Terahertz Spectroscopy Instrumentation in 2025: Transforming Analytical Science with Rapid Innovation and Expanding Market Horizons. Discover How Cutting-Edge Advances Are Shaping the Next Five Years.

- Executive Summary: Key Findings and 2025 Outlook

- Market Size, Growth Rate, and Forecast (2025–2030)

- Technology Landscape: Breakthroughs in Terahertz Instrumentation

- Competitive Analysis: Leading Manufacturers and Innovators

- Application Trends: Pharmaceuticals, Security, Materials Science, and More

- Regional Insights: North America, Europe, Asia-Pacific, and Emerging Markets

- Regulatory Environment and Industry Standards

- Challenges and Barriers to Adoption

- Investment, M&A, and Strategic Partnerships

- Future Outlook: Opportunities, Risks, and Next-Gen Developments

- Sources & References

Executive Summary: Key Findings and 2025 Outlook

Terahertz (THz) spectroscopy instrumentation is experiencing rapid technological advancement and growing commercial adoption as of 2025. The sector is driven by increasing demand for non-destructive testing, advanced material characterization, and security screening across industries such as pharmaceuticals, semiconductors, and aerospace. Key findings for 2025 highlight a shift from laboratory-based systems to more compact, robust, and user-friendly instruments, enabling broader deployment in industrial and field environments.

Leading manufacturers such as TOPTICA Photonics AG, Menlo Systems GmbH, and TeraView Limited (a University of Cambridge spin-out) have introduced new generations of THz time-domain and frequency-domain spectrometers. These systems feature improved signal-to-noise ratios, faster acquisition speeds, and enhanced integration with automation and data analytics platforms. For example, TOPTICA Photonics AG continues to expand its range of fiber-coupled and turnkey THz sources, while Menlo Systems GmbH has focused on compact, portable THz time-domain systems suitable for in-line quality control.

A notable trend in 2025 is the increasing adoption of THz spectroscopy in semiconductor inspection and pharmaceutical quality assurance. Companies are leveraging the unique ability of THz waves to probe beneath surfaces and distinguish between chemical compositions without damaging samples. TeraView Limited has reported successful deployments of its THz systems for wafer inspection and tablet coating analysis, underscoring the technology’s value in high-throughput manufacturing environments.

The instrumentation landscape is also shaped by advances in photonic and electronic THz sources and detectors. Innovations in quantum cascade lasers, photoconductive antennas, and room-temperature detectors are reducing system costs and complexity, making THz spectroscopy more accessible to a wider range of users. Collaborations between instrument manufacturers and component suppliers, such as those involving TOPTICA Photonics AG and Menlo Systems GmbH, are accelerating the pace of product development and standardization.

Looking ahead, the outlook for 2025 and the following years is positive, with continued double-digit growth expected in both research and industrial markets. Ongoing miniaturization, improved user interfaces, and integration with AI-driven data analysis are anticipated to further expand the application base of THz spectroscopy instrumentation. As regulatory bodies and industry standards evolve, the sector is poised for broader adoption in quality control, security, and biomedical diagnostics.

Market Size, Growth Rate, and Forecast (2025–2030)

The global market for terahertz (THz) spectroscopy instrumentation is poised for robust growth from 2025 through 2030, driven by expanding applications in pharmaceuticals, security screening, materials science, and semiconductor inspection. As of 2025, the market is characterized by increasing adoption of both time-domain and frequency-domain THz systems, with a notable shift toward compact, user-friendly, and high-throughput instruments. The demand is further fueled by ongoing advancements in source and detector technologies, as well as the integration of artificial intelligence for data analysis.

Key industry players such as TOPTICA Photonics AG, a German company recognized for its tunable THz sources and detectors, and Menlo Systems GmbH, known for its fiber-based THz time-domain spectrometers, are expanding their product portfolios to address the needs of both research and industrial users. TeraView Limited, based in the UK, continues to lead in the commercialization of THz imaging and spectroscopy systems, particularly for pharmaceutical quality control and non-destructive testing. In the US, Bristol Instruments, Inc. and Laser Export Co. are also active in the development and supply of THz instrumentation.

Recent years have seen a surge in the deployment of THz spectroscopy in semiconductor wafer inspection and defect analysis, with companies like TOPTICA Photonics AG and TeraView Limited collaborating with major electronics manufacturers to integrate THz systems into production lines. The pharmaceutical sector remains a major end-user, leveraging THz spectroscopy for tablet coating analysis, polymorph detection, and counterfeit drug identification.

Market growth is also supported by government and industry initiatives to standardize THz measurement protocols and improve instrument interoperability. The increasing availability of turnkey, benchtop THz spectrometers is lowering the barrier to entry for academic and industrial laboratories, further expanding the addressable market.

Looking ahead to 2030, the THz spectroscopy instrumentation market is expected to maintain a double-digit compound annual growth rate (CAGR), with Asia-Pacific emerging as a key growth region due to investments in electronics manufacturing and life sciences. The outlook is underpinned by ongoing R&D, falling component costs, and the emergence of new application domains such as food safety and cultural heritage analysis. As leading manufacturers continue to innovate and scale production, the market is set for sustained expansion and technological maturation.

Technology Landscape: Breakthroughs in Terahertz Instrumentation

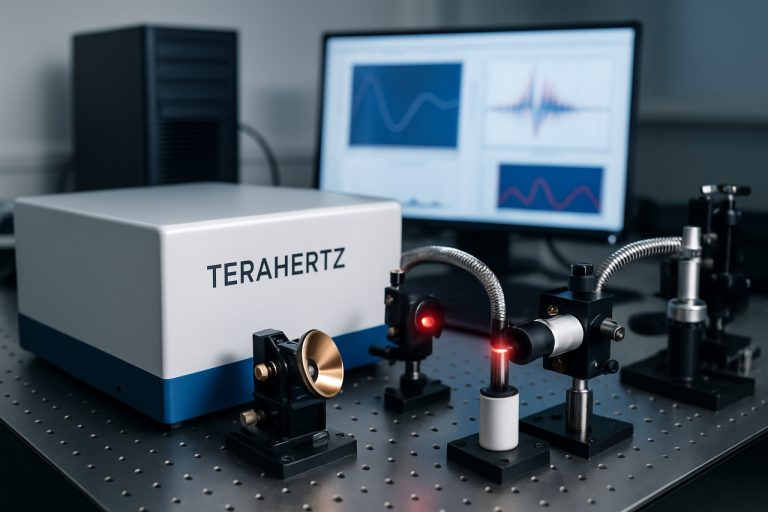

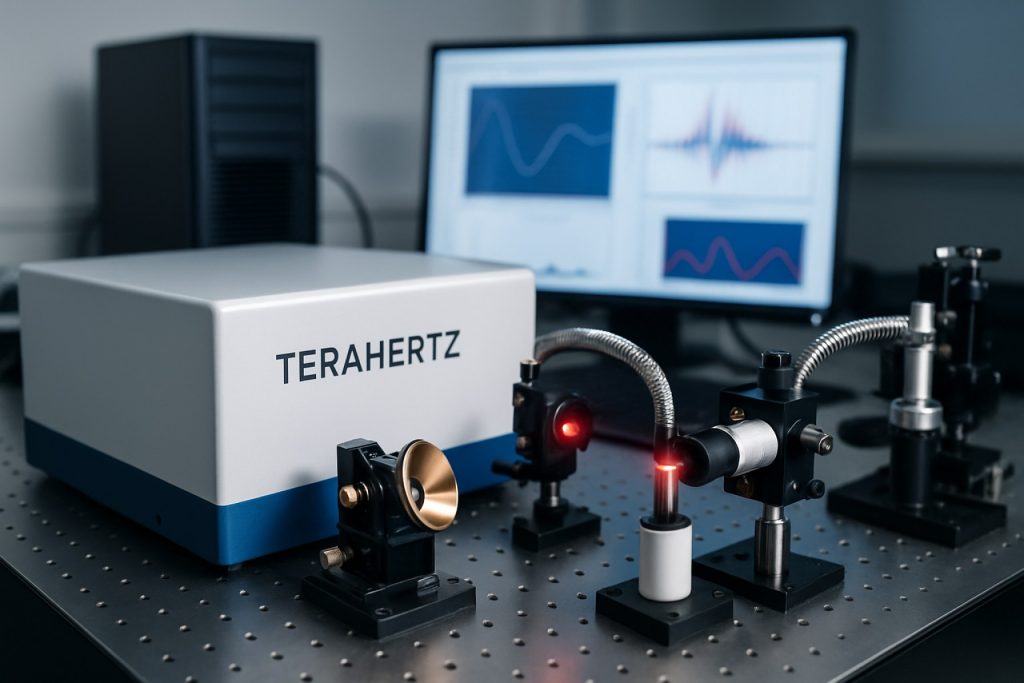

The landscape of terahertz (THz) spectroscopy instrumentation is undergoing rapid transformation in 2025, driven by advances in source and detector technologies, system integration, and application-specific design. Terahertz spectroscopy, which probes the electromagnetic spectrum between microwaves and infrared, is increasingly recognized for its unique capabilities in non-destructive testing, chemical identification, and biomedical diagnostics.

A key breakthrough in recent years has been the commercialization of compact, high-power THz sources. Companies such as TOPTICA Photonics and Menlo Systems have introduced turnkey systems based on photoconductive antennas and optical rectification, offering broad spectral coverage and improved signal-to-noise ratios. These systems are now routinely used in both time-domain (THz-TDS) and frequency-domain (CW-THz) spectroscopy, enabling high-resolution material characterization and imaging.

On the detector side, the integration of low-noise, high-sensitivity receivers has been a focal point. TOPTICA Photonics and Menlo Systems have both developed balanced detection schemes and advanced lock-in amplifiers, which significantly enhance measurement stability and dynamic range. Meanwhile, University of Bristol spin-out TeraView continues to push the envelope with proprietary detector arrays and portable THz imaging platforms, targeting applications in pharmaceuticals and security screening.

System miniaturization and integration are also shaping the 2025 landscape. THz Systems and BAE Systems are developing chip-scale THz spectrometers, leveraging advances in semiconductor fabrication and photonic integration. These efforts are expected to yield robust, field-deployable instruments suitable for industrial process monitoring and point-of-care diagnostics within the next few years.

Another notable trend is the convergence of THz spectroscopy with artificial intelligence and advanced data analytics. Instrument manufacturers are embedding machine learning algorithms for real-time spectral interpretation, anomaly detection, and predictive maintenance. This is particularly evident in the pharmaceutical and food industries, where rapid, automated quality control is paramount.

Looking ahead, the outlook for terahertz spectroscopy instrumentation is marked by continued innovation in source and detector efficiency, further miniaturization, and the expansion of application-specific solutions. As costs decrease and performance improves, THz spectroscopy is poised to transition from specialized research labs to mainstream industrial and clinical environments, with leading companies and research institutions driving this evolution.

Competitive Analysis: Leading Manufacturers and Innovators

The terahertz (THz) spectroscopy instrumentation sector in 2025 is characterized by a dynamic landscape of established manufacturers and emerging innovators, each contributing to the rapid evolution of this technology. The market is driven by increasing demand for non-destructive testing, advanced material characterization, and security screening, with significant investments in both hardware and software development.

Among the global leaders, TOPTICA Photonics AG stands out for its comprehensive portfolio of THz sources and detectors, including continuous-wave and time-domain systems. The company’s modular platforms are widely adopted in academic and industrial research, and recent product lines emphasize higher bandwidth and improved signal-to-noise ratios. Menlo Systems GmbH is another key player, renowned for its femtosecond laser-based THz time-domain spectrometers. Menlo’s systems are recognized for their precision and integration capabilities, supporting applications from semiconductor inspection to pharmaceutical analysis.

In the United States, TeraSense Group Inc. and Advantest Corporation (with its US-based operations) are notable for their focus on industrial and security applications. TeraSense specializes in cost-effective, scalable THz imaging arrays and spectrometers, targeting quality control and process monitoring. Advantest, traditionally a leader in semiconductor test equipment, has expanded its THz product line to address the growing need for high-frequency device characterization, leveraging its global distribution and support network.

Japanese manufacturers such as Hamamatsu Photonics K.K. are also prominent, offering a range of THz detectors and sources with a focus on reliability and integration into OEM systems. Hamamatsu’s recent developments include compact, room-temperature THz sensors, which are expected to lower barriers for adoption in medical diagnostics and food safety.

On the innovation front, startups and university spin-offs are making significant strides. Companies like Bluetest AB (Sweden) and TOPTICA Photonics AG are investing in miniaturization and real-time data processing, aiming to bring portable THz spectrometers to market within the next few years. These efforts are supported by advances in photonic integration and machine learning algorithms for spectral analysis.

Looking ahead, the competitive landscape is expected to intensify as more players enter the market and as established companies expand their product offerings. Strategic partnerships between instrumentation manufacturers and end-user industries—such as pharmaceuticals, semiconductors, and security—are anticipated to accelerate the commercialization of THz spectroscopy. The next few years will likely see further improvements in system sensitivity, speed, and user-friendliness, positioning THz spectroscopy as a mainstream analytical tool across multiple sectors.

Application Trends: Pharmaceuticals, Security, Materials Science, and More

In 2025, terahertz (THz) spectroscopy instrumentation is experiencing significant advancements, driven by its expanding application base in pharmaceuticals, security, materials science, and other sectors. The unique ability of THz waves to probe molecular structures, detect concealed substances, and analyze material properties without causing damage is fueling both research and commercial adoption.

In the pharmaceutical industry, THz spectroscopy is increasingly used for non-destructive quality control, polymorph identification, and tablet coating analysis. Leading instrument manufacturers such as Bruker and TeraView have developed benchtop and portable THz systems tailored for rapid, in-line analysis. These systems enable real-time monitoring of drug formulations and manufacturing processes, supporting regulatory compliance and reducing production costs. The trend toward continuous manufacturing in pharma is expected to further boost demand for THz-based process analytical technology (PAT) tools over the next few years.

Security screening is another area witnessing robust growth. THz imaging and spectroscopy can detect explosives, narcotics, and concealed weapons through clothing and packaging, offering a safer alternative to X-rays. Companies like Advantest and Terasense Group are actively commercializing high-throughput THz scanners for airports, customs, and public venues. Recent improvements in source power, detector sensitivity, and real-time imaging algorithms are making these systems more practical for widespread deployment. The ongoing global focus on public safety is expected to accelerate adoption through 2025 and beyond.

In materials science, THz spectroscopy is being leveraged for non-contact characterization of polymers, semiconductors, and composite materials. Menlo Systems and BATOP are among the companies offering advanced THz time-domain spectrometers and components for research and industrial quality assurance. These instruments provide insights into carrier dynamics, crystallinity, and defect structures, supporting innovation in electronics, photonics, and advanced manufacturing.

Looking ahead, the next few years are likely to see further miniaturization and integration of THz spectroscopy systems, with a focus on user-friendly interfaces and automated data analysis. The emergence of chip-based THz sources and detectors, as pursued by firms like imec, promises to lower costs and enable new portable and embedded applications. As standardization efforts progress and regulatory acceptance grows, THz spectroscopy instrumentation is poised for broader adoption across diverse industries, cementing its role as a critical analytical and security tool.

Regional Insights: North America, Europe, Asia-Pacific, and Emerging Markets

The global landscape for terahertz (THz) spectroscopy instrumentation in 2025 is marked by dynamic regional developments, with North America, Europe, and Asia-Pacific leading innovation and adoption, while emerging markets begin to establish a presence. Each region demonstrates unique strengths and trajectories, shaped by industrial priorities, research funding, and local manufacturing capabilities.

North America remains a pivotal hub for terahertz technology, driven by robust investments in research and a strong ecosystem of academic and industrial collaboration. The United States, in particular, is home to several key players such as TYDEX (with U.S. distribution), TeraView (with North American operations), and Bruker, which offer a range of THz spectrometers and imaging systems. The region benefits from significant government funding for security screening, pharmaceutical quality control, and advanced materials research. In 2025, North American institutions are expected to further expand the use of THz spectroscopy in biomedical diagnostics and semiconductor inspection, leveraging the region’s advanced manufacturing and R&D infrastructure.

Europe is characterized by a strong focus on collaborative research and standardization, with the European Union supporting cross-border projects and infrastructure. Companies such as Menlo Systems (Germany), TOPTICA Photonics (Germany), and BATOP (Germany) are at the forefront of developing compact, high-precision THz sources and detectors. The region’s emphasis on industrial quality assurance, non-destructive testing, and food safety drives demand for THz instrumentation. In 2025 and beyond, Europe is expected to see increased integration of THz systems into manufacturing lines, supported by EU digitalization initiatives and a strong photonics sector.

Asia-Pacific is rapidly emerging as both a manufacturing powerhouse and a center for THz research. Japan, China, and South Korea are investing heavily in THz technology for electronics, telecommunications, and medical imaging. Companies like Hamamatsu Photonics (Japan) and Advantest (Japan) are expanding their THz product portfolios, while Chinese firms are increasing domestic production and export capabilities. The region’s large electronics and semiconductor industries are expected to drive significant growth in THz spectroscopy adoption through 2025, with government-backed initiatives supporting both academic and commercial deployment.

Emerging markets in Latin America, the Middle East, and Africa are at an earlier stage of THz adoption. While local manufacturing is limited, there is growing interest in THz applications for security, agriculture, and resource management. These regions are expected to benefit from technology transfer, international partnerships, and decreasing costs of THz instrumentation over the next few years, gradually expanding their role in the global market.

Regulatory Environment and Industry Standards

The regulatory environment and industry standards for terahertz (THz) spectroscopy instrumentation are evolving rapidly as the technology matures and finds broader adoption in sectors such as pharmaceuticals, security, and materials science. As of 2025, the landscape is characterized by a combination of emerging international standards, ongoing efforts to harmonize safety and performance requirements, and increasing engagement from both governmental and industry-led bodies.

A key development in recent years has been the involvement of international standardization organizations. The International Organization for Standardization (ISO) and the International Electrotechnical Commission (IEC) have initiated working groups focused on the standardization of THz measurement techniques, calibration protocols, and safety guidelines. These efforts are particularly relevant for manufacturers and end-users seeking to ensure interoperability and reliability across different THz systems.

In the United States, the National Institute of Standards and Technology (NIST) continues to play a pivotal role in developing reference materials and measurement standards for THz instrumentation. NIST’s ongoing projects include the creation of traceable calibration sources and the establishment of best practices for THz time-domain and frequency-domain spectroscopy, which are expected to be referenced in future regulatory frameworks.

On the industry side, leading manufacturers such as TOPTICA Photonics, Menlo Systems, and Bruker are actively participating in standardization initiatives and collaborating with regulatory bodies to shape the technical requirements for THz devices. These companies are also implementing internal quality management systems aligned with ISO 9001 and related standards to ensure product consistency and compliance.

Safety regulations are a growing focus, particularly as THz systems become more powerful and are deployed in public or industrial environments. The Occupational Safety and Health Administration (OSHA) in the US and its European counterparts are monitoring developments to assess potential occupational exposure risks, though current evidence suggests that THz radiation is non-ionizing and generally considered safe at typical operational levels.

Looking ahead, the next few years are expected to bring greater regulatory clarity as THz spectroscopy becomes more mainstream. Anticipated milestones include the publication of harmonized international standards, the introduction of certification schemes for THz instruments, and the possible integration of THz-specific requirements into existing frameworks for analytical and imaging equipment. Industry stakeholders are advised to monitor updates from ISO, IEC, and national standards bodies, as well as to engage in public consultations to ensure that evolving regulations support both innovation and safety in the THz sector.

Challenges and Barriers to Adoption

Despite significant advances in terahertz (THz) spectroscopy instrumentation, several challenges and barriers continue to impede widespread adoption as of 2025. One of the primary technical hurdles remains the generation and detection of stable, high-power THz radiation at room temperature. Many current systems rely on cryogenically cooled detectors or complex laser sources, which increase both the cost and operational complexity. While photoconductive antennas and nonlinear crystals have improved performance, their efficiency and robustness under industrial conditions are still under active development.

Cost is a persistent barrier. High-precision THz sources and detectors, such as those based on femtosecond lasers or quantum cascade lasers, remain expensive to manufacture and maintain. This limits accessibility for smaller research labs and commercial users outside of specialized sectors. Companies like TOPTICA Photonics and Menlo Systems are working to commercialize more compact and cost-effective THz systems, but price points are still significantly higher than for established spectroscopic techniques.

Another challenge is the lack of standardized, user-friendly instrumentation. Many THz systems require expert knowledge to operate and interpret results, which restricts their use to highly trained personnel. Efforts are underway to develop turnkey solutions with automated calibration and data analysis, but as of 2025, these are not yet widespread. Brunel University London and other academic institutions are collaborating with industry to address these usability issues, aiming to lower the barrier for non-specialist users.

Material and component limitations also persist. The transparency of common optical materials in the THz range is limited, necessitating the use of specialized optics and substrates. This complicates system integration and increases costs. Additionally, the relatively low spatial resolution of THz imaging compared to visible or infrared techniques restricts its application in fields requiring fine detail, such as semiconductor inspection.

Regulatory and safety concerns are emerging as THz systems become more powerful and widespread. While THz radiation is non-ionizing, there is a need for clear guidelines on safe exposure levels and electromagnetic compatibility, especially for industrial and medical applications. Industry bodies such as the IEEE are beginning to address these issues, but comprehensive standards are still in development.

Looking ahead, overcoming these barriers will require continued collaboration between manufacturers, academic researchers, and standards organizations. Advances in semiconductor materials, photonic integration, and software automation are expected to gradually reduce costs and complexity, paving the way for broader adoption of THz spectroscopy instrumentation in the coming years.

Investment, M&A, and Strategic Partnerships

The terahertz (THz) spectroscopy instrumentation sector is experiencing a notable uptick in investment, mergers and acquisitions (M&A), and strategic partnerships as the technology matures and finds broader applications in pharmaceuticals, security, materials science, and semiconductor inspection. In 2025, this momentum is driven by both established photonics companies and innovative startups seeking to expand their technological capabilities and market reach.

Key industry players such as TOPTICA Photonics, a German-based leader in laser and terahertz systems, have continued to invest in R&D and strategic collaborations. In recent years, TOPTICA has expanded its terahertz product line and entered into partnerships with academic institutions and industrial users to accelerate the adoption of THz spectroscopy in quality control and non-destructive testing. Similarly, Menlo Systems, another German company renowned for its frequency comb and terahertz solutions, has been active in forming alliances with semiconductor manufacturers and research consortia to integrate THz spectroscopy into advanced chip inspection workflows.

On the M&A front, the sector has seen increased activity as larger instrumentation firms seek to acquire specialized THz technology providers. For example, Bruker Corporation, a global leader in scientific instruments, has a history of acquiring innovative spectroscopy companies to broaden its portfolio. While no major THz-specific acquisition by Bruker has been publicly confirmed as of early 2025, industry analysts anticipate that such moves are likely in the near future as the company continues to invest in next-generation spectroscopy platforms.

Strategic partnerships are also shaping the competitive landscape. TESAT-Spacecom, a German aerospace electronics specialist, has entered into collaborations with photonics and defense companies to develop THz-based security screening and satellite communication systems. Meanwhile, Advantest Corporation, a Japanese leader in semiconductor test equipment, has announced joint development projects with THz component manufacturers to enhance wafer inspection and failure analysis capabilities.

Looking ahead, the outlook for investment and partnership activity in terahertz spectroscopy instrumentation remains robust. The convergence of photonics, electronics, and AI-driven data analysis is expected to drive further cross-sector collaborations. As regulatory bodies and industry standards organizations increasingly recognize the value of THz technologies, additional funding rounds, joint ventures, and targeted acquisitions are anticipated through 2025 and beyond, positioning the sector for sustained growth and technological innovation.

Future Outlook: Opportunities, Risks, and Next-Gen Developments

The future of terahertz (THz) spectroscopy instrumentation is poised for significant advancements in 2025 and the following years, driven by rapid technological innovation, expanding application domains, and increasing industry investment. The sector is witnessing a convergence of improved source and detector technologies, miniaturization, and integration with artificial intelligence (AI) and machine learning for enhanced data analysis.

Key industry players are actively shaping the landscape. TOPTICA Photonics, a leading manufacturer of laser and photonics solutions, continues to develop compact, high-power THz sources and detectors, focusing on reliability and user-friendly operation for both research and industrial settings. Menlo Systems is advancing fiber-based THz time-domain spectroscopy (THz-TDS) systems, emphasizing turnkey solutions and integration with existing laboratory infrastructure. Bruker, a major supplier of scientific instruments, is expanding its THz product line, targeting pharmaceutical, security, and materials science applications.

In 2025, the market is expected to see broader adoption of portable and real-time THz spectroscopy devices. These instruments are increasingly being deployed for non-destructive testing, quality control in manufacturing, and security screening. The integration of THz systems with AI-driven analytics is anticipated to accelerate, enabling faster, more accurate interpretation of complex spectral data and facilitating automated decision-making in industrial environments.

Opportunities abound in sectors such as semiconductor inspection, where THz spectroscopy can detect sub-surface defects and measure layer thickness with high precision. The pharmaceutical industry is leveraging THz systems for polymorph identification and tablet coating analysis, while the food industry explores THz for contaminant detection and quality assurance. The ongoing miniaturization of THz components, including photoconductive antennas and quantum cascade lasers, is expected to lower costs and expand accessibility.

However, several risks and challenges remain. The high cost of advanced THz sources and detectors, as well as the need for specialized expertise to operate and interpret results, may limit adoption in some sectors. Standardization of measurement protocols and data formats is still evolving, which could hinder interoperability and broader market penetration. Additionally, regulatory frameworks for THz applications in medical and security fields are under development, potentially impacting deployment timelines.

Looking ahead, next-generation THz spectroscopy instrumentation will likely feature further integration with cloud-based platforms, enabling remote diagnostics and collaborative research. Advances in materials science, such as the use of novel 2D materials for THz generation and detection, are expected to enhance sensitivity and bandwidth. As industry leaders like TOPTICA Photonics, Menlo Systems, and Bruker continue to innovate, the sector is set for robust growth and diversification across scientific and industrial domains.

Sources & References

- TOPTICA Photonics AG

- Menlo Systems GmbH

- TeraView Limited

- TeraView Limited

- Bristol Instruments, Inc.

- TeraSense Group Inc.

- Advantest Corporation

- Hamamatsu Photonics K.K.

- Bluetest AB

- Bruker

- Advantest

- Terasense Group

- Menlo Systems

- imec

- TYDEX

- Bruker

- International Organization for Standardization

- National Institute of Standards and Technology

- Bruker

- IEEE

- TESAT-Spacecom