Titanium Alloy Implantable Devices Manufacturing in 2025: Unleashing Next-Gen Biocompatibility and Market Growth. Explore How Advanced Alloys and Precision Engineering Are Shaping the Future of Medical Implants.

- Executive Summary: 2025 Market Outlook and Key Drivers

- Global Market Size, Growth Rate, and Forecasts to 2030

- Breakthroughs in Titanium Alloy Materials and Surface Technologies

- Regulatory Landscape and Compliance (FDA, ISO, EU MDR)

- Leading Manufacturers and Strategic Partnerships

- Applications: Orthopedic, Dental, Cardiovascular, and Beyond

- Manufacturing Innovations: Additive Manufacturing and Precision Machining

- Supply Chain Dynamics and Raw Material Sourcing

- Sustainability, Recycling, and Environmental Impact

- Future Trends: Smart Implants, Personalization, and Digital Integration

- Sources & References

Executive Summary: 2025 Market Outlook and Key Drivers

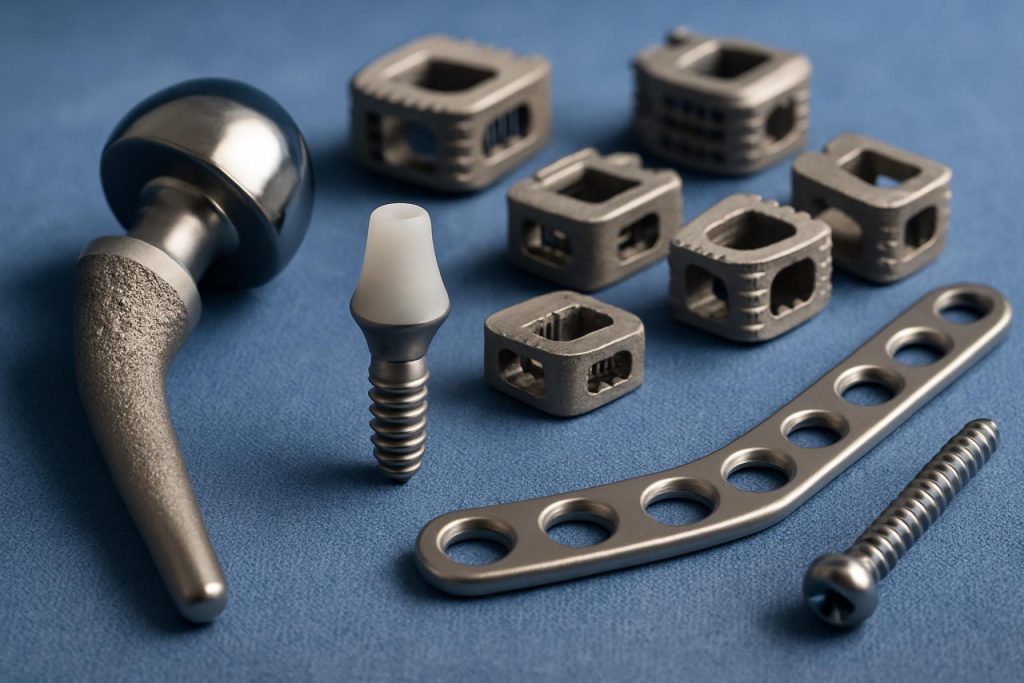

The titanium alloy implantable devices manufacturing sector is poised for robust growth in 2025, driven by the convergence of advanced materials science, precision manufacturing technologies, and rising global healthcare demand. Titanium alloys, particularly Ti-6Al-4V, remain the material of choice for orthopedic, dental, and cardiovascular implants due to their superior biocompatibility, corrosion resistance, and mechanical strength. The sector is witnessing increased adoption of additive manufacturing (AM) and advanced machining, enabling the production of complex, patient-specific implants with enhanced osseointegration and reduced lead times.

Key industry players such as Smith & Nephew, Zimmer Biomet, and Stryker are investing heavily in digital manufacturing platforms and automation to streamline production and ensure traceability. These companies are also expanding their global manufacturing footprints, with new facilities and partnerships in Asia-Pacific and Europe to meet rising regional demand. For example, Stryker has continued to scale its additive manufacturing capabilities, focusing on proprietary 3D-printed titanium technologies for orthopedic and spinal implants.

The regulatory landscape is evolving, with agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) emphasizing stricter quality controls and post-market surveillance for implantable devices. This is prompting manufacturers to invest in advanced inspection systems and digital quality management, further driving innovation in the sector. Additionally, the push for sustainability is influencing material sourcing and manufacturing practices, with companies exploring closed-loop recycling of titanium scrap and energy-efficient production methods.

Market data from leading titanium suppliers, including TIMET (Titanium Metals Corporation) and VSMPO-AVISMA, indicate stable supply and ongoing investments in high-purity medical-grade titanium production. These suppliers are critical in supporting the sector’s growth, ensuring consistent quality and traceability of raw materials. The integration of digital supply chain solutions is expected to further enhance transparency and responsiveness in the coming years.

Looking ahead, the titanium alloy implantable devices manufacturing market is set to benefit from demographic trends such as aging populations and increased prevalence of musculoskeletal disorders. The sector’s outlook for 2025 and beyond is characterized by continued innovation, global expansion, and a strong focus on regulatory compliance and sustainability, positioning it as a key enabler of next-generation medical care.

Global Market Size, Growth Rate, and Forecasts to 2030

The global market for titanium alloy implantable devices is poised for robust growth through 2025 and into the latter part of the decade, driven by increasing demand for advanced orthopedic, dental, and cardiovascular implants. Titanium alloys, particularly Ti-6Al-4V, are favored for their biocompatibility, corrosion resistance, and mechanical strength, making them the material of choice for a wide range of implantable medical devices.

In 2025, the market size for titanium alloy implantable devices is estimated to exceed several billion USD, with leading manufacturers reporting strong order books and capacity expansions. For example, Smith+Nephew, a major global medical technology company, continues to invest in titanium-based orthopedic solutions, while Zimmer Biomet and Stryker are expanding their portfolios of titanium alloy implants for joint reconstruction and trauma applications. DePuy Synthes, part of Johnson & Johnson, is also a significant player, leveraging titanium alloys in spinal and cranial implant systems.

Growth rates for the sector are projected to remain strong, with compound annual growth rates (CAGR) in the range of 5–7% through 2030, according to industry consensus and company outlooks. This expansion is underpinned by several factors:

- Rising global incidence of musculoskeletal disorders and an aging population, particularly in North America, Europe, and Asia-Pacific.

- Technological advancements in additive manufacturing (3D printing) of titanium implants, enabling patient-specific solutions and more complex geometries. Companies such as Smith+Nephew and Stryker have made significant investments in 3D-printed titanium implants.

- Expansion of healthcare infrastructure and increased access to advanced surgical procedures in emerging markets.

The outlook for the next few years includes continued innovation in surface treatments and coatings to enhance osseointegration and reduce infection risks. Additionally, supply chain resilience and raw material sourcing remain focal points, with major titanium suppliers such as TIMET (Titanium Metals Corporation) and VSMPO-AVISMA supporting the medical device sector with high-purity titanium alloys.

By 2030, the titanium alloy implantable devices market is expected to reach new highs, driven by ongoing R&D, regulatory approvals of novel devices, and the global trend toward value-based healthcare. The sector’s growth trajectory is likely to remain positive, with leading manufacturers and suppliers playing pivotal roles in shaping the future of implantable medical technology.

Breakthroughs in Titanium Alloy Materials and Surface Technologies

The landscape of titanium alloy implantable device manufacturing is experiencing significant breakthroughs in both material science and surface engineering as of 2025. Titanium alloys, particularly Ti-6Al-4V, remain the gold standard for orthopedic, dental, and cardiovascular implants due to their exceptional biocompatibility, corrosion resistance, and mechanical strength. However, recent advancements are pushing the boundaries of what these materials can achieve, with a focus on enhancing osseointegration, reducing infection risks, and enabling patient-specific solutions.

One of the most notable trends is the development and commercialization of next-generation titanium alloys with tailored microstructures. Companies such as ATI and Carpenter Technology Corporation are actively producing advanced titanium alloys with improved fatigue resistance and lower elastic modulus, which better match the properties of human bone and reduce stress shielding. These alloys are being adopted in load-bearing implants, such as hip and knee replacements, where longevity and patient outcomes are critical.

Surface modification technologies are also seeing rapid innovation. Plasma electrolytic oxidation (PEO), laser texturing, and nano-coating techniques are being integrated into manufacturing lines to create bioactive surfaces that promote faster bone in-growth and reduce bacterial adhesion. Zimmer Biomet and Smith+Nephew have introduced proprietary surface treatments for their titanium-based implants, aiming to accelerate healing and minimize post-surgical complications. These surface technologies are increasingly being validated by clinical data, supporting their adoption in regulatory submissions and hospital procurement.

Additive manufacturing (AM), particularly electron beam melting (EBM) and selective laser melting (SLM), is revolutionizing the production of complex, patient-specific titanium implants. Stryker and DePuy Synthes have established dedicated AM facilities, enabling the fabrication of porous structures that mimic natural bone architecture and enhance biological fixation. The scalability and customization offered by AM are expected to drive further adoption in the coming years, especially as regulatory pathways for 3D-printed implants become more streamlined.

Looking ahead, the integration of antimicrobial coatings, smart sensor technologies, and bioresorbable alloying elements is anticipated to further expand the functionality of titanium implantable devices. Industry leaders are investing in R&D collaborations with academic institutions and medical device startups to accelerate the translation of these innovations from lab to clinic. As regulatory agencies continue to update standards for new materials and processes, the next few years are poised to see a wave of titanium alloy implants that are safer, more durable, and more responsive to patient needs.

Regulatory Landscape and Compliance (FDA, ISO, EU MDR)

The regulatory landscape for titanium alloy implantable devices is evolving rapidly in 2025, shaped by stringent requirements from major authorities such as the U.S. Food and Drug Administration (FDA), the International Organization for Standardization (ISO), and the European Union Medical Device Regulation (EU MDR). These frameworks are critical for manufacturers, as they dictate the standards for safety, efficacy, and quality management in the production of titanium alloy implants, which are widely used in orthopedics, dental, and cardiovascular applications.

In the United States, the FDA continues to enforce its 21 CFR Part 820 Quality System Regulation (QSR), which mandates comprehensive quality management systems for medical device manufacturers. For titanium alloy implants, this includes rigorous controls over material sourcing, traceability, and process validation. The FDA’s premarket approval (PMA) and 510(k) pathways require extensive biocompatibility and mechanical testing data, particularly for new titanium alloy compositions or additive manufacturing (AM) techniques. Leading U.S. manufacturers such as Zimmer Biomet and Smith+Nephew have invested in advanced compliance systems to streamline submissions and post-market surveillance, reflecting the agency’s increasing focus on real-world evidence and device tracking.

Globally, ISO 13485:2016 remains the cornerstone for quality management in medical device manufacturing, with a strong emphasis on risk management, process validation, and supplier controls. For titanium alloy implants, ISO 5832 series standards specify the chemical composition and mechanical properties required for surgical implants, ensuring consistency and safety across international markets. Companies such as Sandvik, a major supplier of titanium powders and bars, and Sandvik Materials Technology (now Alleima), are actively involved in aligning their production and documentation processes with these standards to support global device manufacturers.

In the European Union, the implementation of the EU MDR (Regulation (EU) 2017/745) has significantly raised the bar for clinical evidence, post-market surveillance, and traceability. The regulation’s Unique Device Identification (UDI) system and stricter requirements for notified body review have led to longer approval timelines and increased documentation for titanium alloy implants. European manufacturers such as Stryker and DePuy Synthes are adapting by enhancing their regulatory affairs teams and investing in digital compliance tools.

Looking ahead, the regulatory environment is expected to become even more harmonized, with ongoing efforts to align FDA, ISO, and EU MDR requirements. This trend will likely drive further investment in digital quality management systems, real-time data analytics, and advanced traceability solutions among titanium implant manufacturers. As regulatory scrutiny intensifies, companies that proactively adapt to these evolving standards will be best positioned to maintain market access and ensure patient safety.

Leading Manufacturers and Strategic Partnerships

The titanium alloy implantable devices sector in 2025 is characterized by a dynamic landscape of leading manufacturers and a growing emphasis on strategic partnerships to drive innovation, scale, and regulatory compliance. Titanium alloys, particularly Ti-6Al-4V, remain the material of choice for orthopedic, dental, and cardiovascular implants due to their superior biocompatibility, corrosion resistance, and mechanical strength.

Among the global leaders, Smith & Nephew continues to expand its portfolio of titanium-based orthopedic implants, leveraging advanced additive manufacturing (AM) techniques to produce highly customized and porous structures that promote osseointegration. Similarly, Zimmer Biomet maintains a strong presence in the market, with ongoing investments in both traditional forging and cutting-edge 3D printing technologies for spinal, hip, and knee implants.

In the Asia-Pacific region, United Orthopedic Corporation has emerged as a significant player, focusing on titanium alloy joint replacement systems and expanding its manufacturing capabilities to meet rising regional demand. Meanwhile, Stryker remains at the forefront of innovation, particularly through its acquisition of companies specializing in additive manufacturing and surface modification technologies, which are critical for next-generation implantable devices.

Strategic partnerships are increasingly shaping the competitive landscape. For example, DePuy Synthes, part of Johnson & Johnson, has entered collaborations with materials science firms and digital health companies to integrate smart sensor technologies into titanium implants, aiming to enhance post-surgical monitoring and patient outcomes. Medtronic is also notable for its alliances with titanium powder suppliers and contract manufacturers, ensuring a resilient supply chain and rapid scaling of new product lines.

Raw material suppliers such as TIMET (Titanium Metals Corporation) and VSMPO-AVISMA play a foundational role, providing high-purity titanium alloys to medical device OEMs worldwide. These suppliers are increasingly involved in joint ventures with device manufacturers to co-develop proprietary alloy grades tailored for specific implant applications.

Looking ahead, the next few years are expected to see further consolidation among manufacturers, deeper integration of digital manufacturing technologies, and expanded cross-sector partnerships—particularly as regulatory requirements for traceability and performance intensify. The sector’s outlook remains robust, driven by demographic trends, technological advances, and the ongoing shift toward patient-specific, high-performance titanium alloy implants.

Applications: Orthopedic, Dental, Cardiovascular, and Beyond

Titanium alloy implantable devices are central to modern medicine, with applications spanning orthopedics, dental, cardiovascular, and emerging fields. In 2025, the demand for these devices continues to rise, driven by an aging global population, increased prevalence of chronic diseases, and advances in surgical techniques. Titanium alloys, particularly Ti-6Al-4V, remain the material of choice due to their biocompatibility, corrosion resistance, and mechanical strength.

In orthopedics, titanium alloy implants are widely used for joint replacements, spinal fixation, and trauma devices. Leading manufacturers such as Zimmer Biomet and Smith+Nephew have expanded their portfolios to include patient-specific implants and 3D-printed components, leveraging additive manufacturing to improve osseointegration and reduce recovery times. The adoption of 3D printing is expected to accelerate, enabling more complex geometries and porous structures that mimic natural bone, a trend confirmed by ongoing investments from Stryker in advanced manufacturing facilities.

Dental applications represent another significant segment, with titanium alloys used for root-form implants, abutments, and prosthetic frameworks. Companies like Nobel Biocare and Dentsply Sirona are at the forefront, offering systems that integrate digital workflows and surface treatments to enhance osseointegration and long-term stability. The dental sector is also witnessing a shift toward minimally invasive procedures, further boosting demand for precision-engineered titanium components.

In the cardiovascular field, titanium alloys are integral to pacemaker casings, heart valve frames, and vascular stents. Medtronic and Boston Scientific utilize titanium’s non-magnetic and corrosion-resistant properties to ensure device longevity and compatibility with diagnostic imaging. The next few years are expected to see increased use of titanium in transcatheter and minimally invasive cardiovascular devices, reflecting a broader trend toward less invasive interventions.

Beyond these established areas, titanium alloys are being explored for neurostimulation devices, cochlear implants, and even drug delivery systems. The versatility of titanium, combined with ongoing advances in surface modification and additive manufacturing, is likely to expand its application scope. Industry leaders such as DePuy Synthes and Smith+Nephew are investing in R&D to address new clinical needs, including antimicrobial coatings and smart implant technologies.

Looking ahead, the outlook for titanium alloy implantable devices manufacturing remains robust. The convergence of digital design, additive manufacturing, and material science is set to drive innovation, with a focus on patient-specific solutions and improved clinical outcomes. Regulatory bodies are also adapting to these advances, streamlining approval pathways for novel titanium-based implants, which should further accelerate market growth through 2025 and beyond.

Manufacturing Innovations: Additive Manufacturing and Precision Machining

The manufacturing landscape for titanium alloy implantable devices is undergoing significant transformation in 2025, driven by the convergence of additive manufacturing (AM) and advanced precision machining. Titanium alloys, particularly Ti-6Al-4V, remain the material of choice for orthopedic, dental, and cardiovascular implants due to their biocompatibility, corrosion resistance, and mechanical strength. The adoption of innovative manufacturing techniques is enabling the production of more complex, patient-specific, and high-performance implants.

Additive manufacturing, especially selective laser melting (SLM) and electron beam melting (EBM), is at the forefront of this evolution. These technologies allow for the fabrication of intricate lattice structures and porous surfaces that enhance osseointegration and reduce implant weight. Leading medical device manufacturers such as Stryker and Zimmer Biomet have invested heavily in AM capabilities, with Stryker’s proprietary AMagine process and Zimmer Biomet’s use of EBM for orthopedic implants. These companies are leveraging AM to produce patient-matched implants and components with optimized geometries that are difficult or impossible to achieve with traditional subtractive methods.

Precision machining remains essential, particularly for achieving the tight tolerances and surface finishes required for critical implant interfaces. Companies like DePuy Synthes (a Johnson & Johnson company) and Smith+Nephew continue to refine their CNC machining processes, integrating automation and real-time quality control to ensure consistency and compliance with stringent regulatory standards. Hybrid manufacturing approaches, combining AM for near-net-shape production and precision machining for finishing, are increasingly common.

In 2025, digitalization and data-driven manufacturing are further enhancing process control and traceability. The integration of in-situ monitoring during AM, as well as advanced metrology in machining, is reducing defects and improving yield. Companies such as GE (through GE Additive) are pioneering closed-loop systems that use real-time data to adjust parameters and ensure part quality.

Looking ahead, the next few years are expected to see broader adoption of AM for mass customization, with regulatory bodies providing clearer pathways for approval of additively manufactured implants. The continued evolution of titanium powder production, recycling, and post-processing technologies will further drive down costs and expand the range of implantable devices that can benefit from these manufacturing innovations.

Supply Chain Dynamics and Raw Material Sourcing

The supply chain for titanium alloy implantable devices is characterized by a complex interplay of raw material sourcing, alloy production, and precision manufacturing, all underpinned by stringent regulatory requirements. As of 2025, the demand for titanium alloys—primarily Ti-6Al-4V (Grade 5) and its medical-grade variants—remains robust, driven by the continued growth of orthopedic, dental, and cardiovascular implant markets. The biocompatibility, corrosion resistance, and mechanical strength of titanium alloys make them the material of choice for load-bearing and long-term implantable devices.

Raw titanium is primarily sourced from mineral concentrates such as ilmenite and rutile, with major mining operations located in Australia, South Africa, and China. The conversion of these minerals into high-purity titanium sponge is dominated by a handful of global producers, including TOYOTA TSUSHO CORPORATION and VSMPO-AVISMA Corporation. VSMPO-AVISMA Corporation, based in Russia, is recognized as the world’s largest titanium producer, supplying a significant share of the medical-grade titanium used in implant manufacturing worldwide. However, ongoing geopolitical tensions and trade restrictions have prompted medical device manufacturers to diversify their supplier base and seek alternative sources, particularly in Japan, the United States, and Europe.

Titanium alloy ingots and semi-finished products are further processed by specialized companies such as TIMET (Titanium Metals Corporation), which operates facilities in North America and Europe, and Sandvik, a Swedish engineering group with a strong presence in medical materials. These companies supply precision-forged bars, plates, and rods tailored to the exacting standards of implantable device manufacturers. The supply chain is further supported by firms like Carpenter Technology Corporation, which focuses on high-performance specialty alloys for medical applications.

In 2025, the titanium supply chain faces several challenges, including price volatility due to energy costs, logistical disruptions, and the need for traceability and certification. Medical device manufacturers are increasingly demanding full material provenance and compliance with international standards such as ASTM F136 and ISO 5832-3. To address these requirements, suppliers are investing in digital traceability systems and closer integration with downstream partners.

Looking ahead, the outlook for titanium alloy implantable device manufacturing remains positive, with anticipated growth in minimally invasive and patient-specific implants driving demand for advanced titanium products. However, supply chain resilience and sustainable sourcing will remain critical priorities, prompting ongoing investment in recycling, alternative feedstocks, and regional supply hubs by leading industry players.

Sustainability, Recycling, and Environmental Impact

The sustainability and environmental impact of titanium alloy implantable device manufacturing are increasingly central concerns for the medical device industry in 2025 and the coming years. Titanium alloys, particularly Ti-6Al-4V, are favored for their biocompatibility, corrosion resistance, and mechanical strength, but their extraction, processing, and fabrication are energy-intensive and generate significant waste. As regulatory and societal pressures mount, manufacturers are adopting new strategies to minimize environmental footprints and enhance circularity.

A key trend is the integration of recycling processes for both pre-consumer (manufacturing scrap) and post-consumer (retrieved implants) titanium. Leading producers such as TIMET and Carpenter Technology Corporation have invested in closed-loop recycling systems, reclaiming titanium swarf and offcuts from machining operations. These materials are re-melted and re-alloyed, reducing the need for virgin titanium sponge and lowering associated carbon emissions. Sandvik, a major supplier of titanium for medical applications, has also implemented advanced recycling protocols, aiming to increase the proportion of recycled content in its medical-grade alloys.

Additive manufacturing (AM), or 3D printing, is another area driving sustainability improvements. AM technologies, widely adopted by companies like Stryker and Zimmer Biomet, enable near-net-shape production of implants, drastically reducing material waste compared to traditional subtractive machining. This not only conserves raw titanium but also decreases the energy required for post-processing and finishing. Furthermore, AM facilitates the use of recycled titanium powders, further closing the material loop.

Environmental impact assessments are also being incorporated into supply chain management. Companies such as Smith+Nephew are increasingly transparent about their sourcing and manufacturing practices, publishing sustainability reports and setting targets for emissions reduction and resource efficiency. The adoption of renewable energy in titanium melting and processing facilities is expected to accelerate, with several manufacturers piloting solar and wind-powered operations.

Looking ahead, regulatory frameworks in the EU and North America are likely to mandate stricter reporting and reduction of environmental impacts for medical device manufacturers. Industry bodies such as the International Titanium Association are collaborating with manufacturers to develop best practices for recycling and life-cycle management of titanium implants. As a result, the next few years will see a continued shift toward greener manufacturing, with a focus on maximizing recyclability, minimizing waste, and reducing the carbon footprint of titanium alloy implantable devices.

Future Trends: Smart Implants, Personalization, and Digital Integration

The landscape of titanium alloy implantable devices manufacturing is rapidly evolving, with 2025 marking a pivotal year for the integration of smart technologies, personalization, and digital workflows. Titanium alloys, particularly Ti-6Al-4V, remain the material of choice for orthopedic, dental, and cardiovascular implants due to their biocompatibility, corrosion resistance, and mechanical strength. However, the next few years are set to witness transformative trends that will redefine both the manufacturing process and the clinical performance of these devices.

A major trend is the rise of smart implants—devices embedded with sensors or electronic components to monitor physiological parameters, detect early signs of complications, and enable real-time data transmission. Leading manufacturers such as Smith+Nephew and Zimmer Biomet are investing in research and partnerships to develop titanium-based implants with integrated sensor technology. These smart systems are expected to improve post-operative care and patient outcomes by providing clinicians with actionable data, a trend that is likely to accelerate as wireless power and miniaturized electronics mature.

Personalization is another key driver, enabled by advances in digital design and additive manufacturing (AM). Companies like Stryker and DePuy Synthes are leveraging 3D printing to produce patient-specific titanium implants, tailored to individual anatomy and pathology. This approach not only enhances implant fit and function but also reduces surgical time and the risk of complications. The adoption of AM is expected to expand further in 2025 and beyond, as regulatory pathways become clearer and in-hospital printing capabilities grow.

The digital integration of manufacturing and clinical workflows is also gaining momentum. Digital twins, AI-driven design optimization, and cloud-based collaboration platforms are being adopted by manufacturers to streamline the development and validation of titanium implants. GE, through its additive division, is actively developing digital solutions for the medical device sector, enabling real-time monitoring of production quality and traceability of each implant. This digital thread from design to deployment is anticipated to become standard practice, improving efficiency and regulatory compliance.

Looking ahead, the convergence of smart functionality, personalization, and digital integration is set to define the next generation of titanium alloy implantable devices. As manufacturers continue to invest in R&D and digital infrastructure, the sector is poised for significant advancements in patient care, device performance, and manufacturing agility through 2025 and the following years.