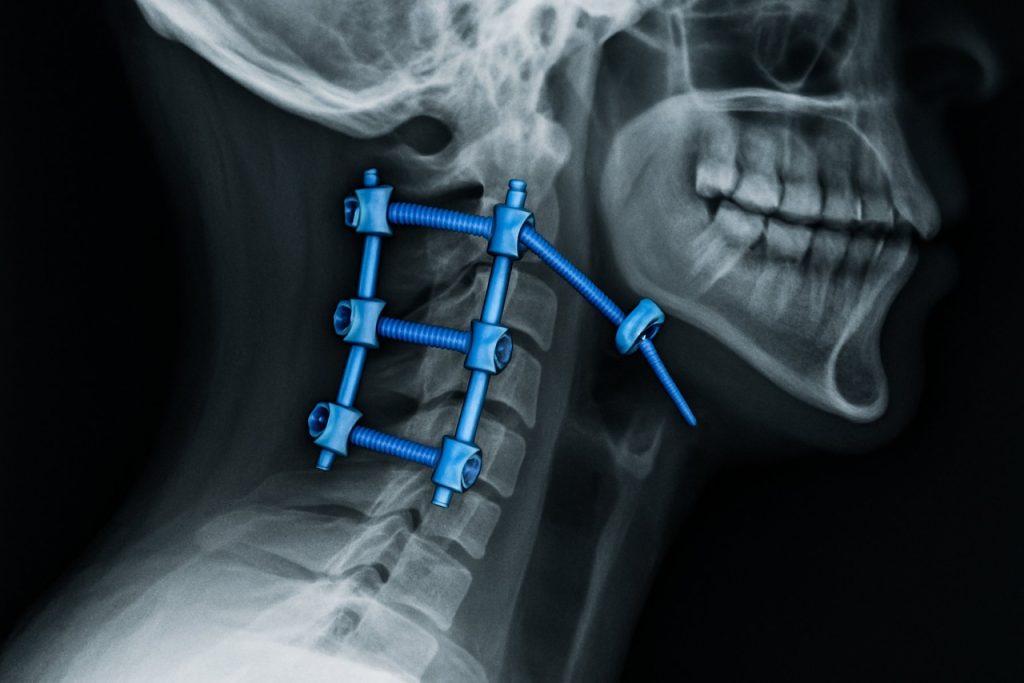

Cutting-Edge Device Technologies & Material Advancements

The cervical vertebrae fixation devices manufacturing sector is witnessing significant technological advancements and material innovations, with 2025 poised to be a pivotal year for both incremental improvements and disruptive product launches. Manufacturers are focusing on designing devices that offer greater biomechanical stability, enhanced biocompatibility, and improved patient outcomes, while also streamlining surgical procedures for healthcare providers.

One key trend is the adoption of advanced biomaterials such as titanium alloys and PEEK (polyetheretherketone), which combine high strength, radiolucency, and excellent fatigue resistance. Companies like Zimmer Biomet are integrating proprietary titanium surface technologies to promote osseointegration and reduce the risk of device migration. In parallel, DePuy Synthes has expanded its cervical interbody portfolio with next-generation PEEK-Optima devices, providing surgeons with a broader range of options tailored to patient anatomy and pathology.

Additive manufacturing, or 3D printing, is another transformative force in this sector. Firms such as Smith+Nephew are leveraging 3D-printed titanium to create lattice structures that mimic natural bone architecture, facilitating bone in-growth and improving implant fixation. These technologies are especially valuable for complex reconstructions and revision surgeries, where conventional solutions may fall short.

Minimally invasive device platforms are also at the forefront of innovation. Medtronic has introduced cervical fixation systems that enable less invasive surgical approaches, reducing tissue disruption, operative time, and hospital stays. Their latest screw and plate systems feature low-profile designs and intuitive instrumentation, catering to the growing demand for patient-centric solutions.

Biomaterial coatings are making strides in infection prevention and bone fusion acceleration. Companies such as NuVasive are actively developing proprietary surface textures and coatings that enhance cellular response and reduce the incidence of post-operative complications. These advancements are complemented by digital integration, where smart instrumentation provides real-time feedback during implantation, further increasing procedural accuracy.

Looking ahead to the next few years, the cervical vertebrae fixation device manufacturing landscape will likely see a convergence of bioengineering, materials science, and digital health. The focus will remain on patient-specific implants, sustainability in manufacturing processes, and the integration of smart features for intraoperative guidance. As regulatory pathways evolve to accommodate these innovations, adoption rates are expected to accelerate, setting new standards in spinal care.

Regulatory Shifts, Approvals & Compliance Trends

The landscape for cervical vertebrae fixation devices manufacturing in 2025 is being shaped by evolving regulatory frameworks, heightened standards for device safety, and a global emphasis on harmonizing compliance processes. Regulatory authorities in major markets are intensifying their scrutiny of spinal implant devices, driving manufacturers to adopt more rigorous quality management and documentation practices.

In the United States, the Food and Drug Administration (FDA) continues to update its guidance for spinal implant submissions, with a particular focus on materials’ biocompatibility, mechanical strength, and long-term safety data. The introduction of the FDA’s Safety and Performance Based Pathway for spinal systems has enabled certain manufacturers to expedite premarket notifications, provided their devices meet specific performance criteria and reference predicate devices with established histories of safety (U.S. Food and Drug Administration). As of 2025, the FDA is also piloting additional post-market surveillance protocols, requiring ongoing real-world evidence collection for cervical fixation systems.

Across Europe, the Medical Device Regulation (MDR) fully came into force in 2021 and continues to impact both existing and new cervical fixation devices. Manufacturers must meet stringent requirements for clinical evaluation, post-market surveillance, and traceability, prompting many to invest in upgraded regulatory affairs departments and digital compliance tools. Notified Bodies, such as TÜV SÜD and BSI Group, are working closely with device manufacturers to ensure timely conformity assessments and CE marking under the MDR framework.

In Asia-Pacific, regulatory harmonization is progressing, with Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) and China’s National Medical Products Administration (NMPA) both streamlining approval pathways for innovative orthopedic implants. For example, leading global manufacturers such as Medtronic and Stryker have reported recent device approvals in these markets, reflecting not only compliance with local regulations but also adaptation to unique market requirements.

Over the next few years, manufacturers are expected to face increasing demands for transparent supply chains and the integration of Unique Device Identification (UDI) systems. This is driving investment in digital manufacturing records and interoperable tracking platforms. Additionally, sustainability and material sourcing disclosures are becoming integral to compliance, as regulators and healthcare providers seek to minimize environmental impact throughout the product lifecycle. Collectively, these trends will require cervical vertebrae fixation device manufacturers to maintain proactive, agile regulatory strategies—balancing speed to market with the highest standards of safety and traceability.

Strategic Partnerships, M&A, and Investment Activity

The landscape of cervical vertebrae fixation devices manufacturing continues to be shaped by heightened strategic partnerships, mergers and acquisitions (M&A), and investment activity as companies seek technological advancements and expanded market reach through 2025 and beyond. The sector is witnessing consolidation, with leading medical device manufacturers acquiring innovative startups and forming alliances to bolster their portfolios in spinal fixation solutions.

A significant development in recent years has been the acquisition of emerging technology firms by established players. For example, Medtronic, one of the world’s largest medical device companies, has consistently invested in spinal technologies. Its acquisition strategy focuses on integrating novel fixation device designs and advanced biomaterials to enhance cervical fusion outcomes. In parallel, Stryker continues to expand its presence in the cervical fixation segment through targeted investments and acquisitions of companies with complementary product lines and proprietary fixation systems.

Strategic partnerships are also driving innovation. Zimmer Biomet has engaged in collaborations with technology developers to advance minimally invasive cervical fixation devices, aiming to reduce surgical time and improve patient recovery. Similarly, DePuy Synthes, a Johnson & Johnson company, has formed alliances with digital health and implant technology leaders to integrate smart instrumentation and intraoperative navigation into their cervical fixation platforms.

Investment activity is robust, with venture capital and strategic investors targeting startups specializing in next-generation cervical fixation devices. Companies like Globus Medical have announced funding rounds and co-development agreements to accelerate the commercialization of new implant materials and fixation techniques with improved biomechanical properties.

Looking ahead to the next few years, the outlook is for continued M&A as large manufacturers seek to fill gaps in their product portfolios and respond to evolving clinical needs. The drive for innovation in areas such as bioresorbable implants, 3D-printed patient-specific devices, and enhanced intraoperative guidance is expected to underpin further investments and collaborations in the sector. Regulatory considerations and the need for clinical validation will remain central to these strategies, but the overall trajectory points to an increasingly interconnected and technology-driven cervical vertebrae fixation device manufacturing ecosystem.

Emerging Applications: Personalized, Minimally Invasive, and Smart Fixation Solutions

The landscape of cervical vertebrae fixation devices manufacturing is undergoing rapid transformation in 2025, driven by the demand for personalized medicine, minimally invasive procedures, and the integration of smart technologies. Manufacturers are increasingly focusing on patient-specific implants, leveraging advanced imaging and 3D printing to create customized solutions that enhance biomechanical compatibility and improve surgical outcomes. Companies such as Stryker and Zimmer Biomet have expanded their portfolios to include cervical fixation systems with modular components, allowing for tailored adjustment according to individual patient anatomy.

Minimally invasive surgical techniques are a key driver in product development, with manufacturers introducing implants and instrumentation designed for smaller incisions, reduced tissue disruption, and faster recovery times. Medtronic has developed a suite of cervical fixation devices compatible with minimally invasive approaches, which are expected to see increasing adoption through 2025 as surgeons and hospitals seek to reduce complications and shorten hospital stays.

Smart fixation solutions are also emerging as a significant trend, with the integration of sensors and connectivity into spinal implants. These innovations enable real-time monitoring of parameters such as load, alignment, and healing progress, providing valuable data to clinicians throughout the postoperative period. While still in early stages of commercialization, companies like DePuy Synthes are investing in research and partnerships aimed at developing intelligent implants that could offer predictive analytics and remote monitoring capabilities.

- In 2024, NuVasive announced advancements in their cervical fixation platforms, including features to facilitate less invasive placement and intraoperative adaptability.

- Globus Medical continues to introduce systems designed for both traditional and minimally invasive cervical fusion, with a focus on ergonomic instrumentation and streamlined workflows.

Looking ahead, the cervical vertebrae fixation device market is expected to witness intensified activity in the development of patient-specific, minimally invasive, and smart solutions. Collaborative efforts between device manufacturers, digital health companies, and surgical robotics firms are poised to further accelerate innovation and expand the adoption of these emerging applications into mainstream clinical practice over the next few years.

Manufacturing Innovations: Automation, 3D Printing, and Cost Optimization

The manufacturing landscape for cervical vertebrae fixation devices is experiencing significant transformation in 2025, with manufacturers embracing automation, additive manufacturing (3D printing), and cost optimization strategies to enhance both product quality and operational efficiency. These innovations are driven by the rising demand for minimally invasive spinal procedures and the need for patient-specific implants, as well as ongoing pressure to reduce healthcare costs.

Automation has been widely adopted in the production of cervical fixation devices, particularly in processes such as CNC machining, quality inspection, and packaging. Leading manufacturers have integrated robotic systems and advanced software to streamline production lines, reduce human error, and increase throughput. Zimmer Biomet has reported ongoing investments in smart manufacturing initiatives, utilizing automation to ensure consistent product quality and traceability across its spinal implant lines. Similarly, DePuy Synthes employs automated inspection systems to maintain the stringent tolerances required for cervical fixation components.

3D printing, especially with biocompatible metals such as titanium alloys, is becoming a cornerstone of innovation in this field. Additive manufacturing enables rapid prototyping, customization of implants to match patient anatomy, and the ability to produce complex geometries that are not feasible with traditional subtractive techniques. Medtronic has expanded its portfolio of 3D-printed spinal fixation devices, offering highly porous structures designed to promote osseointegration and improve clinical outcomes. Globus Medical also utilizes additive manufacturing to develop next-generation cervical plates and screws, leveraging the technology for both design flexibility and time-to-market advantages.

Cost optimization remains a critical focus, as healthcare providers seek value-based solutions. Manufacturers are addressing this by adopting lean manufacturing principles, optimizing supply chains, and investing in in-house capabilities to reduce reliance on external suppliers. The use of advanced analytics and digital twins allows companies like Stryker to monitor production workflows in real time, identify inefficiencies, and implement corrective actions swiftly. Additionally, vertical integration and the expansion of regional manufacturing hubs—such as those announced by NuVasive—help reduce logistics costs and shorten delivery times, which is especially pertinent for urgent, patient-specific implant orders.

Looking ahead, the continued convergence of automation, additive manufacturing, and cost control is expected to further accelerate the evolution of cervical vertebrae fixation device manufacturing. These advances position manufacturers to respond more rapidly to clinical needs, regulatory changes, and emerging market opportunities through 2025 and beyond.

Challenges & Barriers: Supply Chain, Reimbursement, and Surgeon Adoption

The manufacturing landscape for cervical vertebrae fixation devices in 2025 is shaped by a complex interplay of supply chain constraints, reimbursement uncertainties, and variable surgeon adoption rates. Each of these factors presents distinct challenges that manufacturers must navigate to ensure steady growth and innovation.

Supply Chain Disruptions and Raw Material Sourcing

Global supply chain disruptions, heightened by lingering effects from the COVID-19 pandemic and geopolitical tensions, continue to impact the steady flow of essential raw materials—such as titanium alloys and medical-grade polymers—necessary for device manufacturing. Leading manufacturers, including Medtronic and Stryker, have acknowledged ongoing efforts to mitigate risks by diversifying suppliers and investing in local supply chain resilience. However, intermittent shortages and increased costs remain barriers, potentially affecting production timelines and pricing strategies.

Reimbursement and Regulatory Complexity

Obtaining favorable reimbursement for new cervical fixation technologies remains challenging due to evolving payer policies and the need for robust clinical evidence. The reimbursement landscape in 2025 is further complicated by regional differences in healthcare funding and stricter regulatory requirements for demonstrating device safety and efficacy. Zimmer Biomet and DePuy Synthes have cited the necessity of close collaboration with regulatory authorities and payers to streamline approval processes and secure coverage for novel devices, which can delay market entry and limit patient access.

Surgeon Adoption and Training

Surgeon adoption of new cervical fixation devices hinges on several factors: perceived clinical benefit, ease of use, and the availability of comprehensive training programs. Despite ongoing educational initiatives, reluctance to transition from familiar systems to newer technologies persists, particularly among experienced surgeons. Companies such as NuVasive have intensified investments in surgeon training platforms and hands-on workshops to foster confidence and proficiency with advanced fixation systems. Nonetheless, adoption rates vary widely by region and institution, creating an uneven market landscape.

Outlook for 2025 and Beyond

Looking ahead, manufacturers are expected to prioritize digital supply chain management, collaborative reimbursement strategies, and immersive training solutions to address these enduring challenges. While the path is marked by uncertainty, proactive adaptation and partnership with healthcare stakeholders remain essential for advancing cervical vertebrae fixation device innovation and accessibility in the coming years.

Future Outlook: Game-Changers, Industry Roadmap, and Strategic Recommendations

The cervical vertebrae fixation devices manufacturing sector is poised for significant transformation through 2025 and the subsequent years, driven by technological innovations, regulatory adaptations, and evolving clinical demands. As the global population ages and the incidence of degenerative spinal disorders rises, manufacturers are focusing on next-generation materials, smart implant technologies, and streamlined production processes to enhance patient outcomes and maintain competitive advantage.

A major game-changer in the near term is the integration of advanced biomaterials and surface technologies. Companies like Medtronic and Stryker are actively developing fixation systems using titanium alloys, PEEK (polyetheretherketone), and bioactive coatings to improve fusion rates and reduce complications such as device migration and infection. These efforts are complemented by additive manufacturing (3D printing), which allows for complex geometries tailored to individual anatomy, as seen in the personalized cervical cage solutions provided by DePuy Synthes.

Smart implants and intraoperative navigation are expected to gain traction through 2025. Embedded sensors and RFID technologies are under exploration to enable real-time monitoring of fusion progress and device integrity, potentially reducing the need for revision surgeries. Zimmer Biomet is investing in minimally invasive systems coupled with data-driven surgical planning, while Globus Medical is expanding its portfolio to support robotic-assisted fixation procedures.

Strategically, manufacturers are advised to strengthen partnerships with healthcare providers and research institutions to accelerate device validation and regulatory approval, particularly as the U.S. Food and Drug Administration (FDA) and European regulators update their guidelines for spinal implants. Cross-industry collaboration—such as with software developers for surgical navigation platforms—will be essential for staying ahead of evolving clinical requirements.

Looking ahead, the industry roadmap points to greater customization, digital integration, and sustainability. Emphasis on reducing the environmental footprint of production and packaging is emerging, with companies like NuVasive highlighting eco-friendly manufacturing initiatives. Strategic recommendations include ramping up R&D for patient-specific solutions, investing in smart device capabilities, and proactively addressing regulatory and reimbursement landscapes to ensure long-term growth and leadership in cervical vertebrae fixation devices manufacturing.