Organ-on-a-Chip Engineering in 2025: Transforming Drug Discovery and Personalized Medicine. Explore the Next 5 Years of Rapid Innovation, Market Expansion, and Real-World Impact.

- Executive Summary: 2025 Market Outlook and Key Drivers

- Technology Landscape: Core Platforms and Innovations

- Leading Companies and Industry Collaborations

- Market Size, Segmentation, and 2025–2030 Growth Forecasts

- Applications in Drug Discovery, Toxicology, and Disease Modeling

- Integration with AI, Automation, and Data Analytics

- Regulatory Landscape and Standardization Initiatives

- Challenges: Scalability, Reproducibility, and Commercialization

- Emerging Trends: Multi-Organ Chips and Personalized Models

- Future Outlook: Strategic Opportunities and Industry Roadmap

- Sources & References

Executive Summary: 2025 Market Outlook and Key Drivers

The organ-on-a-chip (OoC) engineering sector is poised for significant growth in 2025, driven by increasing demand for more predictive, human-relevant preclinical models in drug discovery, toxicology, and disease research. As pharmaceutical R&D costs escalate and regulatory agencies emphasize alternatives to animal testing, OoC platforms are gaining traction as transformative tools for both industry and academia. The year 2025 is expected to see accelerated adoption, with key drivers including technological advancements, regulatory momentum, and expanding industry partnerships.

Major players such as Emulate, Inc., MIMETAS, and TissUse GmbH continue to lead the market, offering a range of microfluidic-based chips that replicate the physiological and mechanical functions of human organs. Emulate, Inc. has expanded its portfolio to include liver, lung, intestine, and kidney chips, and is collaborating with pharmaceutical companies to integrate these platforms into drug development pipelines. MIMETAS is recognized for its OrganoPlate® platform, which enables high-throughput screening and complex tissue modeling, while TissUse GmbH focuses on multi-organ chips that simulate systemic interactions, a key step toward whole-body-on-a-chip systems.

In 2025, regulatory agencies are expected to further support OoC adoption. The U.S. Food and Drug Administration (FDA) has already initiated collaborations with industry leaders to evaluate OoC models for safety and efficacy testing, signaling a shift toward regulatory acceptance. The European Medicines Agency (EMA) and other international bodies are also exploring guidelines for integrating OoC data into regulatory submissions, which could accelerate market uptake.

The market outlook for 2025 is characterized by robust investment and strategic partnerships. Pharmaceutical and biotechnology companies are increasingly partnering with OoC developers to co-develop disease models and validate drug candidates, reducing reliance on animal models and improving translational relevance. Additionally, the emergence of new entrants and academic spin-offs is fostering innovation, particularly in areas such as personalized medicine and rare disease modeling.

Looking ahead, the next few years are expected to bring further miniaturization, automation, and integration of artificial intelligence into OoC platforms, enhancing data analysis and predictive power. As the technology matures and regulatory frameworks evolve, organ-on-a-chip engineering is set to become a cornerstone of preclinical research and precision medicine, with broad implications for drug development, safety assessment, and healthcare innovation.

Technology Landscape: Core Platforms and Innovations

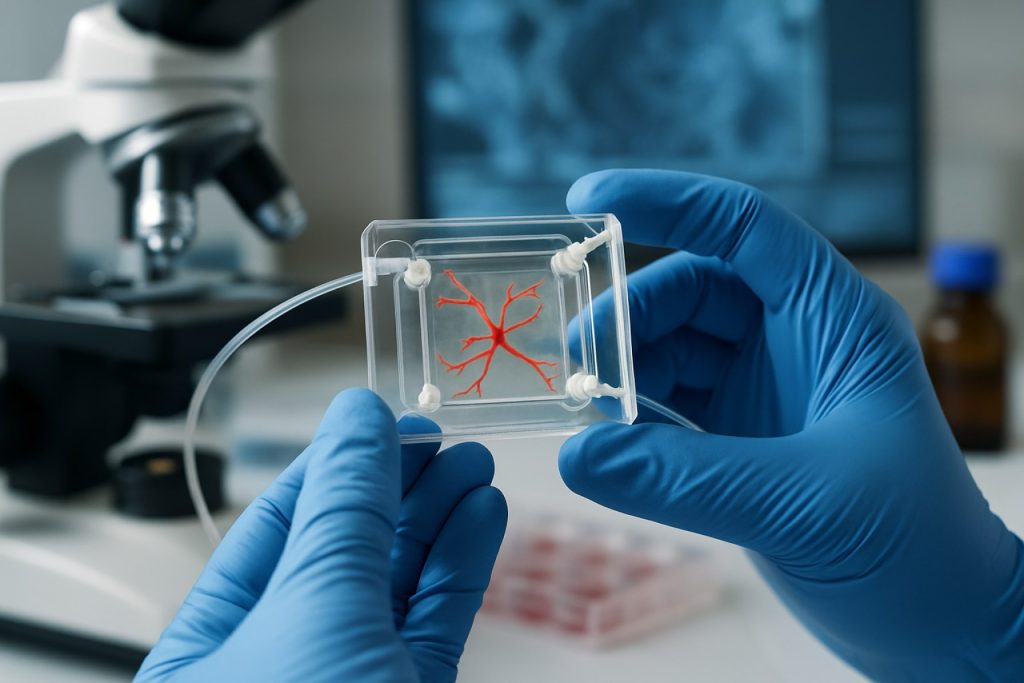

Organ-on-a-chip (OoC) engineering is rapidly transforming preclinical research and drug development by providing physiologically relevant microenvironments that mimic human organ functions. As of 2025, the technology landscape is characterized by a convergence of microfluidics, advanced biomaterials, and integrated sensing, with a focus on scalability, reproducibility, and regulatory acceptance.

The core platforms in OoC engineering are dominated by microfluidic devices fabricated from materials such as polydimethylsiloxane (PDMS), thermoplastics, and, increasingly, biocompatible hydrogels. These platforms enable the recreation of tissue-tissue interfaces, dynamic flow conditions, and mechanical cues essential for organ-level function. Companies like Emulate, Inc. have established themselves as leaders, offering a suite of commercialized chips for liver, lung, intestine, and kidney models. Their systems integrate automated fluid handling and real-time monitoring, supporting both academic and pharmaceutical partners in toxicity testing and disease modeling.

Another key player, MIMETAS, has advanced the field with its OrganoPlate® platform, which leverages a 3D microfluidic approach to culture organoids and tissues in a high-throughput format. This technology is particularly valued for its scalability and compatibility with standard laboratory automation, making it attractive for large-scale drug screening. CN Bio has also contributed significantly, focusing on multi-organ systems and metabolic disease models, and collaborating with regulatory agencies to align their platforms with evolving guidelines for non-animal testing.

Recent innovations include the integration of biosensors for real-time readouts of physiological parameters such as oxygen, pH, and metabolic activity. Companies like TissUse are pioneering multi-organ-on-a-chip systems, enabling the study of inter-organ interactions and systemic responses to drugs. The push towards standardized, modular platforms is evident, with several manufacturers working on interoperable chips and open-source designs to facilitate broader adoption and data comparability.

Looking ahead, the next few years are expected to see further miniaturization, increased automation, and the incorporation of patient-derived cells for personalized medicine applications. Regulatory engagement is intensifying, with organizations such as the FDA and EMA collaborating with industry to define validation pathways. As the technology matures, the focus will shift from proof-of-concept studies to robust, validated platforms that can be integrated into mainstream drug development pipelines, potentially reducing reliance on animal models and accelerating the path to clinical trials.

Leading Companies and Industry Collaborations

The organ-on-a-chip (OoC) sector in 2025 is characterized by rapid technological advancements and a growing ecosystem of leading companies and strategic collaborations. These efforts are driving the adoption of microphysiological systems in drug discovery, toxicology, and disease modeling, with a focus on improving predictive accuracy and reducing reliance on animal testing.

Among the most prominent players, Emulate, Inc. continues to be a pioneer, offering a suite of organ-on-a-chip platforms that replicate human biology with high fidelity. Emulate’s technology is widely adopted by pharmaceutical companies and regulatory agencies for preclinical testing, and the company has established collaborations with major industry stakeholders to expand the application of its chips to new organ systems and disease models.

Another key innovator, MIMETAS, is recognized for its OrganoPlate® platform, which enables high-throughput screening and complex tissue modeling. MIMETAS has formed partnerships with global pharmaceutical firms to integrate its technology into drug development pipelines, and its chips are increasingly used for personalized medicine applications.

In Europe, TissUse GmbH stands out for its multi-organ-chip systems, which allow for the simulation of systemic interactions between different human tissues. TissUse collaborates with both academic and industrial partners to develop advanced models for ADME (absorption, distribution, metabolism, and excretion) studies and disease research.

The sector is also witnessing the entry of established life sciences companies. Thermo Fisher Scientific and Corning Incorporated have expanded their portfolios to include organ-on-a-chip consumables and instrumentation, leveraging their global distribution networks to accelerate market adoption. These companies are investing in R&D and forming alliances with startups to co-develop next-generation platforms.

Industry-wide collaborations are further catalyzing progress. The National Center for Advancing Translational Sciences (NCATS) in the United States continues to support public-private partnerships aimed at standardizing OoC technologies and validating their use for regulatory submissions. In 2025, several consortia involving pharmaceutical companies, device manufacturers, and regulatory bodies are working to establish best practices and interoperability standards.

Looking ahead, the next few years are expected to see deeper integration of artificial intelligence and automation in organ-on-a-chip workflows, as well as expanded collaborations between technology providers and end-users. These developments are poised to further enhance the predictive power and scalability of OoC systems, solidifying their role in the future of biomedical research and drug development.

Market Size, Segmentation, and 2025–2030 Growth Forecasts

The organ-on-a-chip (OoC) engineering sector is poised for robust growth between 2025 and 2030, driven by increasing demand for physiologically relevant in vitro models in drug discovery, toxicology, and disease modeling. The market is segmented by organ type (lung, liver, heart, kidney, gut, and multi-organ systems), application (pharmaceutical R&D, personalized medicine, academic research, and cosmetics testing), and end-user (pharmaceutical and biotechnology companies, academic and research institutes, and regulatory bodies).

As of 2025, the global OoC market is estimated to be in the low hundreds of millions of USD, with North America and Europe leading in adoption due to strong pharmaceutical and biotechnology sectors, as well as supportive regulatory environments. The Asia-Pacific region is expected to see accelerated growth, particularly in China, Japan, and South Korea, as local companies and research institutes increase investment in advanced biomedical technologies.

Key players in the market include Emulate, Inc., a pioneer in commercializing organ-on-a-chip platforms for pharmaceutical and academic partners, and MIMETAS, which specializes in high-throughput organ-on-a-chip systems for drug screening and disease modeling. CN Bio is notable for its focus on liver and multi-organ models, while TissUse is recognized for its multi-organ chip technology enabling systemic studies. Other significant contributors include Nortis and AxoSim, both of which have developed specialized platforms for kidney and neural tissue modeling, respectively.

Market segmentation is evolving rapidly, with multi-organ and disease-specific chips gaining traction. Pharmaceutical R&D remains the dominant application, as companies seek to reduce late-stage drug attrition and reliance on animal models. For example, Emulate, Inc. has established collaborations with major pharmaceutical firms to integrate OoC platforms into preclinical workflows. Cosmetics and chemical safety testing are also emerging segments, particularly in regions with stringent animal testing bans.

Looking ahead to 2030, the OoC market is projected to experience double-digit compound annual growth rates (CAGR), fueled by technological advances in microfluidics, automation, and integration with artificial intelligence for data analysis. The development of standardized, regulatory-accepted platforms is expected to further accelerate adoption, with organizations such as the U.S. Food and Drug Administration and the European Medicines Agency actively evaluating OoC technologies for regulatory science and safety assessment. As the field matures, the convergence of organ-on-a-chip with personalized medicine and biomanufacturing is anticipated to unlock new market opportunities and drive sustained growth through 2030.

Applications in Drug Discovery, Toxicology, and Disease Modeling

Organ-on-a-chip (OoC) engineering is rapidly transforming the landscape of drug discovery, toxicology, and disease modeling, with 2025 marking a pivotal year for both technological maturation and commercial adoption. These microfluidic devices, which recapitulate the physiological functions of human organs, are increasingly recognized as powerful alternatives to traditional cell culture and animal models, offering enhanced predictive accuracy and ethical advantages.

In drug discovery, OoC platforms are being integrated into preclinical pipelines to assess pharmacokinetics, efficacy, and safety profiles of new compounds. Leading companies such as Emulate, Inc. and MIMETAS have developed multi-organ and organ-specific chips that allow for high-throughput screening and real-time monitoring of drug responses. For example, Emulate, Inc. has partnered with major pharmaceutical firms to deploy its Liver-Chip and Kidney-Chip systems, which have demonstrated improved prediction of drug-induced liver injury and nephrotoxicity compared to conventional models. Similarly, MIMETAS’s OrganoPlate platform supports parallel testing of hundreds of compounds, accelerating lead optimization and reducing late-stage attrition.

Toxicology testing is another area where OoC technology is gaining traction. Regulatory agencies and industry stakeholders are increasingly interested in adopting these systems to reduce reliance on animal testing and improve human relevance. CN Bio has advanced its PhysioMimix platform, which enables long-term culture and repeated dosing studies, providing more accurate toxicity data for chronic exposure scenarios. The U.S. Food and Drug Administration (FDA) has initiated collaborations with several OoC developers to evaluate the regulatory acceptance of these models, signaling a shift toward broader validation and standardization efforts in the coming years.

Disease modeling using OoC devices is also expanding, with applications ranging from oncology to neurodegenerative and infectious diseases. Companies like TissUse are pioneering multi-organ chips that simulate complex disease states and inter-organ interactions, enabling researchers to study disease progression and therapeutic interventions in a controlled, human-relevant context. The COVID-19 pandemic accelerated interest in lung- and vascular-on-chip models, and ongoing work in 2025 is extending these approaches to model rare and chronic diseases.

Looking ahead, the next few years are expected to see increased integration of OoC platforms with artificial intelligence and advanced imaging, further enhancing data richness and predictive power. As industry leaders such as Emulate, Inc., MIMETAS, CN Bio, and TissUse continue to expand their product portfolios and partnerships, organ-on-a-chip engineering is poised to become a cornerstone of translational research and precision medicine.

Integration with AI, Automation, and Data Analytics

The integration of artificial intelligence (AI), automation, and advanced data analytics is rapidly transforming the field of organ-on-a-chip (OoC) engineering in 2025, with significant implications for drug discovery, toxicology, and personalized medicine. As OoC platforms generate increasingly complex and high-dimensional datasets—ranging from real-time imaging to multi-omics readouts—AI-driven tools are becoming essential for extracting actionable insights and optimizing experimental workflows.

Leading OoC manufacturers are actively embedding AI and automation into their platforms. Emulate, Inc., a pioneer in the sector, has developed automated systems for fluidic control and sample handling, enabling high-throughput screening and standardized data collection. Their platforms are designed to interface with machine learning algorithms that can identify subtle phenotypic changes and predict compound toxicity or efficacy, accelerating preclinical decision-making. Similarly, MIMETAS integrates automated liquid handling and imaging with their OrganoPlate® technology, supporting large-scale, reproducible experiments and facilitating the application of AI-based image analysis for quantifying cellular responses.

Data analytics platforms are also being tailored specifically for OoC applications. CN Bio has introduced cloud-based data management solutions that aggregate and harmonize data from multi-organ systems, supporting advanced analytics and remote collaboration. These systems are increasingly leveraging AI to model organ interactions, predict pharmacokinetics, and simulate disease progression, providing a more holistic understanding of human biology in vitro.

Automation is further streamlining OoC workflows, reducing manual intervention and variability. Companies such as TissUse GmbH are developing multi-organ chip platforms with integrated robotics for media exchange, sampling, and environmental control, paving the way for fully automated, end-to-end experimental pipelines. This level of automation is crucial for scaling up OoC studies to meet the demands of pharmaceutical and biotechnology partners.

Looking ahead, the convergence of AI, automation, and data analytics is expected to drive the next wave of innovation in OoC engineering. The focus is shifting toward real-time, closed-loop systems where AI algorithms dynamically adjust experimental parameters based on live data, optimizing tissue responses and experimental outcomes. As regulatory agencies increasingly recognize the value of AI-enhanced OoC data, these integrated platforms are poised to play a central role in preclinical research, safety assessment, and the development of personalized therapeutics over the next several years.

Regulatory Landscape and Standardization Initiatives

The regulatory landscape for organ-on-a-chip (OoC) engineering is rapidly evolving as these microphysiological systems gain traction in drug development, toxicity testing, and disease modeling. In 2025, regulatory agencies and industry consortia are intensifying efforts to establish clear pathways for the qualification, validation, and standardization of OoC technologies, recognizing their potential to reduce reliance on animal models and improve translational relevance.

A pivotal development is the ongoing collaboration between the U.S. Food and Drug Administration (FDA) and leading OoC developers. The FDA’s Emerging Sciences Working Group has been actively engaging with companies such as Emulate, Inc. and MIMETAS to evaluate the use of organ-on-a-chip platforms in regulatory submissions. In 2024, the FDA announced a pilot program to assess the utility of OoC data in preclinical safety assessments, with results expected to inform future guidance documents in 2025 and beyond. This initiative is expected to accelerate the integration of OoC data into Investigational New Drug (IND) applications and other regulatory filings.

In Europe, the European Medicines Agency (EMA) and the European Union Reference Laboratory for alternatives to animal testing (EURL ECVAM) are supporting standardization efforts through multi-stakeholder consortia. The Joint Research Centre (JRC) is coordinating projects to define performance standards and reference materials for OoC systems, aiming to harmonize validation procedures across member states. These efforts are complemented by the activities of the European Organ-on-Chip Society (EUROoCS), which is developing best practice guidelines and facilitating data sharing among academic, industrial, and regulatory stakeholders.

Industry-driven standardization is also gaining momentum. Emulate, Inc. and MIMETAS are collaborating with pharmaceutical partners to establish reproducibility benchmarks and quality control metrics for their platforms. Meanwhile, TissUse GmbH is participating in international working groups to define interoperability standards, ensuring that OoC devices from different manufacturers can be integrated into automated workflows.

Looking ahead, the next few years are expected to see the publication of formal regulatory guidance documents and the adoption of international standards for organ-on-a-chip systems. The International Organization for Standardization (ISO) and the American Society for Testing and Materials (ASTM) are both developing technical standards for microphysiological systems, with draft documents anticipated by 2026. These initiatives are poised to provide a robust framework for the regulatory acceptance and widespread adoption of OoC technologies in biomedical research and pharmaceutical development.

Challenges: Scalability, Reproducibility, and Commercialization

Organ-on-a-chip (OoC) engineering has made significant strides in recent years, but as the field matures in 2025, several critical challenges remain—particularly in scalability, reproducibility, and commercialization. These hurdles are central to the widespread adoption of OoC technologies in pharmaceutical development, toxicology, and personalized medicine.

Scalability is a persistent challenge. While academic prototypes have demonstrated the potential of OoC systems, translating these into high-throughput, industrial-grade platforms is complex. The integration of microfluidics, cell culture, and sensor technologies at scale requires robust manufacturing processes. Companies such as Emulate, Inc. and MIMETAS are at the forefront, developing modular and automated platforms that can be produced in larger quantities. For example, Emulate, Inc. has introduced the Human Emulation System, which is designed for compatibility with standard laboratory automation, aiming to bridge the gap between bespoke research devices and scalable commercial products.

Reproducibility is another major concern. Variability in chip fabrication, cell sourcing, and operational protocols can lead to inconsistent results, undermining confidence in OoC data for regulatory or clinical decision-making. Industry leaders are addressing this by standardizing materials and protocols. MIMETAS has developed the OrganoPlate platform, which leverages microfluidic technology in a standardized 384-well plate format, facilitating reproducibility across experiments and laboratories. Additionally, CN Bio offers single- and multi-organ systems with validated protocols and quality control measures to ensure consistent performance.

Commercialization efforts are intensifying as pharmaceutical and biotechnology companies seek alternatives to animal testing and more predictive human models. However, regulatory acceptance remains a bottleneck. In 2025, collaborations between OoC developers and regulatory agencies are expanding, with organizations such as the U.S. Food and Drug Administration (FDA) actively evaluating OoC data for drug safety and efficacy assessments. Companies like Emulate, Inc. have established partnerships with the FDA to validate their platforms for regulatory use, a critical step toward broader market adoption.

Looking ahead, the next few years are expected to see further advances in automation, integration with artificial intelligence for data analysis, and the development of multi-organ and disease-specific chips. As standardization and regulatory pathways solidify, the commercial landscape for OoC technologies is poised for significant growth, with leading companies and regulatory bodies shaping the future of this transformative field.

Emerging Trends: Multi-Organ Chips and Personalized Models

Organ-on-a-chip (OoC) engineering is rapidly advancing, with 2025 poised to be a pivotal year for the integration of multi-organ chips and the development of personalized models. These innovations are transforming preclinical research, drug discovery, and precision medicine by providing more physiologically relevant and human-specific data than traditional cell cultures or animal models.

A key trend is the emergence of multi-organ chips, which interconnect several tissue types—such as liver, heart, kidney, and lung—on a single microfluidic platform. This approach enables the study of complex organ-organ interactions, systemic drug metabolism, and toxicity in a controlled environment. Companies like Emulate, Inc. and MIMETAS are at the forefront, with platforms that allow for the modular connection of different organ chips. In 2024, Emulate, Inc. announced expanded capabilities for their Human Emulation System, supporting multi-organ workflows and more predictive pharmacokinetic modeling. Similarly, MIMETAS has advanced its OrganoPlate platform, enabling high-throughput, multi-tissue experiments that are increasingly adopted by pharmaceutical partners.

Personalized organ-on-a-chip models are also gaining momentum, leveraging patient-derived cells to create individualized disease models. This trend is supported by collaborations between OoC companies and biobanks or clinical centers, aiming to tailor drug testing and toxicity screening to specific genetic backgrounds. CN Bio has developed liver-on-a-chip systems that can be seeded with primary human hepatocytes from diverse donors, facilitating studies on inter-individual variability in drug response. The company is working with pharmaceutical and academic partners to expand these personalized applications in 2025 and beyond.

Industry bodies such as the European Biotechnology Network and regulatory agencies are increasingly recognizing the potential of OoC technologies. In 2024, the U.S. Food and Drug Administration (FDA) continued its engagement with OoC developers, supporting qualification programs and pilot studies to evaluate the predictive value of multi-organ and personalized chips for regulatory submissions.

Looking ahead, the next few years are expected to see further integration of artificial intelligence and advanced analytics with OoC platforms, enabling real-time data interpretation and predictive modeling. The convergence of multi-organ systems, patient-specific models, and digital tools is anticipated to accelerate the adoption of OoC technologies in drug development pipelines, reduce reliance on animal testing, and pave the way for more effective, individualized therapies.

Future Outlook: Strategic Opportunities and Industry Roadmap

The organ-on-a-chip (OoC) sector is poised for significant transformation in 2025 and the following years, driven by advances in microfluidics, biomaterials, and integrated sensor technologies. As pharmaceutical and biotechnology industries intensify their search for more predictive preclinical models, OoC platforms are increasingly recognized as pivotal tools for drug discovery, toxicity testing, and disease modeling. The strategic outlook for the industry is shaped by a convergence of regulatory engagement, industrial partnerships, and technological innovation.

Key industry players are expanding their portfolios and scaling up production capabilities to meet growing demand. Emulate, Inc., a pioneer in the field, continues to collaborate with major pharmaceutical companies and regulatory agencies to validate OoC systems for safety assessment and efficacy studies. Their Human Emulation System is being adopted for both internal R&D and external partnerships, reflecting a broader trend toward platform standardization and interoperability. Similarly, MIMETAS is advancing its OrganoPlate technology, which enables high-throughput screening and complex tissue modeling, and is actively engaging in multi-center validation studies with industry and academic partners.

The next few years are expected to see increased regulatory clarity and potential pre-qualification of OoC models for specific applications. The U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have both signaled interest in integrating OoC data into regulatory submissions, with pilot programs and workshops involving industry stakeholders. This regulatory momentum is likely to accelerate the adoption of OoC platforms in both drug development pipelines and safety testing, reducing reliance on animal models and expediting time-to-market for new therapeutics.

Strategic opportunities are also emerging in the integration of artificial intelligence (AI) and machine learning with OoC data streams. Companies such as CN Bio are developing multi-organ systems and leveraging advanced analytics to interpret complex biological responses, enabling more predictive and personalized approaches to medicine. The convergence of OoC with digital health and data science is expected to unlock new business models, including cloud-based analysis and remote experimentation.

Looking ahead, the industry roadmap will likely focus on three main areas: (1) expanding the repertoire of organ and disease models, including rare and patient-specific conditions; (2) achieving greater automation and scalability for industrial and clinical applications; and (3) fostering cross-sector collaborations to establish best practices and standards. As the ecosystem matures, partnerships between technology developers, pharmaceutical companies, and regulatory bodies will be critical in shaping the future landscape of organ-on-a-chip engineering.