Graphene Layer Roll-to-Roll Manufacturing in 2025: Unleashing Scalable Production and Market Acceleration. Explore How Advanced Processes Are Shaping the Future of Electronics and Materials Innovation.

- Executive Summary: 2025 Market Outlook and Key Drivers

- Technology Overview: Roll-to-Roll Graphene Layer Manufacturing Explained

- Current Market Size and 2025–2030 Growth Forecasts

- Key Players and Industry Initiatives (e.g., graphene-flagship.eu, firstgraphene.net, directa-plus.com)

- Recent Breakthroughs in Process Efficiency and Quality Control

- Emerging Applications: Electronics, Energy Storage, and Beyond

- Supply Chain and Raw Material Considerations

- Regulatory Landscape and Industry Standards (e.g., graphene-flagship.eu, ieee.org)

- Investment Trends and Strategic Partnerships

- Future Outlook: Market Growth Projections (CAGR 2025–2030 Estimated at 28–35%) and Innovation Roadmap

- Sources & References

Executive Summary: 2025 Market Outlook and Key Drivers

The roll-to-roll (R2R) manufacturing of graphene layers is poised for significant advancements and market expansion in 2025, driven by increasing demand for high-performance materials in electronics, energy storage, and flexible devices. R2R processes, which enable the continuous production of large-area graphene films, are critical for scaling up from laboratory to industrial applications. In 2025, the sector is characterized by a transition from pilot-scale demonstrations to commercial-scale operations, with several key players investing in capacity expansion and process optimization.

Leading companies such as Graphenea and Directa Plus are at the forefront of R2R graphene manufacturing, leveraging chemical vapor deposition (CVD) and other scalable techniques to produce high-quality graphene films. Graphenea, headquartered in Spain, has developed proprietary R2R CVD systems capable of producing continuous graphene sheets suitable for integration into electronic components and sensors. Similarly, Directa Plus in Italy has expanded its production lines to meet growing demand from sectors such as smart textiles and energy storage, emphasizing environmentally friendly and cost-effective processes.

In Asia, companies like Cnano Technology and 2D Carbon (Changzhou) Tech are scaling up R2R graphene production, targeting applications in flexible displays, transparent conductive films, and advanced batteries. These firms are investing in automation and quality control to ensure consistent product performance, a key requirement for adoption in consumer electronics and automotive industries.

The 2025 outlook is shaped by several key drivers:

- Rising demand for flexible and wearable electronics, where R2R graphene films offer superior conductivity and mechanical flexibility.

- Growth in electric vehicle (EV) and energy storage markets, with graphene-enhanced electrodes and supercapacitors benefiting from scalable R2R production.

- Ongoing improvements in process yield, throughput, and cost reduction, making graphene films more competitive with incumbent materials.

- Increased collaboration between material suppliers and end-users to tailor graphene properties for specific industrial needs.

Despite these positive trends, challenges remain in achieving uniformity, defect control, and integration with existing manufacturing lines. However, with continued investment and technical progress, the R2R graphene layer manufacturing sector is expected to see robust growth and broader commercialization through 2025 and beyond, positioning it as a cornerstone technology for next-generation electronics and energy solutions.

Technology Overview: Roll-to-Roll Graphene Layer Manufacturing Explained

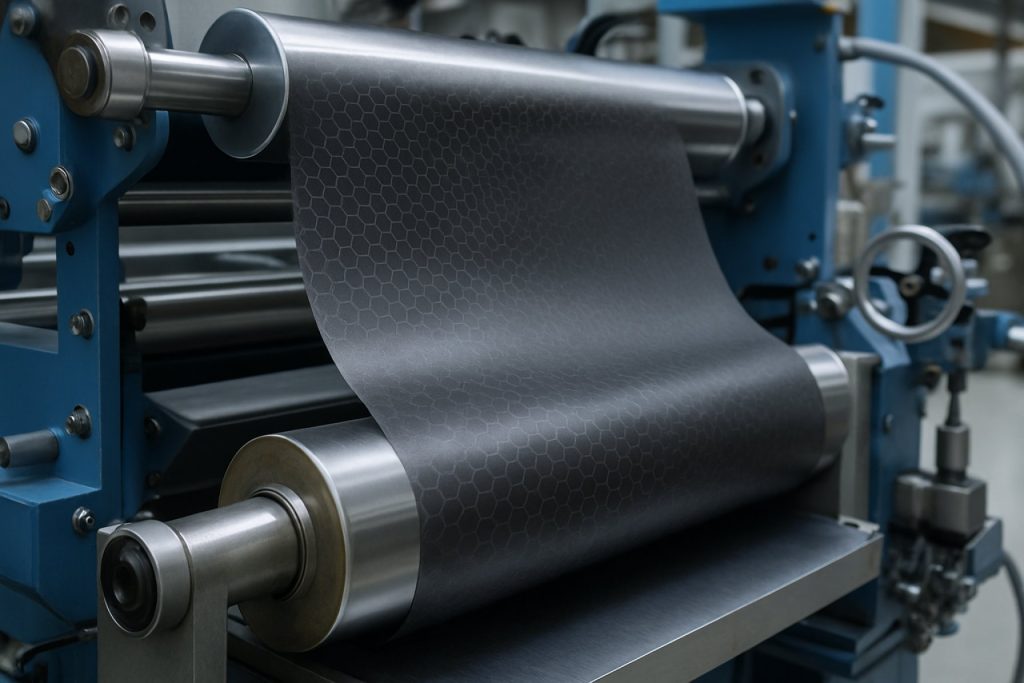

Roll-to-roll (R2R) manufacturing is a continuous process that enables the large-scale production of thin films and coatings by transferring materials onto flexible substrates as they move through rollers. In the context of graphene, R2R technology is pivotal for scaling up the fabrication of high-quality, large-area graphene layers, which are essential for commercial applications in electronics, energy storage, and advanced composites.

The R2R process for graphene typically involves chemical vapor deposition (CVD) of graphene onto metal foils (commonly copper or nickel), followed by transfer onto target substrates such as polymers. This method allows for the production of graphene films with controlled thickness, uniformity, and high electrical conductivity. The process can be integrated with other steps, such as etching and lamination, to streamline manufacturing and reduce costs.

As of 2025, several industry leaders are advancing R2R graphene manufacturing. Graphenea, a prominent European graphene producer, has developed R2R CVD systems capable of producing meter-scale graphene films, focusing on both research and industrial supply. Versarien plc, based in the UK, is also investing in R2R technologies to support the commercialization of graphene-enhanced products, particularly in the electronics and composites sectors. In Asia, Cnano Technology and Haydale Graphene Industries are notable for their efforts in scaling up graphene production using R2R methods, targeting applications in flexible electronics and energy devices.

Recent advancements have focused on improving the quality and scalability of R2R graphene. For example, innovations in CVD reactor design and substrate handling have enabled the production of continuous graphene films with fewer defects and higher uniformity. Automation and in-line quality control systems are being integrated to ensure consistent product standards, which is critical for adoption in high-performance applications such as transparent conductive films and next-generation sensors.

Looking ahead to the next few years, the outlook for R2R graphene manufacturing is promising. Industry analysts and manufacturers anticipate further reductions in production costs and improvements in throughput, driven by process optimization and increased demand from sectors such as flexible displays, wearable electronics, and advanced batteries. Companies are also exploring hybrid R2R processes that combine graphene with other 2D materials to create multifunctional films, broadening the scope of potential applications.

- R2R CVD remains the dominant method for high-quality, large-area graphene film production.

- Key players like Graphenea, Versarien plc, Cnano Technology, and Haydale Graphene Industries are driving industrial adoption.

- Ongoing innovations are expected to enhance scalability, reduce costs, and expand application areas through 2025 and beyond.

Current Market Size and 2025–2030 Growth Forecasts

The global market for graphene layer roll-to-roll (R2R) manufacturing is entering a pivotal growth phase as of 2025, driven by increasing demand for scalable, high-quality graphene films in electronics, energy storage, and advanced composites. The R2R process, which enables continuous production of large-area graphene sheets, is seen as a key enabler for commercializing graphene-based products at industrial scale.

As of early 2025, the market size for R2R-manufactured graphene films is estimated to be in the low hundreds of millions of US dollars, with the majority of commercial activity concentrated in Asia, particularly South Korea, China, and Japan. Leading companies such as Samsung SDI and LG Chem have invested in pilot and pre-commercial R2R graphene production lines, targeting applications in flexible displays, transparent electrodes, and next-generation batteries. In China, Changhae Graphene and The Sixth Element (Changzhou) Materials Technology are scaling up R2R graphene film production, supplying both domestic and international customers.

European players are also active, with Graphenea and Directa Plus developing R2R-compatible graphene materials for electronics and filtration. These companies are collaborating with industrial partners to integrate R2R graphene into commercial products, signaling a shift from laboratory-scale to industrial-scale manufacturing.

From 2025 to 2030, the R2R graphene market is projected to grow at a compound annual growth rate (CAGR) exceeding 20%, fueled by the adoption of graphene in flexible electronics, smart packaging, and energy devices. The expansion of R2R capacity is expected to lower production costs and improve film uniformity, making graphene more accessible for mass-market applications. Industry roadmaps from organizations such as the Graphene Flagship anticipate that by 2030, R2R-manufactured graphene films will be a standard material in several high-volume sectors, including wearables, automotive sensors, and advanced batteries.

- Asia-Pacific will remain the largest and fastest-growing region, with China and South Korea leading in both capacity and end-use integration.

- Strategic partnerships between material producers and device manufacturers are expected to accelerate commercialization.

- Ongoing improvements in R2R process control and quality assurance will be critical for meeting the stringent requirements of electronics and energy storage markets.

Overall, the next five years will be crucial for establishing R2R graphene manufacturing as a backbone technology for the emerging graphene economy, with significant market expansion anticipated as technical and economic barriers are overcome.

Key Players and Industry Initiatives (e.g., graphene-flagship.eu, firstgraphene.net, directa-plus.com)

The roll-to-roll (R2R) manufacturing of graphene layers is a pivotal technology for scaling up graphene production and enabling its integration into commercial products. As of 2025, several key players and industry initiatives are driving advancements in this field, focusing on improving throughput, quality, and cost-effectiveness of graphene films for applications in electronics, energy storage, and composites.

One of the most prominent collaborative efforts is the Graphene Flagship, a European Union-funded initiative that unites over 170 academic and industrial partners. The Flagship has prioritized R2R processes, supporting pilot lines and demonstrators for continuous graphene film production. Their work has led to the development of scalable chemical vapor deposition (CVD) techniques and transfer processes, with several partners now operating pilot-scale R2R systems capable of producing meter-scale graphene films suitable for flexible electronics and sensors.

In the commercial sector, First Graphene Limited (Australia) is notable for its focus on high-quality graphene materials and process innovation. While primarily known for bulk graphene production, the company has invested in R2R-compatible technologies and collaborates with equipment manufacturers to optimize continuous graphene film synthesis and integration into industrial workflows. Their efforts are aimed at supplying graphene for advanced composites and energy storage devices, with pilot projects underway to validate R2R scalability.

Another significant player is Directa Plus S.p.A. (Italy), which specializes in environmentally sustainable graphene production. Directa Plus has developed proprietary R2R processes for producing graphene nanoplatelets and films, targeting applications in textiles, filtration, and smart materials. The company operates industrial-scale facilities and has announced partnerships with manufacturers to integrate R2R graphene films into commercial products, with a focus on quality control and environmental compliance.

Beyond these, several equipment and material suppliers are entering the R2R graphene space. Companies such as Graphenea (Spain) have expanded their offerings to include CVD-grown graphene films on flexible substrates, supporting R2R transfer and patterning. These developments are complemented by collaborations with electronics and battery manufacturers, aiming to accelerate the adoption of R2R graphene in next-generation devices.

Looking ahead, the outlook for R2R graphene manufacturing is promising. Industry initiatives are expected to further reduce production costs and improve film uniformity, with pilot lines transitioning to full-scale commercial operations by 2026–2027. The continued involvement of major players and the emergence of new entrants signal robust growth, with R2R processes poised to become the backbone of large-area graphene applications in the coming years.

Recent Breakthroughs in Process Efficiency and Quality Control

The roll-to-roll (R2R) manufacturing of graphene layers has seen significant advancements in process efficiency and quality control as of 2025, driven by the demand for scalable, cost-effective production methods for electronics, energy storage, and advanced composites. R2R techniques, which enable the continuous production of large-area graphene films, are now being refined to address longstanding challenges such as uniformity, defect minimization, and integration with downstream processes.

One of the most notable breakthroughs has been the optimization of chemical vapor deposition (CVD) processes on metal foils, particularly copper, which remains the substrate of choice for high-quality monolayer graphene. Companies like Graphenea and Versarien have reported substantial improvements in the control of gas flow dynamics, temperature gradients, and precursor delivery, resulting in more consistent graphene thickness and fewer grain boundaries. These refinements have enabled the production of continuous graphene films exceeding meter-scale lengths, with sheet resistances and carrier mobilities approaching those of exfoliated graphene.

In parallel, inline quality control systems have become increasingly sophisticated. The integration of real-time Raman spectroscopy and optical inspection tools directly into R2R lines allows for immediate detection of defects, layer number, and uniformity. Graphene Platform Corporation and First Graphene have both implemented such monitoring systems, which not only reduce waste but also provide valuable data for process optimization. These systems are now capable of mapping the entire width of the graphene web at high speeds, ensuring that only material meeting strict specifications advances to subsequent processing steps.

Another area of progress is the development of transfer-free R2R processes, where graphene is directly synthesized on target substrates, eliminating the need for complex and often yield-limiting transfer steps. Samsung Electronics has demonstrated pilot-scale lines capable of direct graphene growth on flexible polymer substrates, a key enabler for next-generation flexible electronics and transparent conductive films.

Looking ahead, the industry is focused on further automating R2R lines, integrating machine learning algorithms for predictive maintenance and adaptive process control. The outlook for 2025 and beyond suggests that as these technologies mature, the cost per square meter of high-quality graphene will continue to fall, opening new markets in energy, sensors, and optoelectronics. The ongoing collaboration between equipment manufacturers, material suppliers, and end-users is expected to accelerate the commercialization of R2R graphene, with several large-scale facilities slated for commissioning in the next few years.

Emerging Applications: Electronics, Energy Storage, and Beyond

Roll-to-roll (R2R) manufacturing of graphene layers is rapidly advancing as a cornerstone technology for scaling up the production of high-quality graphene films, crucial for emerging applications in electronics, energy storage, and other sectors. As of 2025, the industry is witnessing a transition from laboratory-scale demonstrations to commercial-scale R2R systems, driven by the demand for cost-effective, large-area, and uniform graphene sheets.

The R2R process typically involves the continuous deposition or transfer of graphene onto flexible substrates, such as polymers or metal foils, enabling high-throughput production. Chemical vapor deposition (CVD) remains the dominant method for synthesizing graphene in R2R setups, with copper foils commonly used as catalytic substrates. Companies like Graphenea and Directa Plus are at the forefront, developing proprietary R2R CVD processes to produce monolayer and few-layer graphene films with controlled thickness and minimal defects.

In 2025, several manufacturers are scaling up their R2R lines to meet the growing needs of the flexible electronics and energy storage markets. Graphene Platform Corporation has announced the expansion of its R2R graphene film production, targeting applications such as transparent conductive electrodes for touchscreens, OLEDs, and solar cells. Similarly, Versarien plc is investing in R2R capabilities to supply graphene-enhanced materials for batteries and supercapacitors, aiming to improve energy density and charge/discharge rates.

A key technical challenge remains the transfer of high-quality graphene from metal foils to target substrates without introducing contamination or wrinkles. To address this, companies are developing automated, dry-transfer R2R systems and exploring direct growth on dielectric substrates. Samsung Electronics has reported progress in integrating R2R graphene films into flexible display prototypes, leveraging their expertise in large-area electronics manufacturing.

Looking ahead, the outlook for R2R graphene manufacturing is promising. Industry analysts expect further improvements in throughput, yield, and cost reduction over the next few years, making graphene films increasingly competitive with traditional materials like indium tin oxide (ITO). The convergence of R2R graphene with printed electronics and advanced battery technologies is anticipated to unlock new product categories, from foldable devices to high-performance energy storage systems. As more companies invest in R2R infrastructure and process optimization, the commercialization of graphene-enabled products is set to accelerate through 2025 and beyond.

Supply Chain and Raw Material Considerations

The roll-to-roll (R2R) manufacturing of graphene layers is rapidly evolving, with significant implications for the supply chain and raw material sourcing as the industry moves through 2025 and into the latter part of the decade. R2R processes, which enable the continuous production of large-area graphene films, are seen as a key enabler for scaling up applications in flexible electronics, energy storage, and advanced composites.

A central supply chain consideration is the availability and quality of graphite feedstock, which is the primary raw material for most chemical vapor deposition (CVD) and liquid-phase exfoliation methods used in R2R graphene production. Leading graphite suppliers are increasingly partnering with graphene manufacturers to ensure consistent quality and traceability. For example, NOVONIX Limited and SGL Carbon are notable for their efforts in providing high-purity graphite tailored for advanced material applications, including graphene synthesis.

On the manufacturing side, companies such as Graphenea and Directa Plus are actively scaling up R2R graphene production lines. Graphenea has invested in pilot-scale R2R CVD systems, focusing on uniformity and reproducibility of monolayer and few-layer graphene films. Meanwhile, Directa Plus leverages its proprietary processes to supply graphene materials for textiles and environmental applications, emphasizing supply chain integration from raw graphite to finished product.

A key challenge in 2025 is the standardization of graphene quality metrics across the supply chain. Industry bodies such as the Graphene Flagship are working with manufacturers to develop common standards for layer number, defect density, and sheet resistance, which are critical for downstream integration in electronics and energy devices. This standardization is expected to facilitate broader adoption and reduce qualification times for end users.

Looking ahead, the outlook for R2R graphene manufacturing supply chains is shaped by both technological and geopolitical factors. The push for regionalized supply chains—especially in Europe and North America—aims to reduce reliance on Asian graphite sources and mitigate potential disruptions. Companies are also exploring alternative carbon sources, such as bio-derived precursors, to enhance sustainability and security of supply.

In summary, as R2R graphene manufacturing matures through 2025 and beyond, supply chain strategies will increasingly focus on raw material quality, process integration, and standardization. The efforts of established suppliers and manufacturers, alongside industry consortia, are expected to underpin the reliable scaling of graphene technologies for commercial applications.

Regulatory Landscape and Industry Standards (e.g., graphene-flagship.eu, ieee.org)

The regulatory landscape and industry standards for graphene layer roll-to-roll (R2R) manufacturing are rapidly evolving as the technology matures and approaches broader commercialization. In 2025, the focus is on harmonizing quality benchmarks, safety protocols, and environmental guidelines to support the scale-up of graphene production and integration into end-use applications.

A central player in shaping the European regulatory framework is the Graphene Flagship, a large-scale research initiative funded by the European Union. The Flagship has been instrumental in developing best practices for graphene production, including R2R methods, and in coordinating standardization efforts with international bodies. Their work includes the publication of technical guidelines and the facilitation of cross-industry dialogue to ensure that R2R-produced graphene meets the requirements for electronics, energy storage, and composite materials.

On the global stage, organizations such as the IEEE are actively developing standards for graphene materials and processes. The IEEE P3076 working group, for example, is focused on standardizing the characterization and measurement of graphene films, which is directly relevant to R2R manufacturing. These standards are expected to be increasingly referenced by manufacturers and regulatory agencies in 2025 and beyond, providing a common language for quality assurance and interoperability.

Industry consortia and manufacturers are also contributing to the regulatory landscape. Companies like Graphenea and Directa Plus are participating in collaborative projects and pilot lines to demonstrate compliance with emerging standards and to provide feedback on practical implementation. These efforts are crucial for addressing challenges such as batch-to-batch consistency, traceability, and the safe handling of nanomaterials in high-throughput R2R environments.

Environmental and occupational health regulations are gaining prominence as R2R graphene production scales up. The European Chemicals Agency (ECHA) and similar bodies are monitoring the potential risks associated with nanoparticle release and worker exposure, prompting the development of specific guidelines for R2R processes. Manufacturers are expected to adopt advanced filtration, monitoring, and waste management systems to comply with these evolving requirements.

Looking ahead, the next few years will likely see the formalization of international standards for R2R graphene manufacturing, driven by ongoing collaboration between industry, academia, and regulatory agencies. This will facilitate market entry for new products, support cross-border trade, and ensure that the benefits of graphene technologies are realized safely and sustainably.

Investment Trends and Strategic Partnerships

The landscape of investment and strategic partnerships in graphene layer roll-to-roll (R2R) manufacturing is rapidly evolving as the technology matures and commercial applications expand. In 2025, significant capital inflows and collaborative ventures are shaping the sector, driven by the demand for scalable, cost-effective production of high-quality graphene films for electronics, energy storage, and advanced composites.

Key industry players are attracting substantial investments to scale up R2R manufacturing capabilities. Graphenea, a leading European graphene producer, has continued to secure funding for expanding its R2R chemical vapor deposition (CVD) lines, aiming to meet the growing needs of flexible electronics and sensor markets. Similarly, Directa Plus, headquartered in Italy, has announced new investment rounds in 2024-2025 to enhance its production infrastructure, focusing on large-area graphene films for industrial and environmental applications.

Strategic partnerships are also central to accelerating commercialization. Samsung Electronics has deepened its collaboration with materials suppliers and research institutes to integrate R2R graphene films into next-generation display and battery technologies. In Asia, Cnano Technology is working with electronics manufacturers to develop R2R processes tailored for transparent conductive films, leveraging its expertise in nanomaterials and large-scale production.

In North America, Novusterrae (formerly G6 Materials) is advancing pilot-scale R2R graphene production, supported by partnerships with energy storage and aerospace companies. These collaborations are designed to validate the performance of R2R graphene in real-world applications and to secure long-term supply agreements.

Government-backed initiatives are further catalyzing investment. The European Union’s ongoing support for graphene commercialization through the Graphene Flagship program continues to foster cross-border partnerships, with a focus on scaling R2R manufacturing for industrial adoption. In China, state-backed funding is accelerating the deployment of R2R graphene lines, with several regional innovation hubs supporting joint ventures between academia and industry.

Looking ahead, the outlook for 2025 and beyond suggests continued momentum in both private and public investment, with a strong emphasis on strategic alliances that bridge the gap between laboratory-scale innovation and mass-market production. As R2R manufacturing technologies mature, the sector is expected to see further consolidation, with leading companies forming joint ventures and licensing agreements to accelerate global market penetration and standardization of graphene layer products.

Future Outlook: Market Growth Projections (CAGR 2025–2030 Estimated at 28–35%) and Innovation Roadmap

The roll-to-roll (R2R) manufacturing of graphene layers is poised for significant expansion between 2025 and 2030, with industry consensus projecting a compound annual growth rate (CAGR) in the range of 28–35%. This rapid growth is underpinned by increasing demand for high-quality, large-area graphene films in applications such as flexible electronics, energy storage, and advanced coatings. The R2R process, which enables continuous production of graphene sheets on flexible substrates, is seen as a critical enabler for scaling up graphene commercialization and reducing production costs.

Key industry players are investing heavily in R2R technology. Graphenea, a leading European graphene producer, has developed pilot-scale R2R systems capable of producing meter-scale graphene films, targeting both research and industrial customers. Similarly, Directa Plus in Italy is expanding its R2R capabilities to supply graphene materials for textiles, composites, and environmental applications. In Asia, Cnano Technology and 2D Carbon (Changzhou) Tech are scaling up R2R chemical vapor deposition (CVD) lines, aiming to serve the growing demand from the electronics and battery sectors.

Recent technical milestones include the integration of in-line quality control systems, such as Raman spectroscopy and optical inspection, which are essential for ensuring uniformity and defect-free graphene films at industrial speeds. Companies are also focusing on substrate versatility, with R2R processes now compatible with copper, PET, and other flexible substrates, broadening the range of end-use applications. For example, Graphene Platform Corporation in Japan has demonstrated continuous graphene transfer onto polymer films, a key step for flexible display and sensor markets.

Looking ahead, the innovation roadmap for R2R graphene manufacturing centers on three main areas: (1) further scaling of production widths and speeds to meet industrial throughput requirements; (2) development of multi-layer and heterostructure capabilities for advanced device architectures; and (3) integration with downstream processing, such as direct patterning and lamination, to enable seamless device fabrication. Industry collaborations and public-private partnerships are expected to accelerate these advances, with several pilot lines and demonstration plants scheduled to come online by 2026–2027.

Overall, the next five years will likely see R2R graphene manufacturing transition from pilot to full-scale commercial production, driven by both technological innovation and expanding market pull. As costs decrease and quality improves, R2R graphene is set to become a foundational material for next-generation electronics, energy, and smart materials.