Ultraviolet-C (UVC) Disinfection Robotics Manufacturing in 2025: Transforming Hygiene Standards and Accelerating Global Market Expansion. Explore the Innovations, Key Players, and Forecasts Shaping the Next 5 Years.

- Executive Summary: UVC Robotics Market in 2025

- Industry Overview: UVC Disinfection Robotics Manufacturing

- Key Technologies and Innovations in UVC Robotics

- Major Manufacturers and Industry Leaders (e.g., xenex.com, uvd-robots.com, danishcleantech.com)

- Market Size, Segmentation, and 2025–2030 Growth Forecasts (Estimated CAGR: 18–22%)

- Regulatory Landscape and Safety Standards (e.g., fda.gov, cdc.gov, iec.ch)

- Applications Across Healthcare, Transportation, and Public Spaces

- Supply Chain, Component Sourcing, and Manufacturing Challenges

- Competitive Landscape and Strategic Partnerships

- Future Outlook: Emerging Trends and Long-Term Opportunities

- Sources & References

Executive Summary: UVC Robotics Market in 2025

The Ultraviolet-C (UVC) disinfection robotics manufacturing sector is poised for significant growth in 2025, driven by heightened global demand for automated, chemical-free disinfection solutions across healthcare, transportation, hospitality, and public infrastructure. The COVID-19 pandemic catalyzed rapid adoption of UVC robotics, and the momentum continues as organizations prioritize infection prevention and operational efficiency. UVC robots, which utilize short-wavelength ultraviolet light to inactivate pathogens on surfaces and in air, are increasingly integrated into facility management protocols worldwide.

Key manufacturers are scaling up production and innovating in both hardware and software. UVD Robots, a Danish pioneer, continues to expand its global footprint, supplying autonomous UVC robots to hospitals, airports, and commercial buildings. The company’s robots are deployed in over 70 countries, and in 2025, it is expected to further enhance navigation and safety features to meet evolving regulatory standards. Xenex Disinfection Services, based in the United States, is another major player, known for its LightStrike robots that utilize pulsed xenon UVC. Xenex has reported widespread adoption in healthcare settings, with ongoing R&D focused on increasing disinfection speed and efficacy.

Asian manufacturers are also gaining prominence. TMiRob from China has ramped up production capacity and diversified its product line to include UVC robots for both medical and public transit applications. Meanwhile, Finsen Technologies in the UK and OTSAW in Singapore are expanding their reach into new markets, leveraging partnerships with facility management and logistics companies.

The sector is witnessing increased collaboration with sensor and AI technology providers to improve autonomous navigation, obstacle avoidance, and real-time monitoring. Manufacturers are also responding to regulatory developments, such as stricter safety guidelines for UVC exposure and requirements for efficacy validation, particularly in the European Union and North America.

Looking ahead, the UVC robotics market in 2025 is expected to see double-digit annual growth, with a focus on modular designs, cloud-based fleet management, and integration with building automation systems. The competitive landscape is intensifying, with established robotics firms and new entrants investing in R&D to differentiate their offerings. As end-users seek reliable, cost-effective, and scalable disinfection solutions, manufacturers are well-positioned to capitalize on sustained demand and evolving application scenarios.

Industry Overview: UVC Disinfection Robotics Manufacturing

The Ultraviolet-C (UVC) disinfection robotics manufacturing sector is experiencing significant momentum in 2025, driven by heightened global demand for automated, chemical-free disinfection solutions in healthcare, transportation, hospitality, and public spaces. UVC disinfection robots utilize short-wavelength ultraviolet light (200–280 nm) to inactivate pathogens on surfaces and in the air, offering a rapid and effective alternative to manual cleaning. The COVID-19 pandemic catalyzed widespread adoption, and the trend continues as organizations prioritize infection prevention and operational efficiency.

Key industry players include UVD Robots, a Danish company recognized for its autonomous mobile robots deployed in hospitals and airports worldwide. Xenex Disinfection Services in the United States is another leader, known for its LightStrike robots that use pulsed xenon UVC technology. Finsen Technologies in the UK and PURO Lighting in the US are also prominent, with a focus on both mobile and fixed UVC disinfection systems. Asian manufacturers such as TMiRob (China) and Seoul Viosys (South Korea) are expanding their portfolios, leveraging advances in UVC LED technology for more compact and energy-efficient designs.

Manufacturing in this sector is characterized by integration of robotics, artificial intelligence, and advanced sensor systems to enable autonomous navigation, obstacle avoidance, and real-time monitoring of disinfection efficacy. In 2025, manufacturers are increasingly focusing on modular designs, allowing for rapid customization to meet the needs of diverse environments, from hospital wards to airport terminals. The use of UVC LEDs, as opposed to traditional mercury lamps, is gaining traction due to environmental regulations and the push for longer-lasting, mercury-free solutions.

Data from industry sources indicate that the global installed base of UVC disinfection robots is expected to surpass 20,000 units by the end of 2025, with the healthcare sector accounting for over 60% of deployments. Manufacturers are reporting increased orders from Asia-Pacific and Middle Eastern markets, reflecting broader geographic adoption. Regulatory bodies such as the U.S. Environmental Protection Agency and the International Ultraviolet Association are working with manufacturers to establish safety and efficacy standards, which is expected to further drive market confidence and adoption.

Looking ahead, the industry outlook remains robust, with ongoing R&D investments aimed at improving UVC dosage control, remote monitoring, and integration with building management systems. As public health concerns persist and automation becomes central to facility management, UVC disinfection robotics manufacturing is poised for sustained growth and technological innovation through the remainder of the decade.

Key Technologies and Innovations in UVC Robotics

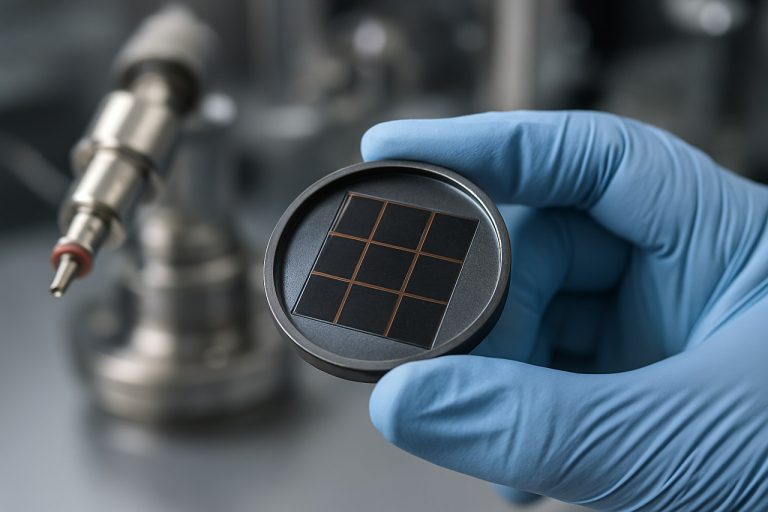

The manufacturing of Ultraviolet-C (UVC) disinfection robotics in 2025 is characterized by rapid technological advancements and a focus on automation, safety, and efficacy. UVC robotics leverage germicidal wavelengths (200–280 nm) to inactivate pathogens on surfaces and in the air, and recent years have seen significant innovation in both the core UVC technology and the robotics platforms that deliver it.

A key trend in 2025 is the integration of advanced sensor arrays and artificial intelligence (AI) to optimize disinfection cycles and ensure comprehensive coverage. Leading manufacturers such as Xenex Disinfection Services and UVD Robots have developed autonomous mobile robots equipped with LIDAR, 3D cameras, and real-time mapping capabilities. These systems enable robots to navigate complex environments, avoid obstacles, and adapt disinfection routines based on room geometry and occupancy, thereby maximizing pathogen reduction while minimizing human intervention.

Another innovation is the use of high-output, long-life UVC lamps and, increasingly, UVC LEDs. While traditional mercury-based lamps remain prevalent due to their proven efficacy, manufacturers are investing in UVC LED arrays for their compactness, instant-on capability, and environmental benefits. Companies like Tru-D SmartUVC and Finsen Technologies are actively developing robots that utilize these next-generation light sources, aiming to improve energy efficiency and reduce maintenance requirements.

Safety remains a paramount concern in UVC robotics manufacturing. In 2025, most commercial units incorporate multiple layers of safety, including motion sensors, emergency shutoff systems, and remote monitoring. For example, Xenex Disinfection Services employs proprietary safety protocols that automatically deactivate UVC emission if a person is detected in the treatment area. This is complemented by cloud-based fleet management platforms, allowing operators to monitor robot status, schedule disinfection cycles, and generate compliance reports remotely.

Looking ahead, the sector is expected to see further miniaturization and modularity, enabling deployment in smaller or more specialized environments such as ambulances, aircraft cabins, and public transportation. The adoption of Internet of Things (IoT) connectivity is also on the rise, facilitating data-driven optimization and integration with broader facility management systems. As regulatory standards for UVC disinfection continue to evolve, manufacturers are increasingly collaborating with industry bodies to validate efficacy and safety, ensuring that UVC robotics remain at the forefront of infection prevention technologies.

Major Manufacturers and Industry Leaders (e.g., xenex.com, uvd-robots.com, danishcleantech.com)

The Ultraviolet-C (UVC) disinfection robotics sector has seen significant growth and technological advancement in recent years, with 2025 marking a period of intensified competition and innovation among major manufacturers. The COVID-19 pandemic catalyzed global demand for automated, touchless disinfection solutions, and this momentum continues as healthcare, transportation, hospitality, and public facility operators seek to maintain high hygiene standards.

Among the industry leaders, Xenex Disinfection Services stands out as a pioneer in pulsed xenon UVC disinfection robots. Based in the United States, Xenex’s LightStrike robots are widely deployed in hospitals and healthcare facilities worldwide. The company emphasizes rapid disinfection cycles and efficacy against a broad spectrum of pathogens, including SARS-CoV-2. In 2024 and 2025, Xenex has expanded its manufacturing capacity and introduced new models with enhanced mobility and data analytics features, aiming to address both hospital and non-healthcare markets.

European innovation is led by UVD Robots, a Danish company under the Blue Ocean Robotics group. UVD Robots’ autonomous mobile platforms integrate UVC lamps with advanced navigation and safety systems, enabling them to operate in complex environments such as airports, schools, and offices. The company has secured contracts across Europe, Asia, and North America, and in 2025, it continues to invest in R&D for improved battery life, AI-driven route optimization, and integration with facility management systems.

Another notable player is Danish CleanTech, which focuses on scalable, modular UVC disinfection solutions for both large and small facilities. Danish CleanTech’s manufacturing approach emphasizes sustainability, with recyclable materials and energy-efficient components. The company collaborates with public health authorities and private sector partners to tailor its robotics for specific regional needs, and in 2025, it is expanding its distribution network in the Middle East and Southeast Asia.

Other significant manufacturers include Tru-D SmartUVC, a subsidiary of PDI Healthcare, which offers UVC robots with real-time dosage monitoring and cloud-based reporting, and Finsen Technologies, a UK-based company specializing in UVC disinfection for both healthcare and transportation sectors. These companies are investing in automation, IoT connectivity, and compliance with evolving international safety standards.

Looking ahead, the UVC disinfection robotics manufacturing industry is expected to see further consolidation, with strategic partnerships and acquisitions likely as companies seek to expand their technological capabilities and global reach. The focus in 2025 and beyond will be on increasing operational efficiency, reducing costs, and developing robots that can adapt to a wider range of environments, ensuring robust growth and continued innovation in the sector.

Market Size, Segmentation, and 2025–2030 Growth Forecasts (Estimated CAGR: 18–22%)

The global market for Ultraviolet-C (UVC) disinfection robotics is poised for robust expansion between 2025 and 2030, with an estimated compound annual growth rate (CAGR) of 18–22%. This growth is driven by heightened demand for automated infection control solutions in healthcare, transportation, hospitality, and public infrastructure, particularly in the wake of persistent concerns over healthcare-associated infections and emerging pathogens.

Market segmentation reveals that healthcare facilities—including hospitals, clinics, and long-term care centers—remain the dominant end-users, accounting for over 60% of UVC disinfection robot deployments as of 2025. The segment is expected to maintain its lead, propelled by regulatory pressures and the need for consistent, high-efficacy disinfection. Other significant segments include commercial real estate, airports, educational institutions, and food processing plants, each adopting UVC robotics to enhance safety and operational continuity.

Regionally, North America and Europe are anticipated to retain the largest market shares through 2030, supported by early adoption, stringent hygiene standards, and substantial investments in healthcare infrastructure. However, the Asia-Pacific region is forecasted to exhibit the fastest growth, fueled by rapid urbanization, expanding healthcare sectors, and increasing government initiatives for infection prevention.

Key manufacturers shaping the market landscape include Xenex Disinfection Services, a U.S.-based pioneer known for its LightStrike robots, and UVD Robots from Denmark, whose autonomous mobile platforms are deployed globally in hospitals and airports. PURO Lighting and Finsen Technologies are also notable for their focus on scalable, high-output UVC solutions. In Asia, TMiRob (China) is expanding rapidly, leveraging partnerships with healthcare providers and public agencies.

Technological advancements are expected to further accelerate market growth. Innovations in sensor integration, AI-driven navigation, and remote monitoring are enhancing the efficacy and safety of UVC robots, making them more attractive for a broader range of applications. Manufacturers are also focusing on modular designs and interoperability with building management systems to facilitate seamless deployment in diverse environments.

Looking ahead, the UVC disinfection robotics market is projected to surpass several billion dollars in annual revenue by 2030, with new entrants and established players alike investing in R&D to address evolving customer needs and regulatory requirements. The sector’s outlook remains highly positive, underpinned by ongoing public health priorities and the proven effectiveness of UVC technology in reducing microbial loads across critical settings.

Regulatory Landscape and Safety Standards (e.g., fda.gov, cdc.gov, iec.ch)

The regulatory landscape for Ultraviolet-C (UVC) disinfection robotics manufacturing is evolving rapidly as the technology becomes more prevalent in healthcare, transportation, and public spaces. In 2025, manufacturers must navigate a complex framework of safety standards and regulatory requirements to ensure both efficacy and user safety.

In the United States, the U.S. Food and Drug Administration (FDA) plays a central role in regulating UVC devices, particularly those marketed for medical or healthcare environments. The FDA classifies UVC disinfection robots as medical devices when they are intended for use in reducing or eliminating pathogenic microorganisms on medical equipment or in healthcare settings. Manufacturers must comply with relevant sections of the Federal Food, Drug, and Cosmetic Act, including premarket notification (510(k)) or premarket approval (PMA) processes, depending on the device’s risk classification. The FDA also emphasizes the importance of accurate performance data, labeling, and user instructions to mitigate risks associated with improper use or exposure to UVC radiation.

Globally, the International Electrotechnical Commission (IEC) sets widely recognized safety and performance standards for UVC disinfection equipment. The IEC 60335-2-65 standard, for example, addresses the safety of electronic air-cleaning appliances, including those using UVC. Additionally, IEC 62471 provides guidelines for the photobiological safety of lamps and lamp systems, which is critical for UVC devices to prevent harm to humans. Manufacturers exporting to the European Union must also consider the CE marking requirements, which involve conformity with the Low Voltage Directive and Electromagnetic Compatibility Directive, as well as compliance with the Restriction of Hazardous Substances (RoHS) Directive.

Infection control authorities such as the Centers for Disease Control and Prevention (CDC) offer guidance on the use of UVC technologies in healthcare and public settings. While the CDC does not directly regulate device manufacturing, its recommendations influence procurement decisions and operational protocols, emphasizing the need for validated efficacy and safety features such as motion sensors, remote operation, and shielding to prevent accidental exposure.

Looking ahead, regulatory bodies are expected to tighten oversight as UVC robotics become more widespread. Anticipated developments include harmonization of international standards, more rigorous efficacy testing requirements, and enhanced post-market surveillance to track device performance and safety incidents. Manufacturers are increasingly investing in compliance infrastructure and collaborating with standards organizations to ensure their products meet evolving regulatory expectations and maintain market access.

Applications Across Healthcare, Transportation, and Public Spaces

The manufacturing of Ultraviolet-C (UVC) disinfection robotics has seen significant advancements in recent years, with 2025 marking a period of rapid adoption and diversification of applications across healthcare, transportation, and public spaces. The COVID-19 pandemic accelerated the demand for automated, chemical-free disinfection solutions, and UVC robotics manufacturers have responded by developing specialized devices tailored to the unique needs of these sectors.

In healthcare, UVC disinfection robots are now a common sight in hospitals, clinics, and long-term care facilities. Leading manufacturers such as Xenex Disinfection Services and Tru-D SmartUVC have deployed thousands of units globally, focusing on reducing healthcare-associated infections (HAIs) by targeting high-touch surfaces and patient rooms. These robots utilize high-intensity UVC lamps and advanced navigation systems to autonomously disinfect spaces, with some models capable of providing real-time data on disinfection efficacy. The integration of Internet of Things (IoT) connectivity allows for remote monitoring and fleet management, further enhancing operational efficiency.

The transportation sector has also embraced UVC robotics, particularly in airports, train stations, and public transit vehicles. Companies like UVD Robots have partnered with major transportation authorities to deploy autonomous UVC robots for the disinfection of passenger terminals, waiting areas, and even aircraft cabins. These robots are designed to operate during off-peak hours, minimizing disruption while ensuring thorough coverage. The adoption of UVC robotics in transportation is driven by the need to restore public confidence in shared spaces and to comply with evolving hygiene regulations.

Public spaces such as schools, shopping centers, and sports arenas are increasingly utilizing UVC disinfection robots to maintain high standards of cleanliness. Manufacturers including Finsen Technologies and OhmniLabs have introduced compact, mobile units that can be easily deployed in a variety of environments. These robots are often equipped with safety features such as motion sensors and remote shut-off capabilities to prevent accidental exposure to UVC light. The flexibility and scalability of these solutions make them attractive for facility managers seeking to automate routine cleaning tasks.

Looking ahead, the outlook for UVC disinfection robotics manufacturing remains robust. Ongoing improvements in UVC LED technology, battery life, and autonomous navigation are expected to drive further adoption. Regulatory bodies are also working to establish standardized guidelines for UVC device efficacy and safety, which will likely influence product development and market expansion in the coming years. As awareness of infection prevention continues to grow, UVC disinfection robotics are poised to become an integral part of hygiene protocols across multiple sectors.

Supply Chain, Component Sourcing, and Manufacturing Challenges

The manufacturing of Ultraviolet-C (UVC) disinfection robotics in 2025 is shaped by a complex supply chain landscape, marked by both opportunities and persistent challenges. The sector relies on a global network for sourcing critical components such as UVC lamps or LEDs, optical filters, high-grade plastics, precision motors, and advanced control electronics. The ongoing transition from mercury-based UVC lamps to solid-state UVC LEDs is a defining trend, driven by regulatory pressures and sustainability goals. Leading UVC LED suppliers, such as Nichia Corporation and Seoul Semiconductor, are ramping up production capacities, but high-performance UVC LEDs remain costlier and less available than traditional lamps, creating bottlenecks for robotics manufacturers.

Manufacturers like Xenex Disinfection Services and UVD Robots have responded by diversifying their supplier base and investing in long-term contracts to secure critical components. However, the sector is not immune to broader electronics supply chain disruptions, including semiconductor shortages and logistics delays, which have persisted into 2025. These disruptions impact the availability of microcontrollers, sensors, and connectivity modules essential for autonomous navigation and remote monitoring features in UVC robots.

Another challenge is the need for specialized optical materials and coatings that can withstand prolonged UVC exposure without degradation. Sourcing these materials often requires collaboration with niche suppliers, adding complexity to the procurement process. Additionally, compliance with international safety and efficacy standards—such as those set by the International Electrotechnical Commission (IEC) and the U.S. Food and Drug Administration (FDA)—necessitates rigorous component traceability and quality assurance protocols, further complicating supply chain management.

On the manufacturing front, companies are increasingly adopting modular designs to streamline assembly and facilitate maintenance. Xenex Disinfection Services and UVD Robots have both emphasized scalable production lines and flexible manufacturing systems to adapt to fluctuating demand, particularly from healthcare and transportation sectors. Automation and digitalization of manufacturing processes are being accelerated to improve yield and reduce lead times.

Looking ahead, the outlook for UVC disinfection robotics manufacturing is cautiously optimistic. While supply chain vulnerabilities remain, ongoing investments in domestic component production, strategic partnerships, and the maturation of UVC LED technology are expected to gradually ease sourcing constraints. The sector’s ability to adapt to regulatory changes and technological advancements will be critical in maintaining growth and ensuring reliable delivery of next-generation UVC disinfection solutions.

Competitive Landscape and Strategic Partnerships

The competitive landscape of Ultraviolet-C (UVC) disinfection robotics manufacturing in 2025 is characterized by a dynamic mix of established technology firms, specialized robotics manufacturers, and new entrants leveraging advances in automation and sensor integration. The sector has seen accelerated growth since the COVID-19 pandemic, with healthcare, transportation, hospitality, and public infrastructure sectors driving demand for autonomous UVC disinfection solutions.

Key players in the market include Xenex Disinfection Services, a U.S.-based company recognized for its LightStrike robots, which utilize pulsed xenon UVC technology and are deployed in hospitals globally. UVD Robots, headquartered in Denmark, is another major manufacturer, known for its fully autonomous mobile robots that combine UVC disinfection with advanced navigation and safety features. PURO Lighting has also expanded its portfolio to include UVC robotics, focusing on both fixed and mobile solutions for commercial and institutional clients.

Strategic partnerships have become a defining feature of the industry’s evolution. For example, UVD Robots has entered into collaborations with healthcare providers and facility management companies to integrate its robots into broader infection prevention protocols. Similarly, Xenex Disinfection Services has partnered with hospital networks and government agencies to scale deployment and validate efficacy in real-world settings. These alliances often extend to technology providers, such as sensor and AI companies, to enhance navigation, safety, and data analytics capabilities.

Manufacturers are also forming alliances with distributors and service providers to expand their geographic reach, particularly in Asia-Pacific and the Middle East, where demand for automated disinfection is rising. For instance, UVD Robots has established distribution agreements in Japan and the UAE, reflecting a broader trend of internationalization among leading firms.

Looking ahead, the competitive landscape is expected to intensify as new entrants, including robotics startups and established automation companies, introduce differentiated products. The integration of Internet of Things (IoT) connectivity, real-time monitoring, and AI-driven optimization is anticipated to be a key battleground for competitive advantage. Strategic partnerships—especially those that combine manufacturing expertise with domain-specific knowledge in healthcare, transportation, or hospitality—will likely shape the next phase of market development and consolidation.

Future Outlook: Emerging Trends and Long-Term Opportunities

The future outlook for Ultraviolet-C (UVC) disinfection robotics manufacturing in 2025 and the following years is shaped by rapid technological advancements, evolving regulatory frameworks, and increasing global demand for automated infection control solutions. The COVID-19 pandemic catalyzed widespread adoption of UVC disinfection robots in healthcare, transportation, and public spaces, and this momentum is expected to continue as organizations prioritize hygiene and operational resilience.

Key manufacturers such as UVD Robots (Blue Ocean Robotics), Xenex Disinfection Services, and PURO Lighting are investing in next-generation robotics platforms that integrate advanced sensors, artificial intelligence, and real-time data analytics. These innovations aim to improve navigation, optimize UVC dosage, and provide verifiable disinfection records, addressing both efficacy and compliance requirements. For example, UVD Robots has announced ongoing development of autonomous systems capable of mapping complex environments and adapting to dynamic conditions, while Xenex Disinfection Services continues to refine its pulsed xenon UVC technology for faster and broader-spectrum pathogen inactivation.

The sector is also witnessing increased collaboration between robotics manufacturers and facility management providers, particularly in sectors such as airports, hotels, and logistics. Companies like PURO Lighting are expanding their partnerships to deploy UVC robots in non-healthcare settings, reflecting a broader recognition of the technology’s value in reducing absenteeism and supporting business continuity.

Regulatory developments are expected to play a significant role in shaping the market. The U.S. Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA) are actively evaluating standards for UVC device safety and efficacy, which may lead to more rigorous certification processes. Manufacturers are responding by investing in compliance and third-party validation, which could become a key differentiator in procurement decisions.

Looking ahead, the integration of UVC robotics with building management systems and the Internet of Things (IoT) is anticipated to unlock new opportunities for remote monitoring, predictive maintenance, and energy optimization. As component costs decrease and manufacturing processes mature, the total cost of ownership for UVC robots is expected to decline, making the technology accessible to a wider range of organizations globally.

In summary, the UVC disinfection robotics manufacturing sector is poised for sustained growth through 2025 and beyond, driven by innovation, regulatory clarity, and expanding applications across diverse industries. Leading companies are well-positioned to capitalize on these trends by delivering smarter, safer, and more efficient disinfection solutions.