Solid-State Batteries Poised to Disrupt Global Markets in 2025 With Explosive 64% CAGR: What You Need to Know Now

The global solid-state battery market is rocketing toward a 64.3% CAGR by 2031, with safer, faster-charging power for cars, gadgets, and more.

- Projected CAGR: 64.3% (2024-2031)

- Top Applications: Electric Vehicles, Consumer Electronics, Medical Devices

- Major Markets: North America, Europe, Asia Pacific

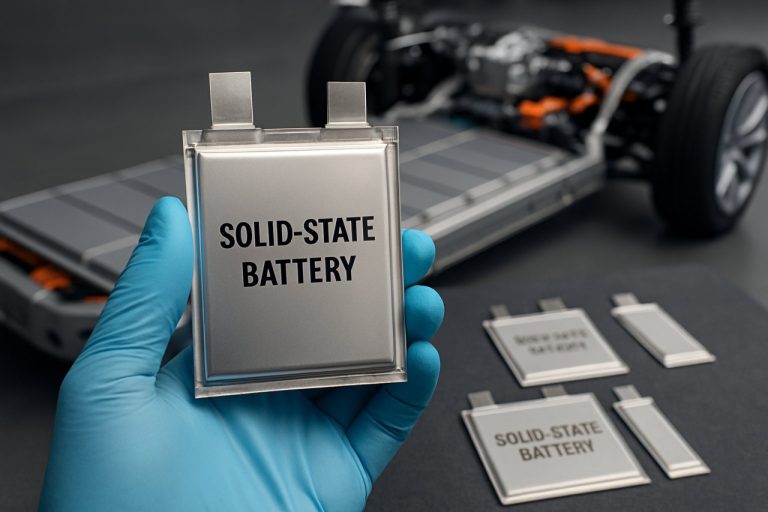

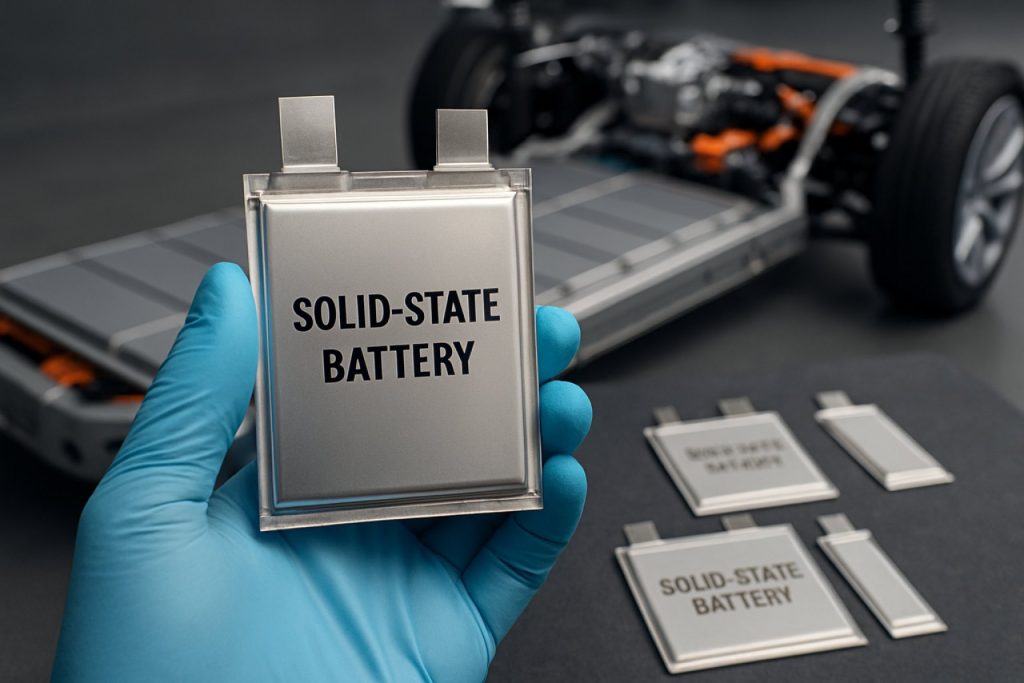

The battery industry is charging toward a future powered by solid-state technology. With energy demands climbing and safety regulations tightening, traditional lithium-ion cells face mounting pressure. Solid-state batteries—using solid electrolytes rather than flammable liquids—promise a leap in safety, energy density, and performance.

By 2031, this market is set to explode, driven by breakthroughs in both electronics and automotive sectors worldwide.

Q: What Are Solid-State Batteries and Why Are They Surging?

Solid-state batteries swap out liquid electrolytes for solid materials, resulting in batteries that are lighter, longer-lasting, and far less prone to catching fire or leaking. These next-gen power sources are ideal for electric vehicles (EVs), portable gadgets, and even medical devices—delivering faster charging and extended life cycles that could unlock a wave of innovation.

How Do Solid-State Batteries Outperform Lithium-Ion?

Solid-state technology delivers up to double the energy density of conventional lithium-ion cells, slashing charging times and boosting overall safety. They are less likely to overheat, and, thanks to their robust build, provide a longer usable lifespan.

Coupled with the rising push for EV adoption, solid-state solutions are positioned to dominate the future of both transportation and mobile tech.

Q: Which Companies Are Leading the Solid-State Battery Race?

Industry titans like Toyota, Panasonic, Bosch, and innovative players such as Solid Power Inc. and Excellatron Solid State LLC are investing billions into R&D and new product lines. Their goals? Cut costs, ramp up manufacturing, and capture emerging markets across Europe, North America, and Asia-Pacific.

These giants are racing to deliver scalable solutions for automakers and consumer tech brands eager to bring next-gen power to market.

How Can Investors and Businesses Capitalize on This Trend?

Strategic market reports—like those offered by DataM Intelligence—highlight not just market size, but also the fastest-growing regions, competitive landscapes, and investment hot spots. The market is segmented by electrolyte type, application, and storage capacity, which gives stakeholders actionable insights into consumer trends and regulatory shifts worldwide.

Q: What Barriers Remain for Mass Adoption?

Despite immense promise, solid-state batteries face hurdles. Manufacturing complexity, higher upfront costs, and technical issues—such as performance in colder climates—continue to hinder rapid rollout. Yet, intensified R&D and global collaboration are already propelling innovation forward.

How to Stay Ahead: Unlocking Opportunities in 2025

1. Monitor emerging markets in Asia-Pacific, North America, and Europe for new investments.

2. Track product launches from leading battery companies and automotive giants.

3. Leverage industry intelligence to identify high-growth application segments—EVs, medical devices, and consumer electronics.

4. Watch for regulatory changes and new safety standards that could open up new investment channels.

Don’t get left behind in the battery revolution—subscribe to industry-leading reports and make informed investment decisions now!

Action Checklist:

- Review the latest market insights for forecasts and trends

- Identify partnership or investment opportunities among leading battery manufacturers

- Assess technology readiness for your sector—prioritize R&D initiatives for solid-state adoption

- Track regulatory environments in key regions for compliance and market access

- Stay alert for breakthrough launches at major electronics and auto shows worldwide